Income tax calculator Ireland: How much income tax will I pay?

Income tax: most of us pay it, but very few are actually aware why we pay it and how much we pay.

We can all agree that the topic of taxes in Ireland can be quite tedious. However, understanding the bare bones of Irish income taxes doesn't have to be a total snooze-fest!

And whether you're a seasoned taxpayer or only at the beginning of your professional journey, knowing how much income tax you'll pay and why you pay it can go a long way to understanding your tax obligations.

In this blog post, we will discuss how much income tax you will pay as well as how to calculate your tax rebate.

The average Irish tax refund is €1,880

What will I pay tax on in Ireland?

Anyone who is an employee (i.e. not contractors and self-employed workers) in Ireland will pay taxes through the Pay As You Earn (PAYE) system.

You'll automatically be deducted tax from your payslip by your payroll as a PAYE worker. Meanwhile, if you're self-employed, you'll have to file a tax return every year where any taxes you owe will need to be paid by the 31 October deadline.

Another deduction you'll see on your payslip each time you're paid is Pay Related Social Insurance (PRSI). This is a contribution to the Irish social insurance fund and most employees will pay this.

The amount of PRSI that you'll pay is based on how much you earn as well as the type of work you do.

There are the 11 different social insurance classes in Ireland based on occupations, and whichever class you are in will dictate how much you pay.

Another form of income tax you can expect to see on your payslip is Universal Social Charge (USC).

You'll be charged USC at the standard rate of tax if your total income exceeds €13,000.

However, if your income is €60,000 or less, a reduced rate will be applied to you if you are above the age of 70 or over or hold a medical card.

Department of Social Protection payments which include Maternity Benefit, Paternity Benefit and State pensions, are all exempt from taxation of Universal Social Charge.

What factors affect how much tax I will pay?

Several factors can influence your income tax liability in Ireland.

It is essential to consider all of the factors that can affect your tax liability when you are estimating your total yearly taxation.

Marital Status:

Married couples/civil partnerships have different tax bands and rates. This is €51,000 in 2024.

Tax Credits and Deductions:

Certain tax credits and deductions can lower your taxable income, reducing the overall tax liability.

Additional Income:

Any additional income, such as rental income or self-employment earnings, may affect your tax liability.

USC and PRSI:

As previously mentioned, USC and PRSI are additional taxes that will be added to your income.

How do I calculate how much tax I pay in Ireland?

Any income you receive as an employee in Ireland is taxed at what is known as the 'standard rate' of 20% up to €42,000 in 2024.

This amount is called the standard rate cutoff point.

Anything earned above this cutoff point will be charged at a higher rate of tax. The higher rate of tax is currently 40%. So, the two rate bands are as follows:

Standard Rate Band:

- 20% tax rate

- Applicable to the first portion of your income, up to a certain threshold

Higher Rate Band:

- 40% tax rate

- Applied to the portion of income exceeding the threshold of the standard rate band

Essentially, how much tax you pay mainly comes down to how much you earn as well as certain personal circumstances, for example if you are single or married, if you look after dependents, and more.

The standard rate of tax cut-off point for a couple who are married or civil partners is €51,000.

If both in the couple are still working, this amount is increased by the lower of the following:

- €33,000, or

- The amount of the income of the spouse or civil partner with the smaller income

Any payslip you receive should outline how much taxes are being deducted.

You should also remember that once tax is paid you may be applicable for certain tax credits.

There are various tax credits you can apply for depending on your personal circumstances, from work-from-home expenses to disability relief, all of which can affect your tax liability.

Owed medical expenses?

How much will my net pay be in Ireland?

Essentially, your net pay in Ireland depends on various circumstances, such as how much you earn.

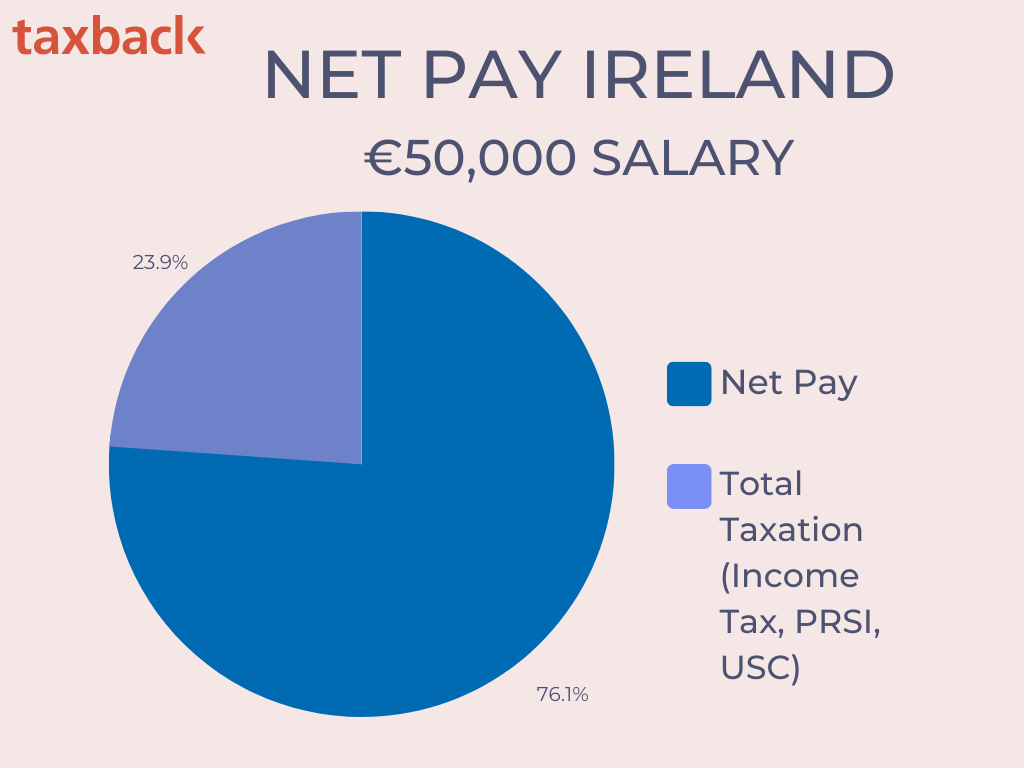

For example - let's say you make €50,000 a year living in Ireland, this means you can expect to be taxed around €11,155 between your income tax, PRSI, and USC.

With that in mind, you can expect that your take-home/net pay will be approximately €38,845 per year, or €3,237 per month.

However, no two people have the same set of circumstances, so these figures may be slightly different for you.

For example, you may be able to avail of certain tax reliefs which can increase your take-home pay.

You may also be filing jointly with a spouse if you are married, which can lead to reduced taxation on your income.

Can you claim back PRSI and USC?

There are only a small amount of circumstances where you may be due a PRSI or USC refund.

For example, PRSI refunds may be issued when the wrong PRSI rate has been paid from your wages or income.

There may also be a case where you have made an overpayment of the USC.

This can often happen when salaries go up or down or USC band rates change.

Taxback offers a FREE comprehensive tax refund calculator for Irish workers.

The average Taxback customer will receive over €1,880 in tax back.

However, you could be due much more than that, especially if you have overpaid income tax.

Who can help me with my Irish taxes?

That's easy - Taxback!

Find out how to claim tax back if it's your first time!

Navigating the Irish tax landscape can be a difficult task, even for seasoned taxpayers.

That's why leaving all the boring stuff with us makes so much sense.

Whether you want to apply for your Irish tax back or file your self-employed tax return, Taxback is the go-to service to help you out!

So, why not kick off your refund application today?!