Do I Have to Pay Taxes on my Twitch Stream Income?

Whether you’re an avid gamer or you don’t know your Super Mario from your Red Dead Redemption, you probably know the gaming industry is worth a hell of a lot of money.

In fact, market research from Newzoo.com has shown that the global games market could potentially grow from $137.9 billion to more than $180.1 billion in 2021. To put things into perspective, in 2013 worldwide, box-office revenue for the film industry was $35.9 billion, while the gaming industry generated around $70.4 billion. That’s almost twice as much revenue as the film industry.

Pro-gaming and e-sports

But, did you know that there are people out there making a pretty decent living from gaming? Come to think of it, “pretty decent” is an understatement. Take Chinese pro-gamer Chen “Hao” Zhihao for instance. In 2014, Zhihao set the Guinness World Record for the most prize money earned through gaming tournaments.

And it’s not just e-sport tournaments that bring in the big bucks, you can now earn from the comfort of your own home by live streaming and recording your gameplay. Gamers everywhere are now using platforms like YouTube and Twitch (more on that in a moment) to reach an audience and make money from their talents.

One of the most popular Twitch streamers is a user named Loltyler1. At just 23 years of age, Tyler Steinkamp rakes in a whopping $5k a day in donations alone. Despite having a reputation as the ‘most toxic player in North America’ Steinkamp’s fan base is enormous. After being banned for 2 years from his game of choice (League of Legends) for disruptive behaviour, his first Twitch stream when the ban was lifted reached over 382,000 viewers, a record-breaking number.

What the hell is Twitch anyway?

Twitch is an immensely popular app and website amongst passionate gamers. It enables people to sign up, live stream their gameplay and broadcast it to the world. Viewers can then send money to the gamers they favour. It takes more than just talent to become a popular Twitch user, you need a certain amount of charisma or likeability. It isn’t just for gamers, you can share art, talk shows and music, but gamers make up a big percentage of Twitch partners. Before Twitch recruited a large gaming audience, the company was on the brink of failure. Now, it’s one of the biggest streaming sites in the world and has been purchased by Amazon for $917 million in 2014.

Twitch Partners and Twitch affiliates are users with a significant following who pay a monthly fee and receive money from ads, donations and other sources via the Twitch platform. This model is used on other platforms like Medium.com and Patreon.com and is similar to the practice of crowdfunding.

Need a hand filing your Twitch tax return?

Tax liability…

I know what you’re thinking; hold on just a sec, you mean to say playing Fortnite with my friends could make me a millionaire?

Well, yes but what a lot of people don’t realise is that if you’re an Irish resident and you use gaming as a source of income, you’re obligated to pay tax on that income in Ireland. Just because it’s a relatively new profession doesn’t mean streamers are exempt from paying tax. Bummer, I know.

You see, a lot of people are self-employed or earning extra income outside of your PAYE salary through unconventional things like YouTube channels and sites like Patreon or Twitch. The problem is, they might not think of it that way. There are people all over the world making money from everything from live-streaming computer coding sessions or through the Korean practice of Mukbang aka live streaming yourself eating large amounts of food. The fact is, the employment landscape is changing to include all sorts of strange new things and people might not be knowledgeable when it comes to associated tax implications.

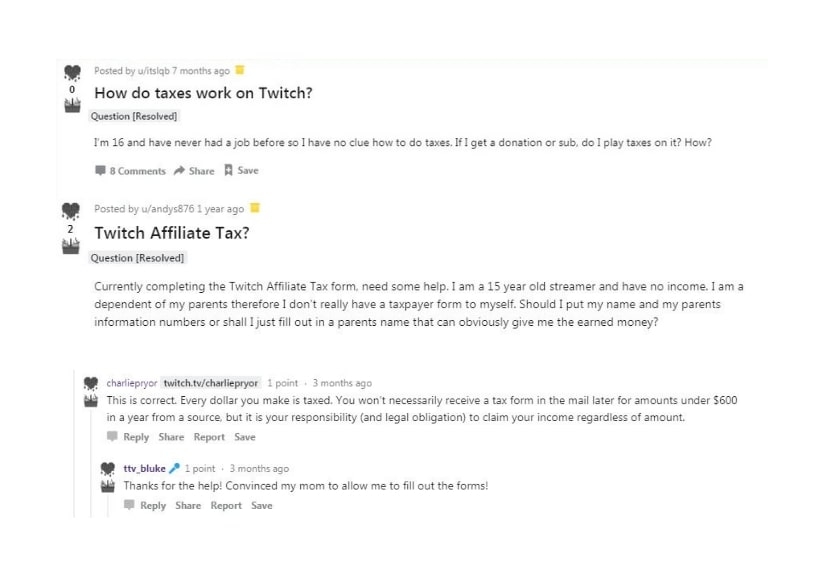

Many streamers, bloggers, social influencers, YouTubers seem to overlook their legal duty to pay taxes in this kind of scenario, and sometimes other factors can impact whether they’re filing taxes. For instance, some might avoid taxes because they feel it’s too complicated and they don’t know where to start. Another factor is a lack of knowledge about taxes and the penalties associated with failing to pay them. Streamers are quite often very young, sometimes as young as 13. Now, I don’t know about you, but I certainly had no notion of taxes when I was a teenager. That’s why it’s important or parents whose children are streamers should look into the appropriate tax filing obligations or seek help from a qualified tax agent like Taxback.com.

This is why it’s not uncommon to come across questions like these on gaming forums…

If you earn over €5k, a self-assessed tax filing is necessary, if you earn under that amount you can file it under your PAYE.

If you are receiving a PAYE income and making money from streaming, it is taxable through the PAYE system. If your income comes from streaming alone, it’s not taxable through the PAYE system, even if it’s under €5,000. In this scenario, you’ll be required to report it through self-assessment.

The fact is, if you’re making money via Twitch or a similar platform, your tax obligations are no different to any other self-employed individual.

Why bother pay taxes?

It’s illegal to avoid taxes and every year that passes without paying them, a surcharge (an annual fee) is added on to the amount you owe for each year you fail to pay. You may also be liable to pay interest. If you fail to disclose your earnings, non-voluntary disclosure can add additional penalties of €3,000 or more.

If you are in a profession like this, it’s a good idea to set aside some money (figure out the right percentage for your country) so that when you file your taxes, you have enough money to pay them. The more you earn, the more you owe. If you made it big and started earning as much as someone like Loltyler1, you would owe a substantial amount.

Need a hand filing your Twitch tax return?

If you're serious about what you’re doing you’ll likely have expenses like say equipment, this might be consoles, headphones, camera or any other necessary tools. In some cases, business expenses like these can be written off against your earnings let’s look at some examples relevant to the gaming industry.

First of all, there are two types of business expenditure – revenue and capital….

Revenue expenses are allowable if they are incurred wholly and exclusively for the purposes of the trade. This would include your electricity, internet, accountancy and legal fees.

Capital expenses may qualify for capital allowances relief at 12.5% over 8 years. These expenses include things like consoles, headphones, camera equipment and so on.

And another thing, if your streaming work happens to be inconsistent or infrequent, it won’t be considered trading which means you cannot access relief for capital allowances.

We know that this kind of thing can be a bit of a headache, so why not let us take care of it? That way, the only challenges you’re up against are the ones in your favourite game!

You’re obligated to file an annual tax return and report your earnings so why not contact us today for help with filing your taxes. Your tax return can also be used to claim any tax allowances that can be offset against your tax bill. You can talk to our team at Taxback.com to save yourself a big headache with the taxman.