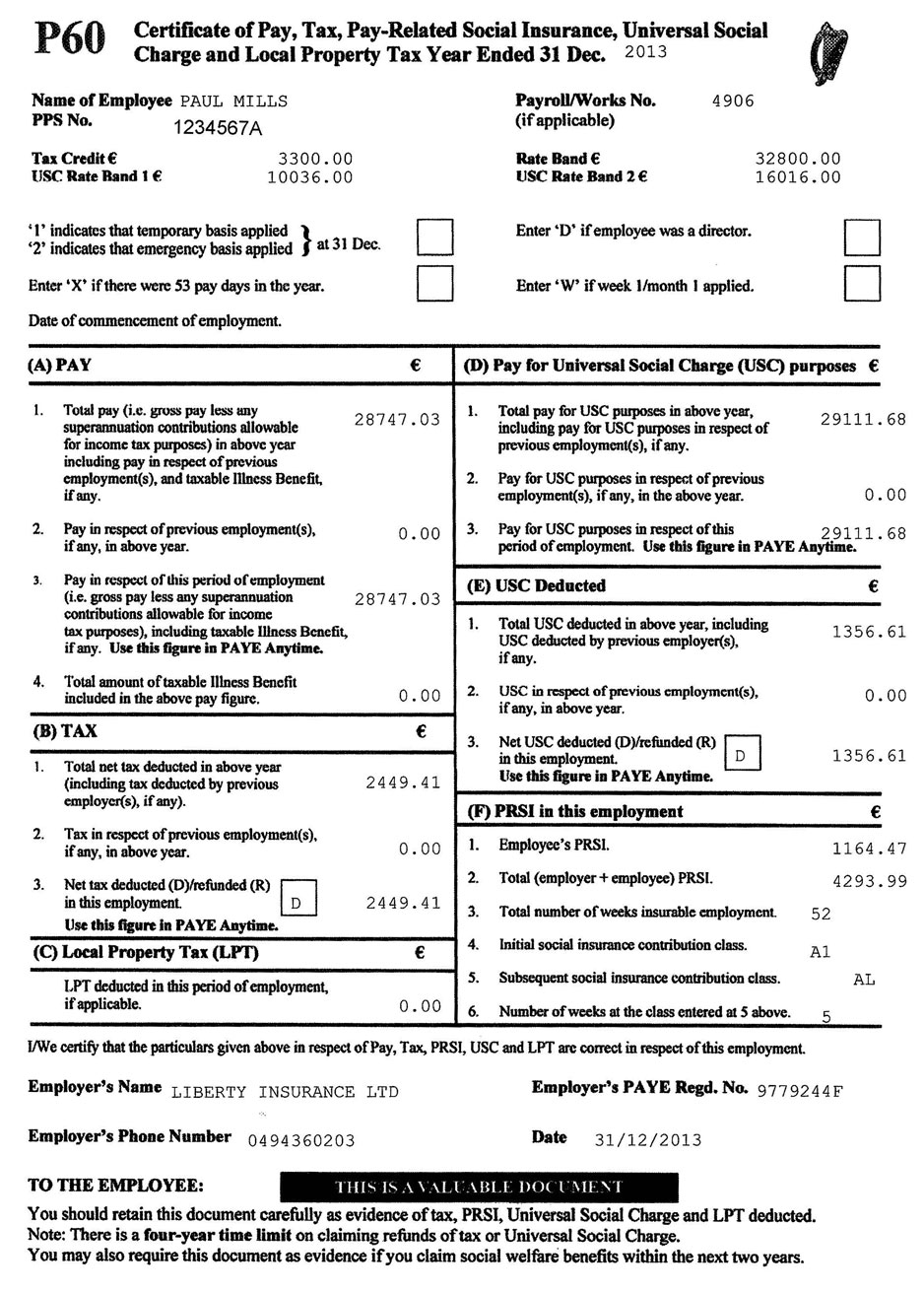

P60 Form Example

Rollover the information icon of each section for more details

P60 contains your personal details i.e. your name, address, PPS number, tax credit and rate band information. It is important to remember that the tax credit and band here is merely a summary of what has been applied via the payroll. Also, it is important to look at the very top section of the P60 to confirm which year the P60 relates to.

Section A confirms your gross taxable pay for the year. The figure here will be after the deduction of any pension contributions you will have made via the payroll. This may explain any difference when you compare this figure to the gross pay per your contract. If you changed employment during the year your pay details in this section will be subdivided into the salary paid to you by your previous employer (s) and that paid to you by your current employer. Also included will be any taxable illness benefits payments received.

Section B confirms the total tax deducted in the year. Again, if you changed employment during the year the tax paid details will be subdivided into that paid in your previous employment (s) and that paid in your current employment thus giving a total summary for the year.

Section C is a new section and confirms the amount of LPT deducted in the current employment via payroll during the tax year. This section does not record any LPT payments made through any other mechanism other than payroll – so you shouldn’t expect to see any direct debit payments recorded here. This figure will appear as 0.00 unless you have elected (or your employer has been mandated) to pay LPT in this way.

Section D confirms the amount of pay subject to USC in this and previous employments in the year. This figure may not be the same as the amount of pay subject to tax as it will be prior to the deduction of pension contributions.

Section F provides details of the PRSI paid in your current employment. This section is different to the last 2 sections in that PRSI paid in previous employments is not recorded here. The first item in this section is the employee PRSI for the year i.e. the PRSI that was actually deducted from your salary. Prior to 2011, this amount would also have included the health levy and this made the calculation a little more complicated but now that the health levy has been abolished, this part of the P60 is a lot easier to understand. The second item in this section is total PRSI i.e. employer and employee PRSI. If you deduct the figure from the first item from this total figure you will have the total PRSI paid on your behalf by your employer in the year. Section C also contains details regarding your PRSI class etc.