Irish Finance Logic: Should I Get a New Car?

Got that itch to buy a car? Or perhaps your old banger has finally died and you can’t decide if you should buy a used car, a nearly-new car, or a brand spanking new car just out of the showroom?

That’s where we can help you break it down!

If you buy an old car, you need to expect that one or two problems could likely come up that could result in a big bill from your mechanic, and as a result, it would be sensible to keep a breakdown fund ready.

When you buy a new car, you can expect it to lose its value fast. If you buy an old car, you can expect that it will come with one or two problems that will likely run up a big bill with your mechanic.

As soon as you steer your new car out of the dealership where you bought it, it is immediately devalued, losing around a 20% of whatever you paid. But you might save thousands in the long run on repairs and maintenance.

So, how can you justify breaking the bank for something that devalues so rapidly? Should you just buy a second hand car or does buying a new car benefit you financially in other ways? Before we get into insurance, fuel and loans, let’s look at the broader argument.

Why should I buy a second hand car?

1. A car loses roughly half its value within 2-3 years meaning that by buying a second hand car, you save a lot of money on depreciation. If you want to know which car models depreciate the slowest, or the quickest, check out the DoneDeal Motor Industry Review https://blog.donedeal.ie/2019/01/motor-industry-review-2018/

2. Cars are well made these days. If a car is 3-4 years old but has been looked after (regularly serviced) it will continue to run smoothly for years. Always request a service history and if they seller can’t provide one, it’s best finding someone who can.

3. Since it’s safe to say as a country we’re doing a bit better off economically in recent years, you can expect more people to change their car more frequently, around every 3-4 years. When it comes to modern cars, 3-4 years is nothing, unless the previous owner was doing cross country drives every week which is unlikely.

4. Our roads –although still god awful in some parts of the country – are improving which means our cars are taking less of a hit when it comes to tyres, steering, exhausts and so on.

5. If the car is 4+ years old, you can bet that the driver has been careful with the NCT in mind. If you’re buying a second hand car – aim to buy one that has less than 12 months on it until the next NCT, unless of course it’s much older, say 10+ years.

Ok, so we’ve made a strong case for buying a second hand car, now, what can be said for buying a new one?

Why should I buy a new car?

1. Not everyone is going to have the cash to fund buying a relatively new car (around 4 years old). However, the older the car, the more problems you’re likely to run into when it comes to maintenance. One of the most beneficial aspects of owning a new car is you’re probably not going to have to spend a penny on repairs or maintenance for at least a good long time. Bar the occasional servicing, it’ll probably be years before you have to have something significant fixed or replaced.

2. Modern cars are designed to be far easier on diesel and petrol. In fact you’d be amazed at how much you can save by driving a more economical, newer car especially if you drive on a daily basis for school runs or work and run up significant mileage. The recent introduction of electric and hybrid cars is an excellent example of this. Consumers can save thousands of Euro on fuel costs.

3. You usually get a minimum 4 years guarantee. Kia now offer a 7 year warranty! With second hand cars you’d be lucky to be given even 6 months.

4. New cars are safer. Thanks to technology most new cars are even equipped with a device that beeps to let you know you’re about to reverse into something, or if you change lanes and there is a car in your blind spot, or if you wander out of your lane unintentionally (maybe you were adjusting your stereo, or maybe you fell asleep!). Many new cars come with even more advanced safety aids like automatic braking. If you drive with young children in the car, you can almost guarantee they’ll be safer in a newer car rather than an older one.

Want Help Funding a New Set of Wheels?

Price

Don’t take the price you see on the windshield straight away. Browse different dealers and see what price they’re offering for the same car. If you can, negotiate on the price and try out your best haggling skills! This will minimise your loses when if you do decide to sell the car on a few years down the line.

Let’s talk insurance

Motor insurance premiums have been on the rise for years now. Insurance costs for brand new cars can vary a lot depending on the insurance provider. On the plus side, newer cars have more advanced anti-theft features.

A new car can also cost more to fix or replace in the instance of a car accident. Take insurance costs into account when you’re considering the value of the car.

What about getting a car loan?

So, you might have noticed more and more people taking on PCP or Personal Contract Purchase agreements these days. This kind of contract became popular during the recession. Sellers were keen to offer PCP loans as a response to the lack of people buying cars.

