Is the Help to Buy incentive actually useful for first-time buyers? We take a closer look at HTB…

For most first-time buyers, paying a deposit is the first stepping stone to getting your hands on those precious new home keys. But saving for a deposit is a major roadblock for many who dream of getting onto the property ladder.

When the Government launched the Help to Buy (HTB) incentive in Budget 2017, one of its key goals was to tackle just this issue. But in practice, how much help is HTB for first-time buyers?

The answer to that question depends largely on your personal circumstances.

What is the HTB scheme?

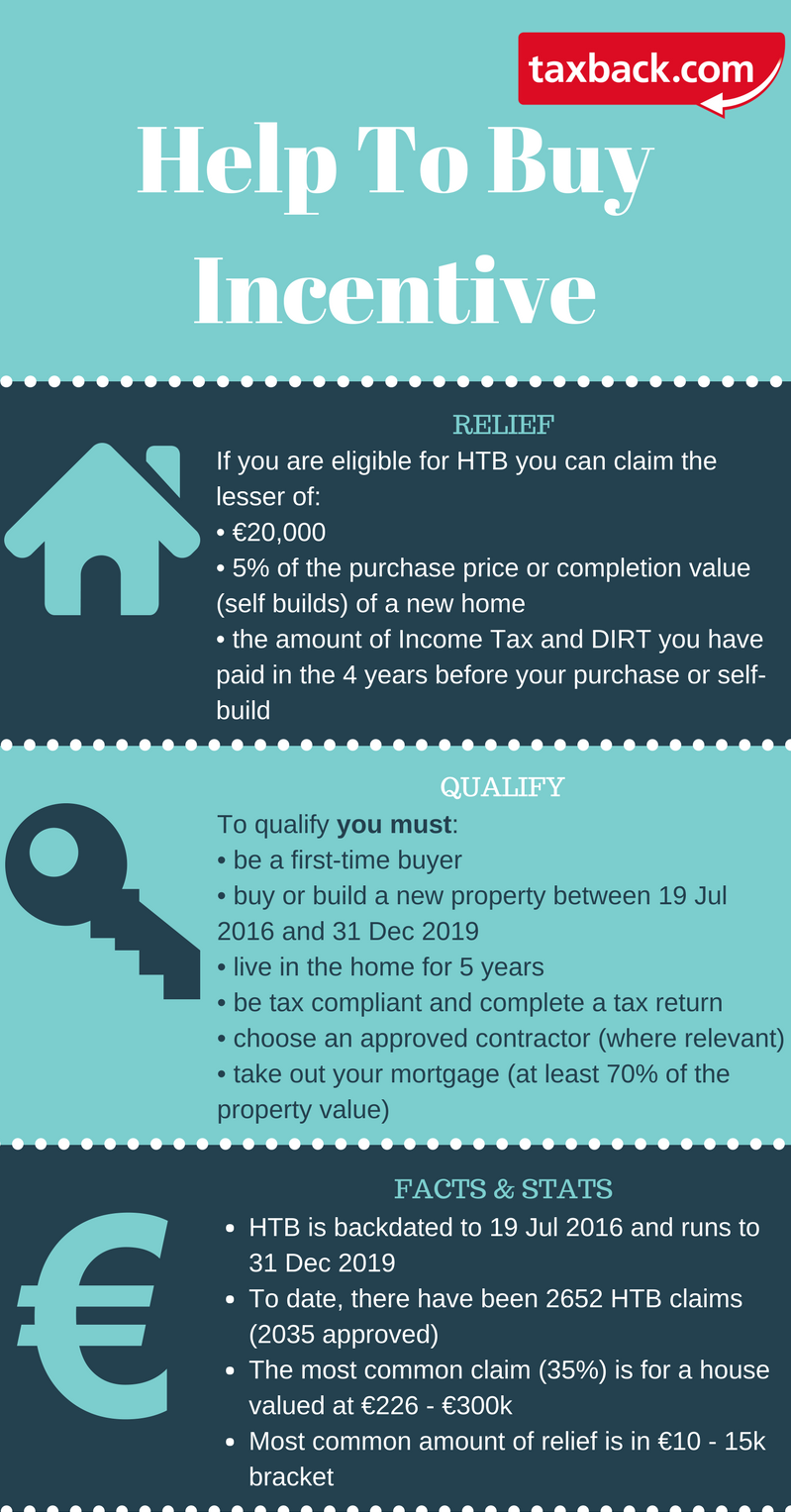

HTB provides first-time buyers with an opportunity to get an income tax rebate (both on the Income Tax and Deposit Interest Retention Tax (DIRT) that you paid in Ireland over the previous four years) of 5 per cent of the purchase value of a newly built home, up to a value of €400,000. That translates to a maximum rebate of €20,000. Properties costing €400,000 to €600,000 will qualify for the €20,000 rebate, but the scheme does not apply to homes over €600,000 in value (€500,000 if you bought it after 1 January 2017). Also, Universal Social Charge (USC) or Pay Related Social Insurance (PRSI) are not taken into account when calculating how much you can claim.

