Flat Rate Expenses – many people in Ireland are entitled to them but not a lot of people know what they are.

This means that thousands of euros in Flat Rate Expense tax credits go unclaimed every year.

Read on to find out…

What is a Flat Rate Expense?

Who is entitled to Flat Rate Expenses?

How much can I claim back on Flat Rate Expenses?

How do I claim a Flat Rate Expense?

What is a Flat Rate Expense?

A Flat Rate Expense is a type of tax relief or tax credit that is available to people in certain occupations. Flat Rate Expenses intend to help with costs associated with work, for instance, uniforms, tools and equipment. There is a set amount allocated to each occupation – hence the name ‘flat rate’ expense.

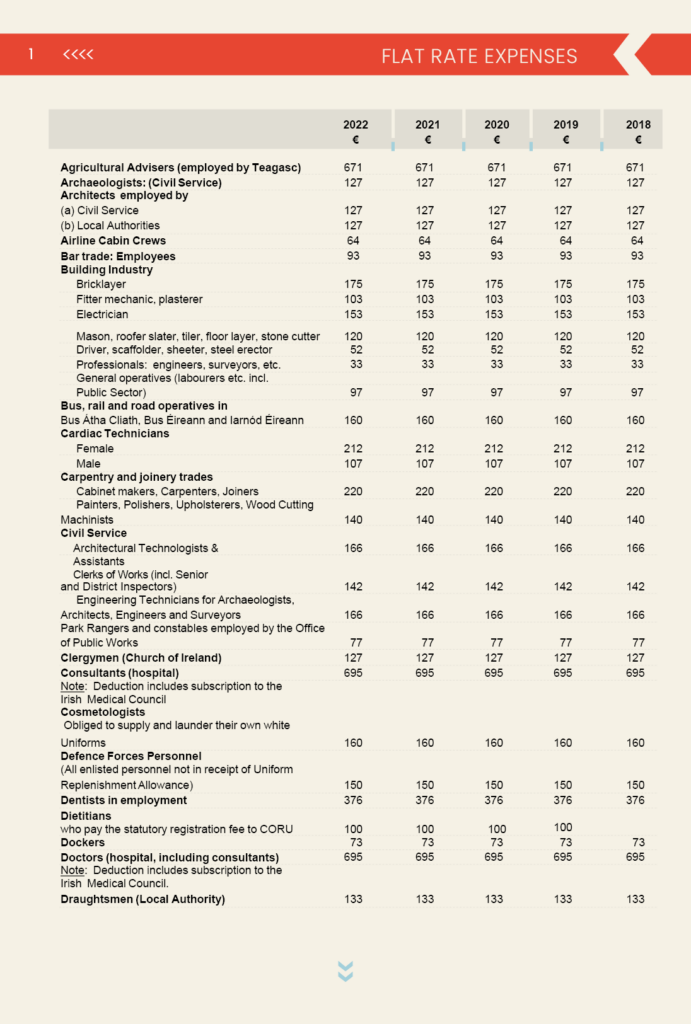

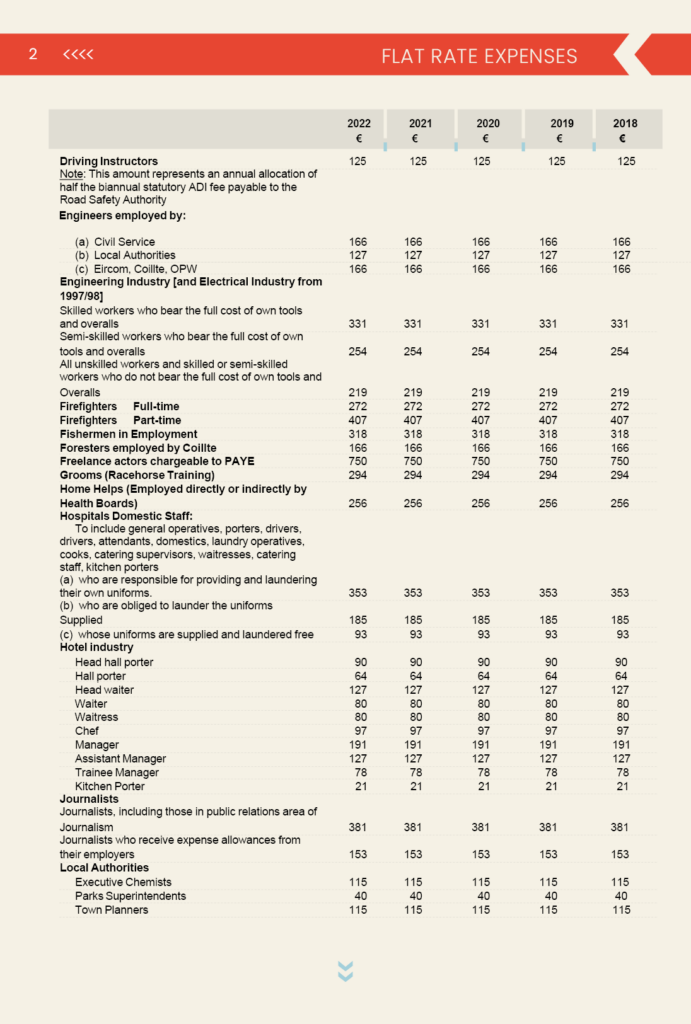

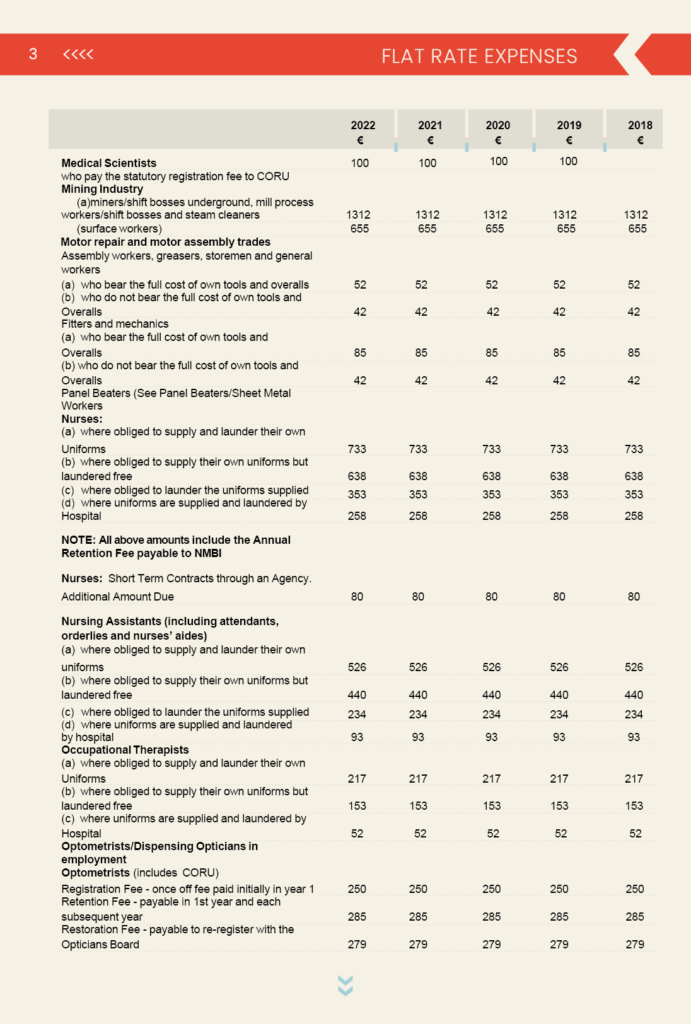

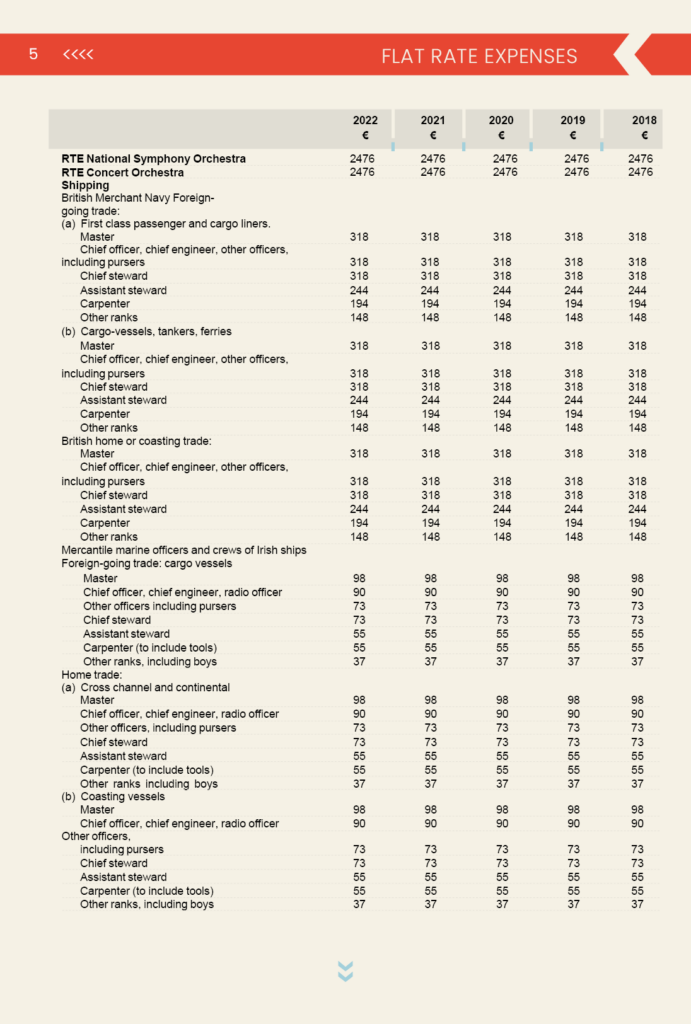

So, for example, the lowest Flat Rate Expense is €64 for cabin crew and the highest Flat Rate Expense is €2,476 for members of the RTE National Symphony Orchestra and RTE Concert Orchestra.

If you’re a dentist in employment you will be entitled to a €376 Flat Rate Expense per year from 2020-2024 (this is because the Flat Rate Expenses have remained the same since 2019).

Wondering if what you earn affects what you’re entitled to? Nope, it doesn’t. Whether you’re a barman who pulls pints of Guinness in a cozy pub in Longford or you’re a specially trained mixologist in one of Dublin’s fanciest bars, you’re entitled to the Flat Rate Expense of €93, regardless of your earnings.

Am I entitled to Flat Rate Expenses?

