Confused About Your Irish Tax Credits? Here's the Low Down!

Many people neglect claiming their tax entitlements believing that it will either be too complicated or not worth their while.

But, nothing could be further from the truth!

In fact, by understanding what you can claim, you can potentially cut back your tax bill by thousands of euros every year.

The average Irish tax rebate a Taxback customer receives is €1,880.

In this guide, we’re going to outline some of the most common Irish tax credits and reliefs that can be claimed and show you exactly how to get a better handle on your tax situation.

What are the Irish Tax Credits?

Put simply, tax credits reduce the amount you have to pay on your tax bill.

Credits are not offset against your income. They are deducted from the amount of tax due. If a payment qualifies for a tax credit - it should be first multiplied by 20%.

Find out how to claim tax back.

Here’s an example to make things a little clearer:

Simon is due €100 in applicable tax credits.

Regardless of how much he earns he can reduce his tax bill by €20 (100 x 20%) using this credit.

Now you’re probably wondering 'How do I know what tax credits apply to me?'

Well, this can be a tricky one to figure out as it really depends on your personal circumstances - but don't worry, we've included a handy chart in this post to help you.

Confused about your tax credits?

We Can Help You Claim a Refund

Each pay period Revenue sends a summary of tax credits to your employer so they can deduct the correct amount of tax.

It is important that you ensure you’re getting the correct amount of credits, and inform Revenue if your personal circumstances have changed.

A revised certificate is then issued by Revenue if your circumstances change during the year. You can review your Irish tax credits on your Tax Credit Certificate.

What tax credit may you be entitled to?

Personal Tax Credit

Every taxpayer who is a resident of Ireland, regardless of his or her age, is entitled to a personal tax credit.

The amount of credit that applies to you will depend on your marital status;