What this is, is a loan with low monthly repayments which is appealing to most people looking for some new wheels on a budget.

The issue with PCP loans is that you’re never the official owner of the car. You’re essentially renting it. If you want to avoid any unforeseen charges when the time comes to trade it in, you need to maintain the car to an incredibly high standard and keep the mileage to an agreed minimum.

In reality, this is easier said than done and many car owners end up paying a lot more than expected when they finally trade in their car. The other drawback is there are 2 balloon payments – one when you first buy the car, and one at the end. If you don’t have the payment at the end, the car is taken away from you even though you have invested a lot of money into the initial balloon payment and monthly payments for years.

Should I consider importing a car to Ireland?

Brexit has had a positive effect on the euro against the sterling meaning Irish motorists can make big savings by importing cars from the UK. If this is the route you choose to take, keep in mind that you must travel to Northern Ireland or another part of the UK as well as getting tied up with vehicle registration tax or VRT, and potentially import duty (depending on the age of the car).

When it comes down to it, you might think you’re going to make huge savings by importing but when you consider the additional costs you’ll face, you may not be saving as much as you might think. Do your research and tally up what you might expect to pay and add that to your estimated price for the car.

Fuel

If you’re buying new, you could consider electric cars or hybrids.

The government is slowly but surely working on closing the price gap diesel and petrol. That and carbon tax although untouched in the last budget can always increase.

If you only drive short distances or you drive infrequently you should consider an electric car. However, it’s probably not a great idea if you’re not in an urban area since charging stations are harder to come by.

