Earning extra cash through the sharing economy? Don’t forget to pay tax!

Thousands of Irish people are swapping and renting their possessions and services online through the sharing economy, but what about your tax obligations?

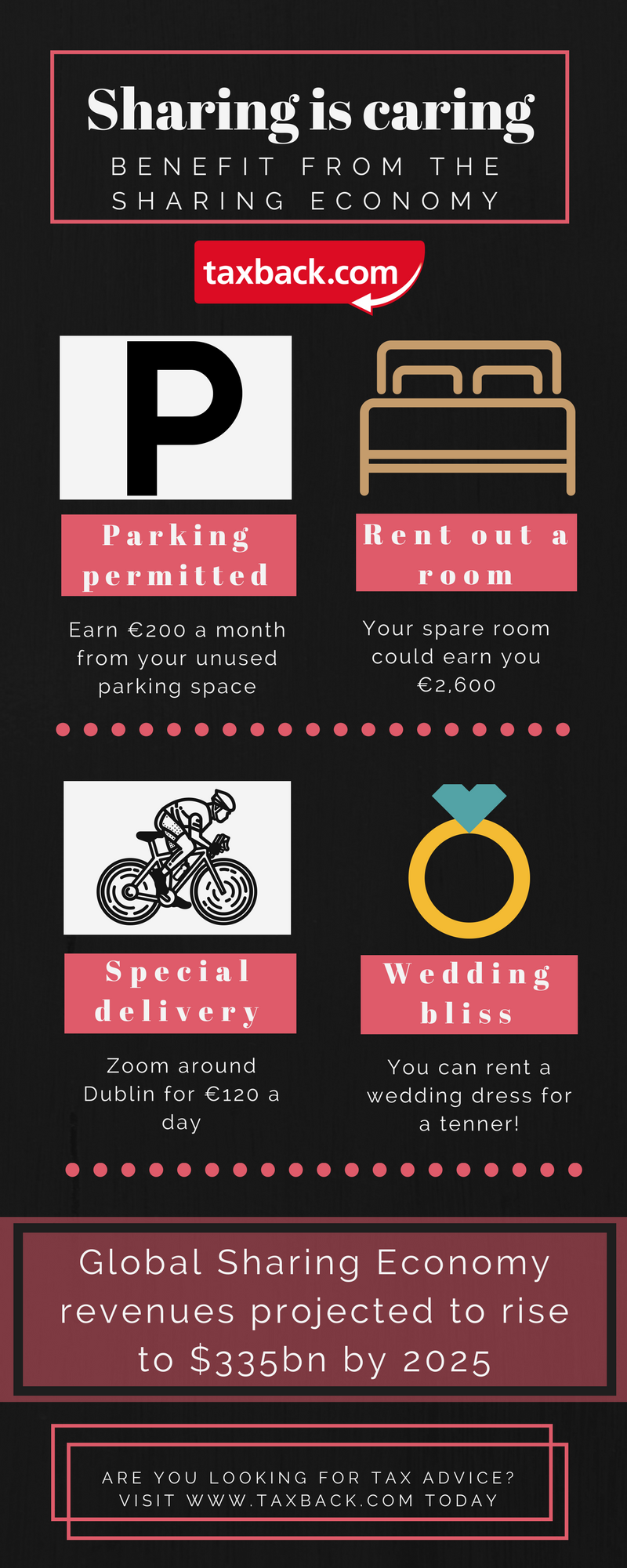

Consultants in PwC say that global sharing revenues could rise to $335bn by 2025. That’s a whopping 20-fold increase from the $15bn of revenue recorded in 2015.

And business is booming in Ireland too. Believe it or not, Airbnb alone contributes roughly €200 million to the Irish economy per year.

It’s very easy to take part. Thanks to smartphones, setting up is often simple. So whether you want to rent your spare room on Airbnb, advertise your gardening services on Adverts.ie, or use DoneDeal.ie to sell your tools to a DIYer in need, you can find your own space in the sharing economy.

In truth you can share almost anything – from your power washer to your bicycle. It’s all about matching those who have with those who need and making the most out of underused assets.

Extra cash

The best part is, if you play your cards right, you can potentially make a lot of extra cash. And thousands of people in Ireland already have.

In 2015, 7,200 Irish hosts earned an average of €2,600 each year by taking paying guests into their homes using Airbnb. Your empty car parking space can be lucrative too. Dublin city-dwellers can make up to €200 a month (per space) renting out unused parking spaces, according to Parkingmotel.ie.

If you like being out and about, signing up with Deliveroo to deliver food could be for you. You can work to your own availability, make as much as €120 in a day, and keep 100% of your tips!

If you’re looking to put your cleaning skills to good use, you can advertise your services on Hassle.com. You can work where and when you want and earn €11 per hour.

Not only can you make money, you can also save it.

Brides-to-be should consider Rentmydress.ie for their wedding. The online dress rental hub allows women to rent clothes, with wedding dresses available from as little as €10!