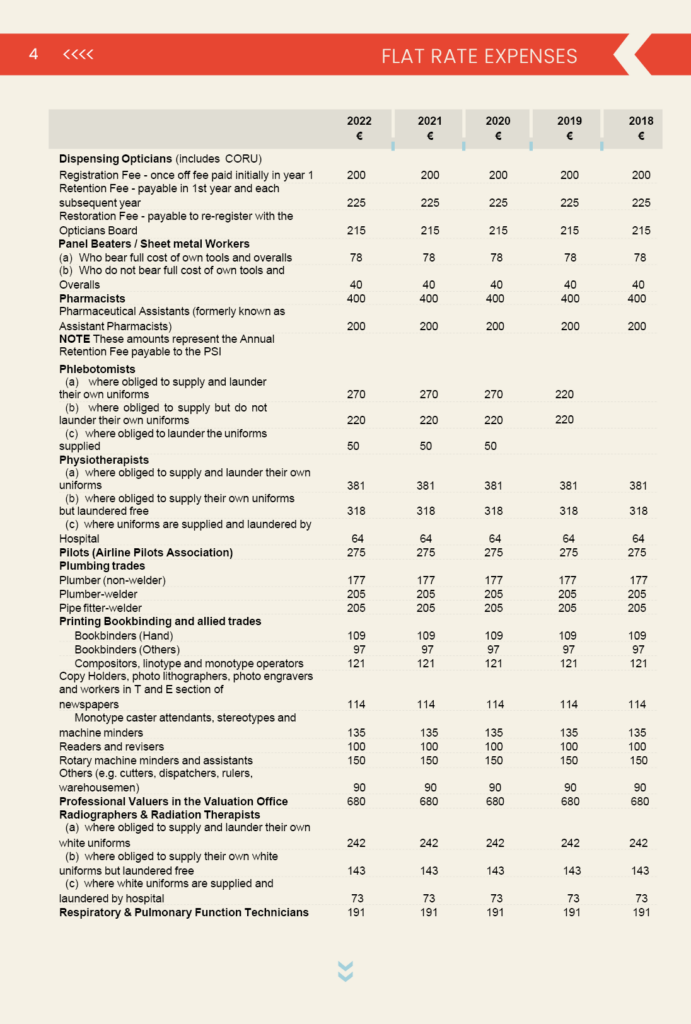

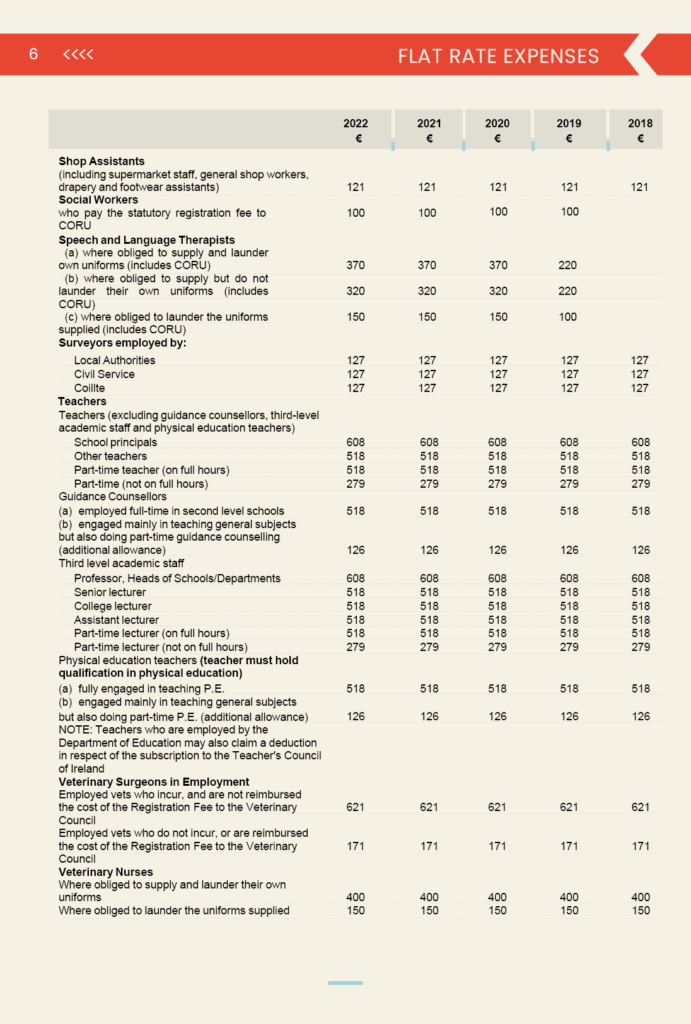

In short, this will depend on your occupation. You can check out the chart below to see if you meet the criteria for receiving a flat rate expense.

Want to Get What You're Owed?

Claim Your Flat Rate Expenses Here!

How do I claim Flat Rate Expenses?

If your employer already has the correct tax information from Revenue and your tax credit certificate contains the right information, you’ll automatically receive your Flat Rate Expense. However, more often than not, you may have to file a Form 12 and submit it to Revenue to let them know that you’re in a position to claim Flat Rate Expenses.

Flat Rate Expenses are one of the single most ‘claimable’ expenses out there, so it’s certainly worth checking if you’re entitled to this relief.

You don’t automatically get the flat rate expenses deduction, so you have to claim it. Once you confirm you are in a type of qualifying employment, you can claim it, and just like medical expenses, you can go back 4 years!

Want some help? Taxback will review your finances and work situation for the last four years and we can help you claim any money you’re owed from this tax credit.

Here’s the full list of Flat Rate Expenses:

Please note that the flat rate expenses listed remain unchanged for both 2023 and 2024.

In conclusion, understanding and claiming Flat Rate Expenses can significantly impact your annual tax credits, yet many individuals in Ireland remain unaware of their entitlements.

With amounts ranging from €64 to €2,476, these expenses cover various occupations, helping offset costs associated with work-related essentials such as uniforms and tools.

As you navigate the complexities of tax returns, it’s crucial to ensure you claim what you’re owed.

At Taxback, our experts will ensure you receive the tax rebate you’re entitled to.

Don’t let valuable tax credits go unclaimed – let Taxback review your finances for the last four years to help you secure your maximum legal refund.

Fill out the short form

Last Updated on September 18, 2024