Guide to the Employment and Investment Incentive (EII) Scheme

We’re sometimes asked about tax-relief investment schemes. The Employment Investment Incentive (EII) is one such scheme, but what exactly is it?

The Employment Investment Incentive (EII) is a tax relief incentive scheme that provides tax relief for investment in certain corporate trades. The scheme allows an individual investor to obtain income tax relief on investments.

The scheme has replaced the Business Expansion Scheme (BES) that was previously in place. The scheme was announced by the Minister for Finance in his Budget 2011 speech and has been approved by the European Commission.

Below we've put some of the questions that are most frequently asked about the scheme.

Why do it?

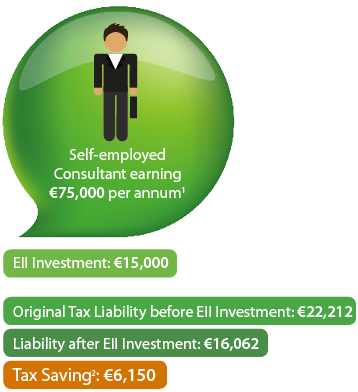

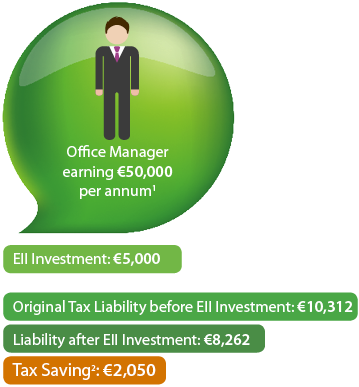

The potential tax savings for EII investors is attractive illustrated as follows:

Who can do it?

The EII scheme is open to anyone who pays income tax and is living in Ireland.

How much can I invest?

There is a maximum investment on which you can claim relief within a year - this is:

- €150,000 for any of the years up to and including 2019

- €500,000 for any years following 2019, if these shares have been held for a minimum of 7 years

- or

- €250,000 for any years following 2019, if these shares have been held for a minimum of 4 years.

Where does my investment go?

Investment is intended for quality Irish growing companies with experienced management teams. If you invest through a fund, your investment is spread over 4 or 5 companies which are selected by the fund manager.

Is the Capital Guaranteed?

The amount you invest is not guaranteed but you will receive the EII tax relief when you file your tax return. Three quarters of the tax relief is received for 2014 and one quarter of the tax relief is received (subject to conditions) later in 2017.

How long is an EII investment?

An EII investor should expect to receive their investment back, with a premium, after three to five years.

What investment growth can I make?

The 8th BVP Green EII Fund targets to grow your investment by 15% per annum including the tax relief. This means an investment of €15,000 would be worth about €17,746 at the end of 4 years. With the tax relief, the investment would have only cost you €9,375.

Where to Next

The BVP EII 2021 fund is now open. You can apply with BVP by following this link, emailing eii@bvp.ie or contact (01) 657 2900.

About the Authors

This article was written by Elliott Griffin and Mark Richardson from BVP Investments Limited. Since 2007, BVP are the investment manager to the BVP Green EII Funds which are qualifying designated investment funds.

BVP Investments Limited is regulated by the Central Bank of Ireland.