You start a new job. Great!

Your first paycheck arrives… Happy days!

Now, your jaw hits the floor because you’ve been EMERGENCY TAXED.

However, there’s no need to panic.

This is a largely avoidable situation.

So keep reading if you don’t want to get stung with emergency tax and how to claim tax back.

How do I know if my income is subject to emergency tax?

Whether you’re starting a new job, entering the workforce or returning to work after a long absence, there are ways to ensure you don’t get taxed on an emergency basis.

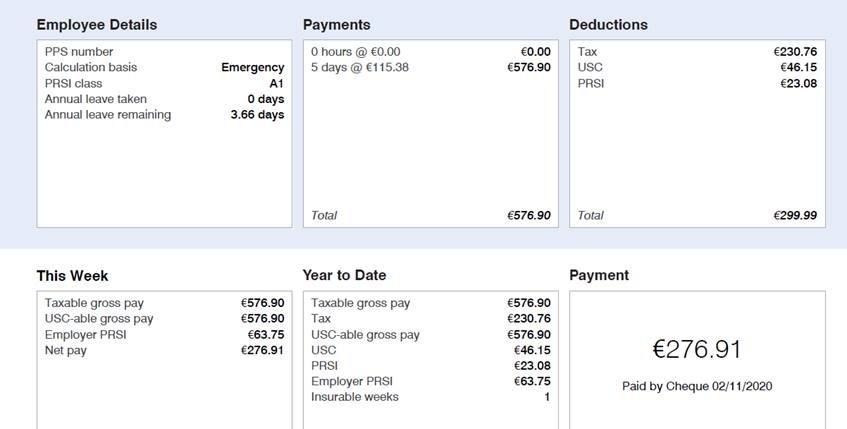

You will know if you have been emergency taxed by looking at your payslip.

In the following example of a payslip, you can see that the employee has not provided their employer with their PPS number and therefore has been taxed on an emergency basis.

Why am I being emergency-taxed?

If your employer has not received all of the important information that they need from you, they will tax you on an emergency basis.

You will be taxed on an emergency basis if you haven’t provided your new employer with your PPSN or if you haven’t registered your new job with Revenue.

What’s the best way to avoid it?

However, there are ways to avoid it, such as giving your PPS number to your new employer as soon as possible.

This number can be found on tax documents or communications from a social welfare or tax office. It may also be on your payslips from previous employment.

If you don’t know your PPS number, you can contact the Department of Social Protection (DSP). If you can’t supply your PPS number, your new employer will deduct tax on an emergency basis.

Under the normal emergency tax rules, if you’ve given your PPS Number to your employer, you get a tax credit and rate band for your first weeks of employment.

These are based on the Single Person Tax Credit and rate band for the tax year (whether you’re single, married or in a civil partnership). So your income is taxed at the standard rate until week 8 and then it’s taxed at the higher rate.

Where you can’t supply a PPS number, your employer is obliged to calculate your tax at a higher rate with no tax credit.

Wondering what Tax Credit Certificate and PPS Number mean? Read Our Bullsh*t-Free Guide to Irish Tax

You should also register your new job with Revenue to avoid being emergency taxed.

It’s best to do this as soon as you accept an offer, even if it’s only part-time or holiday employment. This gives your employer and the tax office time to get things sorted out before your first payday.

Emergency tax examples:

1. If you have no PPS number, you’ll be taxed at the higher rate of tax (40%) and marginal rate of USC (8%). If you subsequently provide your PPS number, previous pay periods won’t be recalculated to grant any tax credits and cut-off points you missed out on until the cumulative basis is applied.

2. Where you provide a PPS number but do not register your job with Revenue, a provisional tax credit of €1,650 and a provisional cut-off point of €33,800 may be granted. The credit is granted for 4 weeks and a cut-off point for 8 weeks.

When you subsequently provide your PPS number, the normal emergency basis will apply to the earnings in that and subsequent weeks.

Once you register your job with Revenue, they will then send a Tax Credit Certificate to you and a Revenue Payroll Notification to your employer, which shows the total amount of your tax credits and rate band.

Your employer will then refund any overpaid tax and Universal Social Charge (USC) on your next payday!

So for example:

Conor starts his first job, but he doesn’t inform Revenue of this.

Conor gives his employer his PPS number so he gets a provisional tax credit of €1,650 and a provisional cut-off point of €33,800. This tax credit is granted for 4 weeks and the cut-off point is granted for 8 weeks.

Then, Conor informs Revenue of his new job. Revenue sends his employer an RPN and a Tax Credit Certificate.

Conor’s employer puts him on a cumulative basis and refunds any overpaid tax and USC on Conor’s next payday.

The average Irish tax refund is €1,880

How much is the emergency tax?

If you’ve given your employer your PPS number, you’ll be taxed under normal emergency tax rules meaning you’re allowed a single person’s rate band for the first 4 weeks of your employment. You’ll be taxed at the standard rate of 20% on income up to the limit of the rate band.

Income above that rate band will be at a higher rate. After four weeks, your full income will be taxed at the higher rate of 40%.

How do I stop paying emergency tax?

The steps you take to move from emergency tax to normal tax will depend on your circumstances.

If you’re starting your first job ever in Ireland, once you have successfully registered your new employment with Revenue and you give your employer your PPSN, your employer will be sent an RPN. Your new employer can then make the correct tax deductions from your pay and take you off emergency tax.

If you take up a 2nd job, the PAYE system will treat one job as your main employment. Revenue will then give your tax credits and rate band to that job.

You should contact Revenue as soon as you start your second job to ensure you receive a separate RPN for each employer. Without this, your new employer may deduct the incorrect amount of tax from your pay.

If you were unemployed between jobs, then you may end up with unused tax credits, which could result in a tax refund, so it’s worth reviewing your tax position at the end of the year. This is typically the case if you were unemployed for at least 4 weeks.

If you’re returning to work after a significant gap, you should ensure your tax and USC deductions are correct. Your new employer must deduct tax and USC from your pay from the beginning of your employment.

If you are still on a Week 1 or ‘non-cumulative basis‘ at the end of the year, you should submit a Form 12 Tax Return to Revenue so they can review your tax situation.

Even though it can seem like the most annoying thing in the world, chances are you’ll get any overpaid tax back promptly once you’re back on the correct rate of income tax.

The average Irish tax refund is €1,880

How do I claim my emergency tax back?

If you need help claiming your emergency tax back, don’t hesitate to contact the team here at Taxback.

A member of our friendly team will be more than happy to help you file your tax return in Ireland so you can claim your tax back.

If you’ve been taxed on an emergency basis, you can contact Taxback to get a refund and if you think you’ve overpaid tax, you can claim your tax refund in Ireland for the previous 4 tax years.

Simply get your tax back here or email info@taxback.com, and claim your tax back in Ireland now!

Why choose Taxback?

-

Maximum tax rebate guaranteed

-

We will transfer your tax refund straight into your bank account, anywhere in the world

-

The average Irish tax refund for Taxback customers is €1,880

Fill out the short form

Last Updated on December 10, 2024