Food For Thought: The Home Carer’s Tax Credit

Irish families are missing out on claiming the Home Carer's Tax Credit!

Did you know that there are A LOT of Irish families are missing out on claiming the Home Carer's Tax Credit?

That's primarily due to the fact that so many families are unsure what tax reliefs that they may claim.

Are you married or in a civil partnership and jointly assessed for tax purposes? You may be able to claim the Home Carer’s Tax Credit if you stay at home to mind the kids.

The credit isn’t just available if you take care of an elderly or disabled person in your home, it also applies if you're working at home with the kids. Recently, the credit was increased from €810 to €1000, so it’s now more important than ever to find out if you can claim.

Qualifying for the Home Carer's Credit

There are a few people in certain circumstances that qualify for the home carer's tax credit.

Essentially, if any of the following apply to you, you may be able to apply:

• You're married / in a civil partnership and jointly assessed for tax purposes

• One spouse / civil partner works in the home caring for one or more dependents

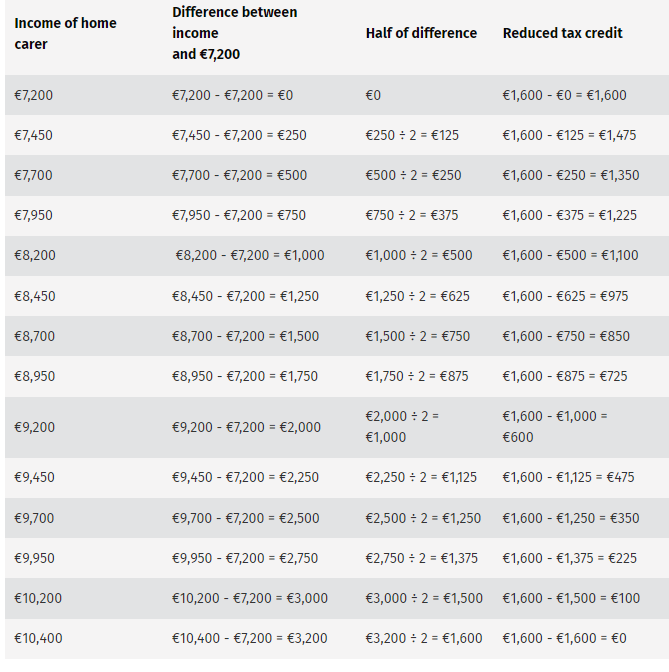

• The home carer's income is less than €7,200 (reduced tax credit if income is €7,200-€9,200).

It's always worth checking out what tax reliefs you may be able to avail of.

Here are some examples of more tax credits.

Who is classed as a dependent?

There are a few different ways in which a person may be classed as a dependent.

Here are some of the examples of dependents:

- A child who qualifies for Child Benefit

- Person aged 65 or over

- Person with physical / mental disability needing care

- Not a spouse or civil partner

- A relative by marriage or someone for whom you are a legal guardian

I lost my job during the pandemic. Can I claim the cHome Carer's Tax Credit?

That depends.

If you meet the qualifying criteria to apply for the credit, then yes, you can avail of it!

This can come as a welcome relief to many families struggling with the financial impact of COVID-19.

How to claim the credit

Claiming the Home Carer's Tax Credit is really easy!

All you need to do is log in to the myAccount section of Revenue.ie to claim the Home Carer Tax Credit for the current year. You can find the application in the 'tax credits' section.

Alternatively, you can complete the Home Carer Tax Credit claim form. You can then post this form to your Revenue office.

Rates:

Can Taxback.com help me?

Yes!

If the above applies to you, you may be able to claim the credit. It can be difficult to know what you’re due but Taxback.com can tell you what you’re owed and give you a free estimate for the last 4 years.