-

Single

-

Married

-

Widowed

-

In a civil partnership

-

Divorced

-

Former civil partner

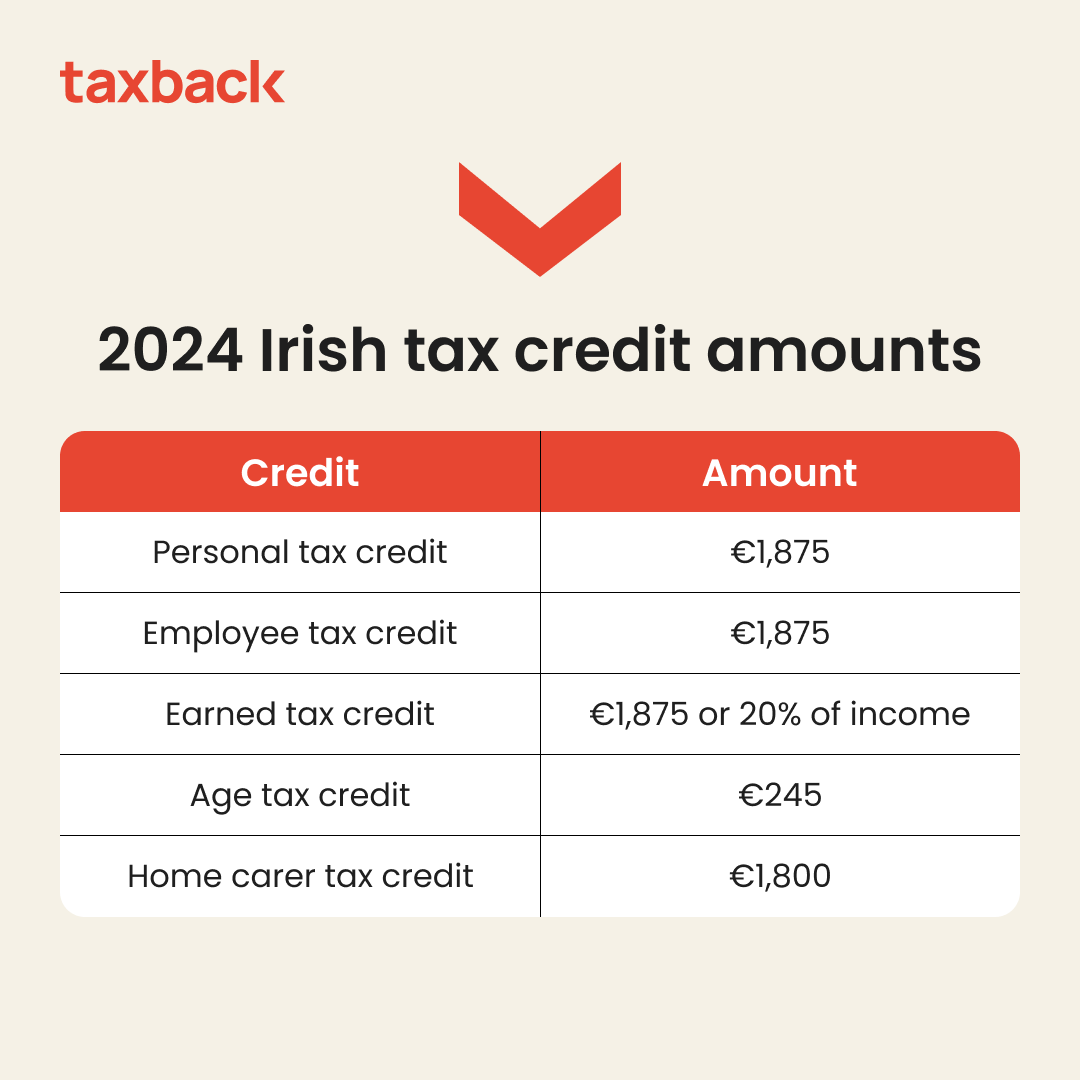

The amount of credit you are entitled to is €1,875 if you are single.

The credit is increased to €3,750 if you are married. You and your partner must decide who will be the assessable spouse or nominated civil partner. The nominated individual is entitled to claim this tax credit. Revenue allows you to get this split equally between both of you once an election is made.

You must be jointly assessed to claim this tax credit. If you'd like to find out more about this, check out our blog on marriage and tax savings.

Employee Tax Credit

All PAYE (Pay As You Earn) taxpayers are entitled to a tax credit known as the Employee Tax Credit, formerly known as the PAYE tax credit. This is worth €1,875 in 2023.

If your income is below €9,375 the credit is capped at 20% of your income.

You only get one credit per year, no matter how many jobs you have.

Personal tax credit and PAYE tax credit are applied each year at source (this means the source of your income) but it’s your responsibility to inform Revenue of your current marital status. Whether you’re single or happily married could potentially affect the amount of tax that you pay.

Failing to inform Revenue of your marital status could very well mean you end up being overcharged for tax.

Get Your Irish Tax Refund Now!

What additional Irish tax credits may you be entitled to?

Earned Tax Credit

The credit is available to individuals who have trading income and it has been claimable since 2016. The credit is not available against passive income such as rental and deposit interest income.

As of 2024, the credit is currently worth €1,875 or 20% of your earned income, whichever is lesser. If you have PAYE income and earned income, the combined value for both PAYE and Earned Tax Credits cannot exceed the amount of the PAYE credit.

Age Tax Credit

The Age Tax credit may be claimed when you or your spouse/ civil partner turns 65. It is worth €245, but it is doubled (€490) if you are married.

Home Carer Tax Credit

You can claim this tax credit if you are married / in a civil partnership and jointly assessed to tax and you or your spouse cares for one or more dependent people.

You cannot claim this credit if the dependent person is your spouse/ civil partner. The carer’s income should be under €10,800. The tax credit rate is €1,800 in 2024.

The dependent person must be either:

- a child for whom you receive child benefits

- a person aged 65 years or above

- a person who is incapacitated

They must also live either on the same property or within 2 km of your home.

If the carer's income is less than €10,800, full credit is due.

In order to claim this credit you will need to outline some of the dependent’s details including:

-

Their name

-

Date of birth

-

PPS

-

Address of relative

Dependent Relative Tax Credit

You can claim this credit, worth €245, if you care for a dependent individual at your own expense. You can claim for your relative or a relative of your civil partner.

You cannot qualify for this tax credit if the annual income of your dependent relative is more than €17,404.

Incapacitated Child Tax Credit

You can receive this credit if you have a child who is permanently disabled (physically or mentally).

To claim this credit you need to fill out a Form ICC1 and get a certified Form ICC2 from the child’s doctor. This credit is €3,500 per child.

Single Person Child Carer Credit

If you are taking care of a child on your own, you can claim Single Person Child Carer Credit. The person with whom the qualified child lives is called the primary claimant.

This tax credit is €1,750 per year. This will reduce the tax you pay by €33.65 per week. You may also be entitled to an increased rate band of €4,000. This is an additional €4,000 at the 20% tax rate.

You can claim the SPCCC in addition to the personal tax credit. If you’re single, separated or widowed, and you have a child, stepchild or adopted child who lives with you for all or part of the tax year – you are eligible to claim this tax credit.