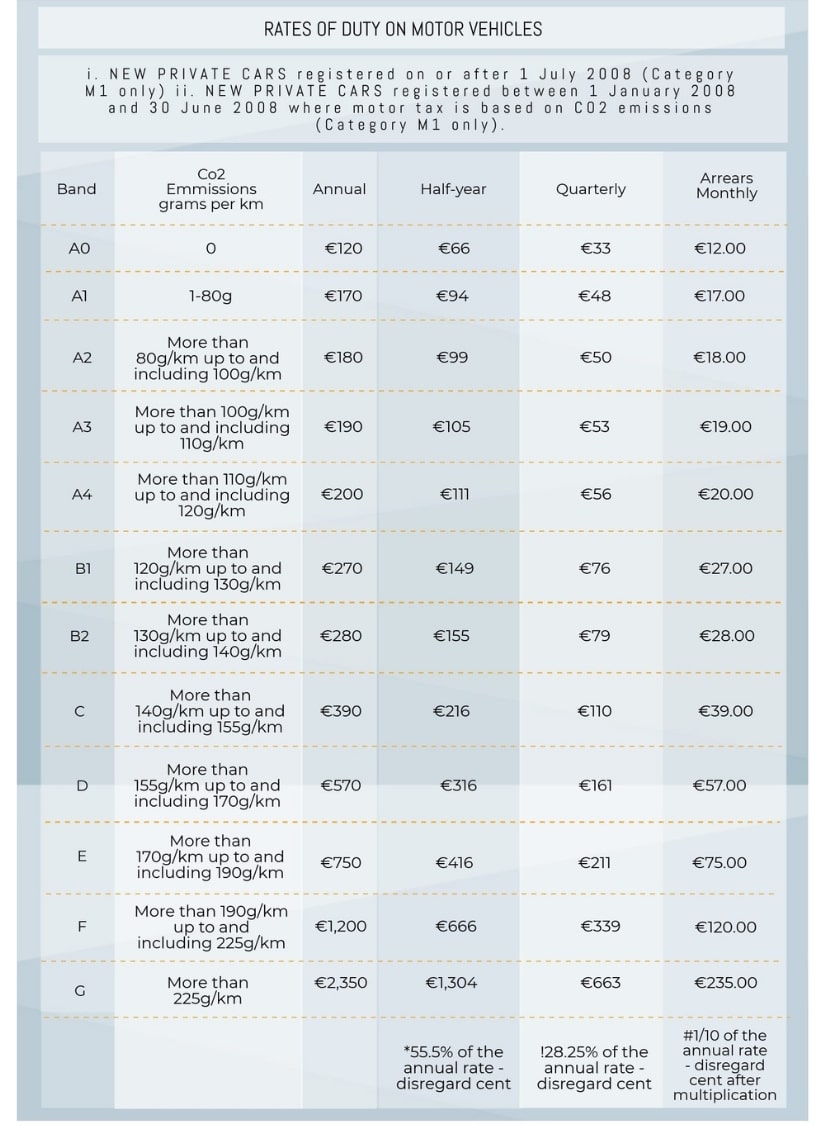

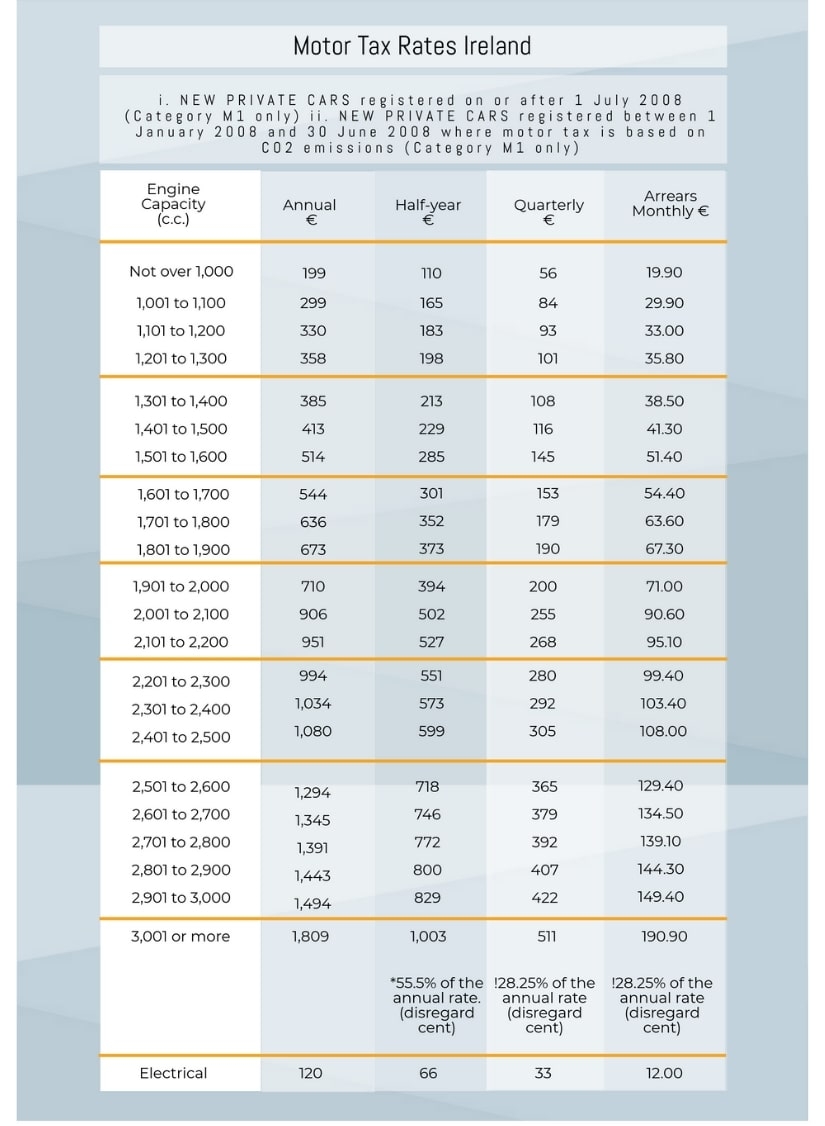

Road Tax

When it comes to road tax, newer cars usually have less Co2 emissions than older cars, so that can mean you pay less for your tax. Of course engine size is also an important factor when it comes to road tax charges.

Want Help Funding a New Set of Wheels?

While we’re on the subject of tax, if you want a little help funding your purchase, why not apply for a tax refund? Our average Irish tax refund is €1,880! It couldn’t hurt having a little extra cash in the bank when you’re splashing out on your new wheels.

If you’d like to apply for a tax refund, contact Taxback.com today for a free, no-strings-attached refund estimate. Our team will check if you’re due money back on a variety of reliefs and expenses. We’ll also walk you through every step of the way until you receive your refund straight into your bank account.