Time for your taxes

Before you start planning what do with all the extra dosh you’ve earned from the sharing economy, remember this income is taxable.

In short, regardless of whether you also have a full-time job, if you earn income from the sharing economy, you’ll need to declare this to Revenue. And yes, you’ll still need to declare the cash you received for your services, even if there’s no record of the transaction.

Your tax obligations will differ depending on whether you have earned more or less than €5000 in a year.

If you have earned more than €5000 a year you will need to register as a self-assessed individual with Revenue by completing a TR 1 form (you will only need to do this once). You’ll then need to file a Form 11 tax return and make a tax payment by October 31st each year for the previous year’s earnings.

Should you earn less than €5000 a year, Form 12 is the correct option to file. Similarly to Form 11, your earnings from the previous year will be relevant when completing a Form 12.

So if you started delivering food for Deliveroo in 2016, you’ll need to pay tax on that income by October 31st 2017.

Airbnb

Airbnb is one of the most popular options for Irish people looking to make some extra cash. However, regardless of the number of times you rent your accommodation to a guest, keep in mind that tax is due to Revenue on all income received.

The frequency of bookings does make a difference to the type of tax you’ll have to pay - either Case I ‘trading’ income or Case IV ‘miscellaneous’ income.

Revenue will likely consider your income as Case I ‘trading’ if:

• you rent out the room or property on 6 or more occasions annually

• or you host for 30 or more nights in a year

• or your Airbnb income exceeds €5,000 in a year

• or the property is available for occupancy all the time

If your Airbnb business falls under Case I ‘trading’ then you’ll need to file a Form 11 tax return each year. Meanwhile, if your Airbnb income falls under the Case IV ‘miscellaneous’ category, Form 12 is the correct one to use.

Similarly, if you advertise your cleaning skills on hassle.com or pet minding services on housemydog.com, the income you earn is not taxed through the PAYE system. Therefore you’ll be deemed as a ‘chargeable person’ for tax purposes and will be required to file either a Form 11 or Form 12 tax return (depending on whether you have earned more or less than €5000 in the year).

What if I traded goods for goods?

If you’ve traded services for services or goods for goods, you’ll still be required to pay tax. Revenue will treat the service or goods you receive as a cash payment. Therefore, the fair market value of any goods and services you received must be included as income on your tax return.

You can calculate the correct value by assessing the open market value of the goods.

What about expenses?

Expenses are a key way to cut your tax bill. No matter how you make money through the sharing economy, you’ll likely have costs you can deduct come tax time. This includes any fees and charges associated with signing up to advertise on a particular website.

It’s important to remember that you can only expense costs which have wholly and exclusively occurred for the purposes of the trade. You can’t include costs which occurred during personal use.

Earning income from the sharing economy?

File your self-assessed tax return here

For example, if you’re an Airbnb host, you can include the cost of:

• Cleaning

• Laundry

• Electricity

• Gas

• Heating

• And commission to Airbnb

You can only expense the percentage of these costs that were used for your Airbnb business. If you find it tricky to work out exactly how much you should charge, you can attribute the costs based on the size of the room used in comparison to your home and the number of days that you’ve had guests throughout the year.

The process is slightly easier if you’re renting out your entire house. In this case, simply attribute the costs based on the number of days guests stayed in your home that year.

For Deliveroo, if you use your bicycle for personal reasons during the week but exclusively to deliver food at the weekends, you claim for those 2 days out of 7 for the costs associated with maintaining your bicycle, so effectively you are only claiming for those 2 days where you use the bike for business.

Similarly, if you’re advertising gardening services on Adverts.ie and you want to deduct the cost of your tools, you can only expense a percentage of the cost based on how often you use the tools for business or personal use. However, you’ll be able to expense costs associated with traveling to and from locations for gardening.

If you own a vehicle that’s used for both business and personal purposes, you’re entitled to claim a percentage of the actual running costs (fuel, repairs, servicing, etc.) which relate solely to trade use.

You can claim in the following way:

• Fixed rate per business mile – a rate/amount per mile is set and this is multiplied by the number of miles covered.

• Mileage rate basis – this method must be used consistently from year to year if chosen. This rate provides running and maintenance cost coverage. It also makes an allowance for depreciation.

If you offer dog minding services, you can expense the costs associated with caring for the animal (such as food and bedding).

Meanwhile if you’ve developed a trade from renting dresses on Rentmydress.ie, you can expense any costs associated with cleaning the clothes when they’re returned.

Keep records and receipts!

Don’t forget to keep a detailed account (including receipts) of all items you intend to deduct. The more detailed records you keep, the more it will help should the taxman come calling for an audit.

Need help with your taxes?

Anyone new to the sharing economy may not be familiar filing a tax return. If you’ve never completed one before, the prospect can be quite daunting. But don’t worry. Taxback.com can offer a helping hand. Our team of experts will guide you through the process and can answer any questions you have.