The credit could also be relinquished by the primary claimant to the secondary claimant after a number of conditions are satisfied.

Surviving civil partner tax credit or widowed person

The amount you will receive for this tax credit depends on whether the widowed individual or surviving partner has dependent children. The time in which your spouse passed away is also taken into consideration.

The credit is worth €3,750 in the year of bereavement and €2,415 in the following years.

In the case that a widowed individual or surviving partner has dependent children, they will also be eligible for the Single Person Child Carer credit, however, where the surviving spouse is entitled to the Single Person Child Carer credit, he or she is not entitled to increased Widowed Person or Surviving Civil Partner Tax Credit.

It should be noted that the Single Person Child Carer is not due in the year of bereavement.

Widowed Parent Tax Credit

A widowed person with dependent children can claim this credit for five years after the year of death of their spouse or civil partner. The credit can be claimed in addition to the Single Person Child Carer Credit.

Blind Person’s Tax Credit

If you have impaired vision, you can claim the blind person’s tax credit. The tax credit for 2024 is €1,650. If both spouses are blind or have impaired vision the tax credit is €3,300.

Guide Dog Allowance

If you’re blind (visually impaired) and if you own a trained dog, you can claim this tax credit. This tax credit is an annual allowance of €825 (equal to a credit of €165).

Get Your Irish Tax Refund Now!

Seafarers’ Tax Allowance and Fisher Tax Credit

If you are a seafarer on a voyage to and from a foreign port, you can claim this tax credit.

You’re entitled to an allowance of €6,350.

To qualify you must be at sea at least for 161 days in the year.

The Fisher Tax Credit is €1,270 per year and you can offset it against your total income (income from fishing and other sources).

Rent Tax Credit

The Rent Tax Credit worth €500 was introduced in the 2023 Budget by the Irish government and increased by €250 in the 2024 Budget. Married couples can also claim the credit worth €1,500 if joint filing.

You can also avail of the Rent Tax Credit for students in 'digs' accommodation.

Third-Level Fees/ Tuition Fees

Available for university fees. You may be able to claim tax reliefs on tuition fees paid for approved:

- Undergraduate courses

- Postgraduate courses

Relief is not available on administration, examination or registration fees.

You can’t claim tax back on fees that have been covered by any kind of scholarship or bursary.

The first €3,000 of a full-time student’s fees do not qualify for the relief.

The first €1,500 of a part-time student’s fees don’t qualify either.

€7,000 per student is the largest fee that you can claim.

Work-from-home tax relief

You can claim this tax relief if you work from home. It can cover the expenses for your electricity costs.

Your employer can pay you €3.20 tax-free a day to cover your expenses. You should know that your employer is not legally obliged to make this payment.

If you don’t receive this reimbursement, you can claim tax back on a number of household expenses only for the time you work. This includes:

- Electricity / Heating

- Broadband

Medical expenses

If you pay for medical expenses (such as GP bills, prescriptions and non-routine dental expenses) you will be entitled to a tax refund of 20% of the cost.

These could be your own medical expenses or those of a family member. You will be entitled to a refund if you paid for the expense.

It is not possible to claim relief for plastic surgery or procedures, such as rhinoplasty.

Nursing home expenses

If you are paying nursing home fees, you can claim tax relief. It does not matter if you are in a nursing home or if you are paying for someone else to stay.

You can claim relief on nursing home expenses at your highest rate of tax (40%) if:

- the nursing home provides 24-hour nursing service

- the maintenance or treatment expenses are in association with the services of a practitioner

- the expenses are for diagnostic procedures

Confused about your tax credits?

Find more information on tax credits and reliefs in Ireland here.

It’s a common misconception that Revenue will automatically apply tax credits.

If you’re owed tax back for medical procedures, tuition fees etc. you’ll have to sort it out yourself.

Also, the basic personal tax credit and PAYE tax credits should be automatically applied but, in many cases, they are not.

Help! I’m still confused about my Irish tax credits!

Many people overpay taxes because they are unaware that there are credits they can claim.

Every day Taxback helps people all over the world claim their tax refunds!

We can help you find out the expenses and credits you are entitled to!

It's our mission to make sure that nobody overpays tax - so if you want to get the most from your tax refund, we can check if you're entitled to any tax reliefs or expenses as far back as 4 years!

If you’re still confused about your Irish tax credits, give us a call or head over to our website for more information.

We even have a 24/7 Live Chat service where someone is always on hand to answer any of your tax-related questions.