Help! How do I nominate an assessable spouse for tax purposes?

Tax advice for married couples!

Approximately 20,000 couples get married in Ireland every single year.

A very high proportion of these couples are entitled to tax breaks after they tie the knot.

Unfortunately, an even higher proportion are either confused about, or completely unaware of, their tax entitlements. Many even miss out on the breaks that they're due.

Don't let this happen to you!

In this guide we'll break down tax entitlements and obligations for married couples and how you can take advantage of what you're due.

I just got married. Am I entitled to any tax breaks?

Potentially.

In a nutshell you can make a saving if:

- Both you and your spouse are working but only one of you pay tax at the higher rate (40%)

- Both you and your partner are working and one of you have unused credits

- Only one spouse is working

- One spouse cares for children in the home

- You're disposing of assets or making investments

A married couple can earn up to €69,100p/a, paying tax at 20%, before the higher rate (40%) of tax kicks in. So if both you and your partner are earning €34,550p/a or more, you will both already be taking full advantage of the standard-rate tax band and no tax saving is available.

Similarly, if you both work and earn less than €34,550p/a each, you won't be any better off when it comes to tax.

When will I start to see some benefits?

Unfortunately, you won't notice any benefits at first. In the year you're married, both you and your partner continue to be treated as single people for tax purposes.

You'll have to wait until the following January before you can seek any savings.

If the tax you paid as two single people is greater than what you would have paid if you were taxed as a married couple you can claim the difference as a refund (you can only claim a refund on the period of the year that was after the date of marriage).

Want to Get What You're Owed?

Do my spouse and I have to be taxed together?

No, when you get married you will have three tax assessment options to choose from.

Firstly, you can decide to be assessed as single people (as you were before you were married).

You can also choose the separate assessment option. If you choose this option, you and your spouse will be treated as single people during the year. The following tax credits, if you're claiming them, are divided equally between you:

- Married or Civil Partner's Tax Credit

- Age Tax Credit

- Blind Tax Credit

- Incapacitated Child Tax Credit

Unused tax credits and rate bands (limited) can also be transferred between partners.

Usually the most favourable basis of assessment for a married couple is the joint assessment option.

Under joint assessment you are chargeable to tax on your combined total income. Tax credits and standard rate cut-off point can be allocated between partners to suit your own circumstances.

You can read more about these tax assessment options here.

Joint assessment sounds good. Sign us up!

Under joint assessment, if both you and your partner have taxable income, you can decide which of you will be nominated as the 'assessable spouse'.

An assessable spouse is responsible for filing tax returns and paying any tax due. Once an assessable spouse is nominated you can ask for tax credits and standard rate cut-off points to be allocated between you in whatever way you wish. If your tax office does not get a request from you to allocate your tax credits in any particular way, they will normally give all of the transferable tax credits to the assessable spouse.

This person continues to be the assessable person until you jointly choose to nominate the other person or until either of you opts for either separate assessment or assessment as a single person.

How do I nominate an assessable spouse?

