How to get your tax refund in New Zealand

Have you been on a working holiday in New Zealand?

Every year thousands of working holiday makers miss out on claiming their New Zealand tax back. This may be because they are unaware that they can claim a refund or think the process is too daunting or confusing and don’t bother claiming what they’re owed.

But when you consider that the average New Zealand tax rebate is $550, it’s hard to imagine why anyone would want to leave so much money unclaimed!

In this blog we’ll discuss everything a working holiday maker needs to know about tax in New Zealand and how you can easily claim your tax refund.

Let’s get started!

Do I have to file a tax return in New Zealand?

The answer to this question depends on your individual circumstances.

For example, if you have overseas income or arrived in the middle of a tax year (the tax year runs from 1 April to 31 March), you must file a tax return. In other words, most working holiday makers must file a return for their first year in New Zealand.

But even if you aren’t required to file a tax return for a particular tax year, it still makes sense to do so as this is how you can apply for your tax back.

Download your FREE New Zealand Tax Guide

What will I need in order to file my tax return?

You will need a copy of your ID and a summary of your earnings (or final payslip).

Your summary of earnings is an official government form you get from the New Zealand tax authorities – at the end of the tax year. Meanwhile, you will find a final payslip attached to your last pay cheque from your employer. Both of these documents outline your earnings and how much tax you paid during the tax year.

When is the New Zealand Tax Deadline?

The deadline for filing your income tax return in New Zealand is 7 July 2023.

How much tax can I claim back?

Thousands of backpackers in New Zealand are entitled to claim tax refunds each year and the average tax refund claimed is $550.

However, the exact amount you get back depends on:

- How much you earned

- The length of time you’ve been working in New Zealand

- The type of work you did

- How much tax was withheld from your wages

Who can help me file my tax return and claim my tax refund?

You can file your tax return claiming your tax refund yourself online or by post. Alternatively, when you apply for your tax back with Taxback, our team will handle all of the tax paperwork for you and transfer your maximum legal tax refund straight to your bank account anywhere in the world.

Get a New Zealand tax refund estimate with Taxback today.

Important factors to consider while on a working holiday in New Zealand

1. New Zealand tax rates

In New Zealand, tax is usually deducted before you even receive your wages. So the income that lands in your bank account is all yours to keep!

The income tax rates in New Zealand are:

| Yearly taxable income | Tax Rate |

|---|---|

| Up to $14,000 | 10.5% |

| From $14,000 - $48,000 | 17.5% |

| From $48,000 - $70,000 | 30% |

| $70,001 and over | 33% |

| No-notification (no IRD number) | 45% |

2. IRD Number

Before you can start working in New Zealand you will need an IRD number. This is a unique number given so you are taxed the correct amount as you work. If you don’t get one and start working you will be taxed at a higher rate.

3. Tax Code Declaration form (IR330)

When you're on a working holiday in New Zealand you must complete a Tax Code Declaration form (IR330) if:

- you start a new job (you must complete a separate Tax Code Declaration (IR330) for each source of income you have)

- your situation changes and you need to change your tax code

- you've repaid your student loan in full

- you start or stop being eligible for the Independent Earner Tax Credit

- you already have a job and you think your tax code is wrong (you may need to ask your employer which tax code you're on