The scheme is backdated to 19 July 2016 and is currently set to run to 31 December 2019.

To date, there have been 2,652 HTB claims and 2,035 of these have been approved.

The limitations

While HTB can be a very useful for many first-time buyers, it does have its limitations. For example, if you are applying for HTB in the expectation that the Government are just going to hand you €20,000, try not to get your hopes up too high.

The only circumstances in which the Government will pay the refund directly to you is if you bought or built the property between 19 July 2016 and 31 December 2016.

If you buy a new build after 1 January 2017, the refund is instead paid to the contractor. And, if you self-build the property after 1 January 2017, the refund will be paid directly to your loan provider. In other words, you will not be able to use the rebate as funds to refurbish or improve your new home.

Jumping through hoops - how does it work?

There are also a number of hoops any applicant will have to jump through in order to qualify – this includes filing a tax return for each year you are looking to claim a refund and being tax compliant.

To qualify for HTB there are a number of boxes you'll need to tick. For starters, you must:

• be a first-time buyer (should you be buying or building the new property with other people, they must also be first-time buyers to avail of HTB)

• buy or build a new property between 19 July 2016 and 31 December 2019

• live in the property as your main home for five years after you buy or build it

• be tax compliant and complete a tax return (if you are self-assessed you must also have tax clearance)

• if purchasing from a contractor, choose one who is approved by Revenue

• take out your mortgage (at least 70% of the purchase value of the property) with a qualifying lender. Cash buyers do not qualify

If you are buying the property, you must have signed a contract to buy that property on or after 19 July 2016. And, if you are self-building, you must have drawn down the first part of the mortgage on or after that date.

Being fully tax compliant is vital in order to qualify for HTB. You'll need to be all square with Revenue for at least the four years immediately prior to your HTB claim. You will also have to file a Form 12 (PAYE taxpayers) or Form 11 (self-assessed) for each of the four years and you must pay any outstanding taxes that are due.

It's important to note that, if you receive a HTB refund, and you do not tick the above boxes (for example, you don't live in the property for the period of 5 years), Revenue are entitled to reclaim the refund in future.

The average Irish tax refund is €1,880

How much can be claimed?

If you are eligible to avail of the HTB initiative, you will be entitled to claim the lesser of:

• €20,000

• 5% of the purchase price of a new home (if you have self-built the relief will be 5% of the completion value of the property)

• the amount of Income Tax and Deposit Interest Retention Tax (DIRT) you have paid in the four years before your purchase or self-build.

In other words, the maximum payment is €20,000 per property and this cap applies regardless of how many people enter into a contract to buy a house.

To date, the incentive has been of more benefit to those buying houses in the lower to mid-range market and it is not just for those looking to purchase at upper end valuations. In fact, the most common claim is for a house with a value of €226-€300k - over a third of claims (35.14%) fall into this bracket. Furthermore, the most commonly claimed amount of relief is in the €10-15k bracket.

Which kind of properties are eligible?

Crucially, any property bought as an investment will not be eligible for HTB. To qualify, the relevant property must either be your home, or if you are self-building, the construction must be subject to Irish VAT.

The property must be a new build that has never previously been used, or was suitable to use, as a residential home. It may qualify for HTB, if it was non-residential, but has been converted for residential use.

The purchase value of the property also plays an important role in determining if you will be eligible for HTB. So, to qualify, the purchase price must be €600,000 or less if you bought the property between 19 July 2016 and 31 December 2016 or €500,000 at most if you bought it after 1 January 2017.

Is HTB any different to First-Time Buyers' (FTB) Relief?

Yes. The HTB incentive is different to First-Time Buyers' (FTB) Relief. In short, FTB only provides relief from DIRT deducted from savings in the 48 months prior to the purchase of the property. Also the FTB relief will only continue to apply for purchases up to 31st December 2017.

Is Stamp Duty effected by HTB?

No. HTB has no impact on the Stamp Duty charge involved in the purchase of a property. If you qualify for HTB you will still have to pay Stamp Duty at 1% of the property value.

What do I need to do to apply?

Before you apply, you must register with Revenue and complete a tax return for each year you are seeking a tax rebate. In order to register with Revenue, you will need your PPS number, date of birth, phone number, email and home addresses.

The average Irish tax refund is €1,880