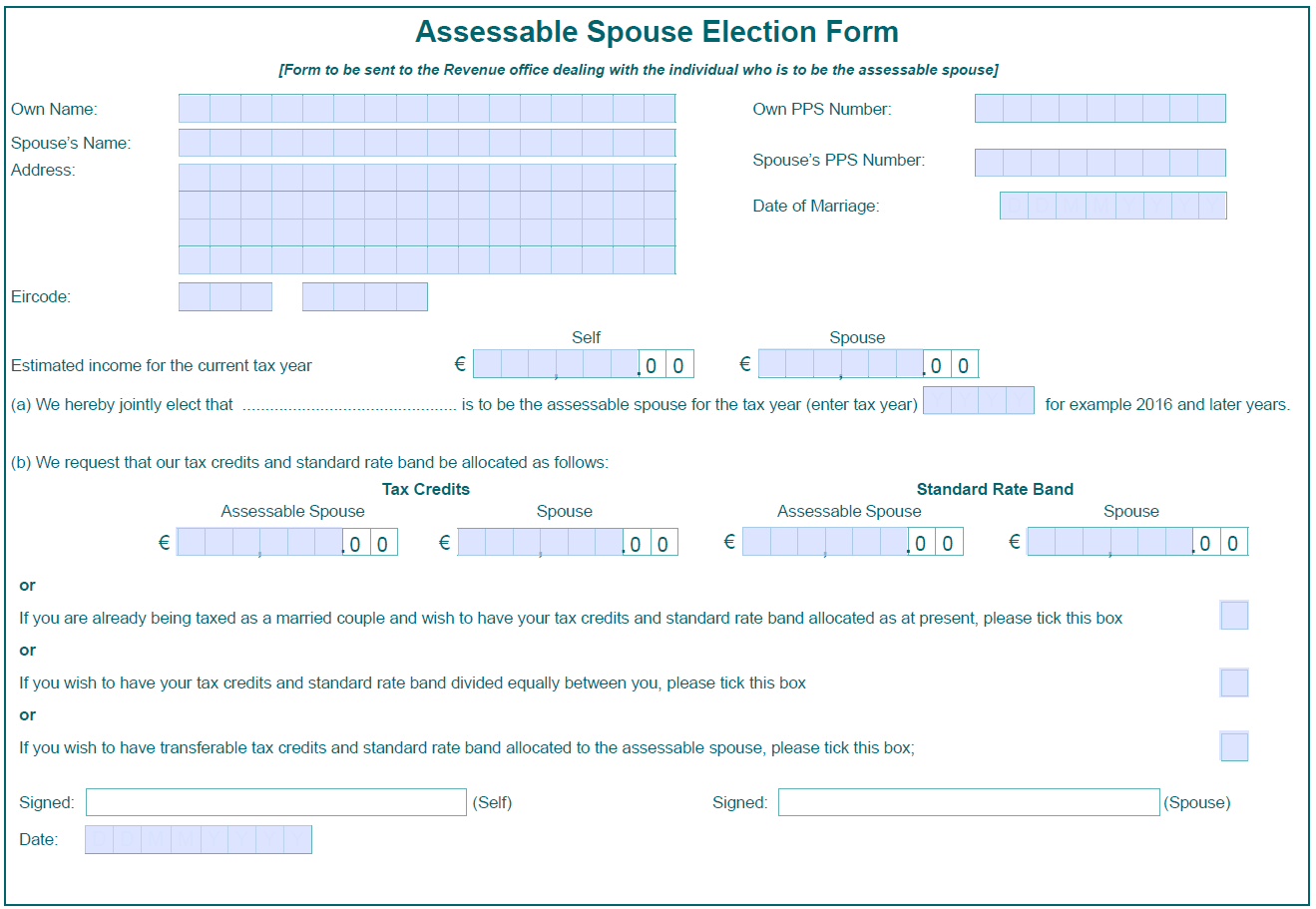

The assessable spouse election form is relatively easily to fill out.

In order to complete the form you will need:

- Your and your partner's names, addresses and PPS numbers

- Your date of marriage

- Both partner's signatures

If you're backdating your form, there is no need to detail the estimated income. Revenue already have this information. However, you can detail your estimated income if you are electing an assessable spouse for the current tax year.

Both partners are entitled to a personal tax credit (€1650 – this credit is transferable) and a PAYE tax credit (worth €1650 – this credit is not transferable).

If you leave the tax credit section blank, Revenue will assign the credits as follows:

- The assessable spouse will have a €42,000 tax rate band and tax credits of €4,950 (this consists of the assessable spouse's credits and the non-assessable spouse's personal tax credit).

- The non-assessable spouse will have a tax rate band of €24,800 and tax credits worth €1,650 (PAYE tax credit).

There are also tick boxes on the form which will allow you to divide the tax credits and standard rate band equally between both partners or to allocate all transferable tax credits and standard rate band to the assessable spouse. You can also choose to leave the credits and rate band as they were before you were married.

You must file this form by 31 March in order for the changes to take effect in that tax year.

Want to Get What You're Owed?

We got married in 2014. But we didn't change our tax status with Revenue. Are we entitled to a tax refund?

Yes, there is a very good chance that you will be entitled to a tax refund. And when you are applying for your Irish tax rebates you can go back four years to take advantage of any reliefs that are due.

Taxback.com can help you to retrieve your tax refund. We'll manage the process for you and handle all of the paperwork.

I've got tax questions. Who can help me?

Taxback.com offer 24/7 Live Chat Support to answer all of your tax questions. We make getting your tax back super easy! We'll maximise what you're legally due. Our average PAYE refund is €995.