Capital Gains Tax

One of the key areas Taxback.com can assist you with is in the area of Capital Gains Tax

Irish tax can be confusing sometimes – even to those who think they know it!

With so many different rules and laws, we don't blame you if you feel a little overwhelmed with Irish tax.

One of the key areas Taxback.com can assist you with is in the area of Capital Gains Tax.

So, what is it and why is it used?

What is Capital Gains Tax?

Capital Gains Tax (CGT) is a tax charged on the capital gain (profit) made on the disposal of any asset.

The current CGT rate is 33% and it is payable by the person making the disposal.

The gain / profit (the difference between the price you paid for the asset and the price you sold it for) is considered taxable income.

Do you have to file a tax return to report Capital Gains Tax?

CGT is a self-assessment tax - therefore, you must file a return on or before 31 October of the same year you disposed the asset.

Even if a loss was realised, you are required to report the gain or loss.

If you're registered for income tax, you need to report the capital gain / loss in a Form 11 tax return. If you're not registered for income tax, you can report it with Form 12 or complete a CG1 form.

A loss on a disposal will normally be allowable if a gain on the same transaction would have been chargeable. Allowable losses are set against the chargeable gains of the same year and if the losses exceed the gains, the excess may be carried forward against gains of later years.

No CGT is usually payable on the disposal of your sole or main residence. A portion of the realised gain may be subject to CGT if you had periods in which you didn't occupy the property. No gain or loss is incurred on the disposal of a property to a spouse.

When is Capital Gains Tax due?

If you disposed of an asset in the time from 1st of January and 30th of November of the same year, the CGT payments are due by 15th December in the same tax year.

If you disposed of an asset in the time between 1st of December and 31st of December the CGT payments are due by 31st of January in the tax year that follows.

Eligible Deductions in Calculating Capital Gain / Loss

The following deductions can be considered when you're calculating your capital gain or loss.

- Cost of acquisition

- Inflation index if the asset / property was bought before 2003

- Expenditures incurred for the purpose of enhancing the value, for example, if a property was bought in 2005 for €200,000 and in 2007 a small guest house for €80,000 was built in the yard of the property. In this case, disposal of the whole property the cost to be deducted for tax purposes would be €280,000.

- All incidental expenses incurred either on acquisition or disposal of the property such as solicitor's fee, advertising costs, auctioneer's fee etc

CGT Filing Requirements

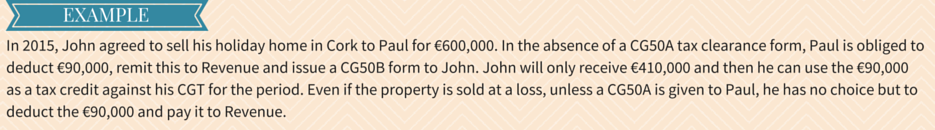

- If a property located within Ireland is sold for more than €500,000 (€1,000,000 for a house or an apartment sold after 01/01/2016) the purchaser must deduct 15% of the agreed price and pay this to Revenue. The purchaser will issue Form CG50B, which shows the amount deducted. The vendor can then use the receipt as a credit for the withholding tax against his / her final CGT liability.

- Alternatively, if the vendor obtains a tax clearance form CG50A from Revenue prior to the disposal of the property and gives it to the purchaser, no withholding tax is to be deducted.

Conditions for obtaining a CG05A tax clearance form

- The person making the disposal is resident in Ireland or

- No CGT is payable on the disposal or

- The CGT chargeable on the disposal has already been paid

Capital Loss

If a loss is incurred on the sale of a property, it can be utilised against any capital gain incurred in the same or subsequent period.

This means that even if a loss was realised on the sale of a house, it can be utilised against any chargeable gain incurred on the sale of other assets such as shares, land etc.

How can Taxback.com help me?

Taxback.com can assist you in ensuring that your CTG return takes account all deductible expenses to reduce your CGT liability or more importantly if there is a CGT loss we can ensure that it is filed and available to be used against future gains.

To get started, apply here.

We take the hassle out of filing your Irish tax return