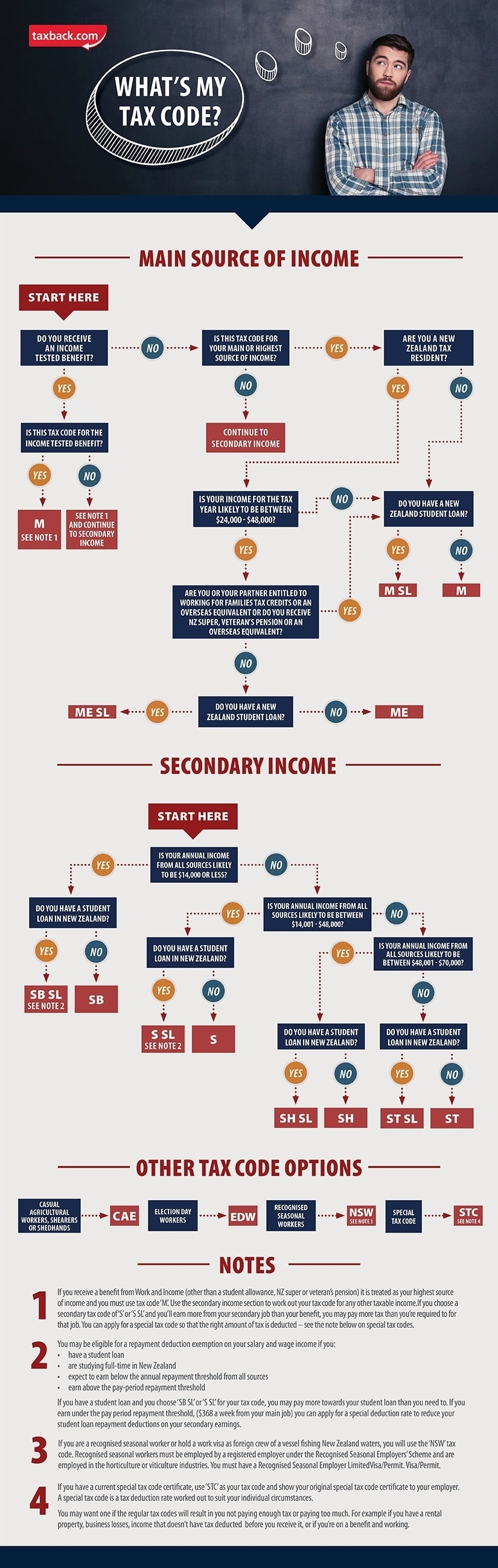

To find out what tax code applies to you check out the infographic:

Once you complete your IR330 form, give it to your employer. If you don’t complete the form you will have to pay the PAYE tax at a higher rate.

4. Tax residency status

You are considered a non-resident for tax purposes if you stay in New Zealand for less than 183 days in any 12 month period and don’t have an enduring relationship with New Zealand.

Alternatively, you are considered a tax resident in New Zealand if you are in the country for more than 183 days in any 12 month period, have a permanent place of abode in New Zealand or are away from New Zealand in the service of the New Zealand government. The 183 days don’t have to be consecutive.

Download your FREE New Zealand Tax Guide

5. Tax Credits

Foreign tax credit

New Zealand tax residents are taxed on worldwide income. This means that if you are a tax resident in New Zealand you must declare income from New Zealand and from other countries for tax. You will be entitled to a foreign tax credit for any foreign tax paid. This credit is limited to the lesser of the amount of tax paid on overseas income or the amount of New Zealand tax applicable on the overseas income or the rate applicable under the relevant double tax agreement (DTA).

Independent earners tax credit (IETC)

If you earn between $24,000 and $48,000 and you’re a tax resident you may be entitled to the IETC. To claim the IETC you will have to complete a Tax Code Declaration form (IR330).

You’ll receive the following if you’re entitled to the credit:

Donations

If you made a donation of over $5 to a charitable organisation or school then you may be able to claim some of it as a tax credit. You will also need to show the receipts for proof that you made a donation. The maximum tax credit you can claim must be smaller than 33.3333% of the total donations you've made or 33.3333% of your taxable income.

To claim a tax credit for donations you need to file an IR526 (Tax Credit Claim form) for the relevant tax year.

The average New Zealand tax refund is $550

Got a question about tax in New Zealand?

Taxback takes the hassle out of filing your New Zealand tax return and claiming your tax refund.

Our team is here to guide you through every aspect of claiming a tax refund from New Zealand.

In fact, if you have a question about your New Zealand tax refund, our Live Chat team are here to support you anytime 24/7.

Use our income tax calculator to find out how much NZ tax you are due back!