Your No-Nonsense Guide to the PAYE Taxes in Ireland

We've broken down the basics in our jargon-free guide so you can get the lowdown on the PAYE tax system in a language you'll understand!

Let's face it, it can be difficult to navigate the jargon-filled world of taxes.

So, if you're struggling to grasp the basics of the PAYE tax system or you need an answer to a specific problem, you're not alone!

That's why we've put together this comprehensive tax guide outlining all you need to know about PAYE taxes!

1.The Basics of PAYE

Well...the term PAYE stands for ‘Pay As You Earn’ and it is a system the Irish Government uses to charge you income tax, Universal Social Charge (USC), and Pay Related Social Insurance (PRSI) (if applicable) on your income. Each time you’re paid, your employer deducts tax from your income, which is then paid directly to Revenue who collect taxes on behalf of the Irish government.

The PAYE system also ensures the yearly amounts you pay are collected evenly on each payday over the course of the tax year.

Download your FREE Irish Tax Guide

Most people who work in Ireland pay income tax on their earnings through the PAYE system, so unless you're contracting or self-employed, then you're probably paying tax through the PAYE system.

Each time you get paid, your payroll will deduct tax from your salary and you’ll see how much was taken on your payslip. If you’re self-employed however, you’ll need to file an income tax return every year and pay any taxes you owe by the 31 October deadline. The PAYE system is also in operation for pensioners upon retiring from pensionable employment.

The average Irish tax refund is €1,880

PRSI is another deduction you’ll see on your payslip each time you’re paid. Pay Related Social Insurance (PRSI) is a contribution to the social insurance fund and most employees over 16 must pay this. You'll need to pay this whether you work full-time or part-time if you earn €38 or more per week.

Self-employed workers with an income of €5,000 a year or more aged 16 or over (and under pensionable age) are also liable for Pay-Related Social Insurance (PRSI) contributions. These contributions may give you an entitlement to claim benefits such as Jobseeker’s Benefit, Illness Benefit, and State Pension. So for example, if you become unemployed and you have enough contributions, you may be able to claim the Jobseeker’s Benefit while you're looking for work.

How much PRSI do I need to pay?

How much PRSI you pay is largely based on your earnings and the type of work you do. Your employer will deduct your PRSI and calculate the amount based on your social insurance class.

PRSI is taken at source by your employer and collected by Revenue who, along with the Department of Social Protection, will keep a record of your contributions.

Social insurance contributions are divided into different categories known as classes or rates of contribution. The class and rate of contribution you pay is calculated by the nature of your work. Here are the 11 different social insurance classes in Ireland based on your occupation:

| Class J |

Anyone earning less than €38 per week. People aged over 66 or people in subsidiary employment are always insurable at Class J, no matter how much they earn. Subsidiary employment for Class J is for example, people who are insurable at Class B, C, D or H in their main employment. Only Occupational Injuries Benefit is covered by Class J social insurance. |

| Class E |

Ministers of religion employed by the Church of Ireland Representative Body. It covers all social insurance payments except Jobseeker's Benefit and Occupational Injuries Benefit. |

| Class B |

Civil servants and Gardaí recruited before 6 April 1995. Registered doctors and dentists employed in the Civil Service. Only covers only a limited number of social insurance payments. |

|

Class C |

Commissioned Army Officers and members of the Army Nursing service recruited before 6 April 1995. Covers only a limited number of social insurance benefits. |

| Class D |

Permanent and pensionable employees in the public service other than those mentioned in Classes B and C recruited before 6 April 1995. Covers only a limited number of social insurance payments. |

| Class H |

Non-Commissioned Officers and enlisted personnel of the Defence Forces. Covers all social insurance payments except Occupational Injuries Benefit. |

| Class K |

Public office holders with an income of over €5,200 a year. People who pay PRSI on unearned income. Public office holders with weekly income of €100 or less are recorded under Class M. There are no social insurance payments for people insured under Class K. |

| Class M |

Employees with no liability to contribute to social insurance. Employees under 16 years of age and people with an income of €500 or less and insured in Class K. Class M covers certain contributors with Occupational Injuries Benefit. |

| Class S |

Class S applies to self-employed people including certain company directors, people in business on their own account and people with income from investments and rents. It covers a limited number of social insurance payments.

|

| Class A |

Most employees in Ireland are Class A. This applies to employees in industrial, commercial, and service type roles under a contract of service with a reckonable pay of €38 or more per week. Also includes civil and public servants recruited from 6 April 1995. People on CE schemes pay a special contribution at Class A8/A9. |

| Class P |

Sharefishermen or Sharefisherwomen classified as self-employed and already paying PRSI come under Class P. This class provides limited Jobseeker's Benefit, limited Illness Benefit and Treatment Benefit. |

You must also pay USC on your income. USC or the Universal Social Charge is a tax on your gross income that replaced both the health and the income levy in January 2011. Chances are if you work in Ireland you'll need to pay USC and you'll see it deducted on your payslip each time you're paid.

All employees earning over €13,000 in gross income will pay USC.

First €12,012

|

0.5% |

| €12,012 - €25,760 | 2% |

| €25,760 - €70,044 | 4% |

| Anything above €70,044 | 8% |

-

If you're aged 70 or over and your total income for the year is €60,000 or less

-

If you're a medical card holder aged under 70 with a total income of €60,000 or less-If your income is more than €60,000, the standard rates of USC apply to your full income.

| Up to €12,012 | 0.5% |

| Income over €12,012 | 2% |

Please note: USC rates apply to you and your spouse/civil partner individually, they can't be combined or transferred.

In some cases, your income may be completely exempt from USC. We've listed them below.

Your income is exempt from USC if you earn less than:

-

€13,000 in 2024

| Payments from Community Employment Schemes and Back to Education Allowance |

| Social welfare or similar payments made from abroad |

| Student grants and scholarships |

| Statutory Redundancy Payments |

| Redundancy payments above the statutory redundancy amount-Universal Social Charge up to certain limits |

|

How maintenance payments are treated for Universal Social Charge purposes depends on whether they are voluntary payments or legally enforceable payments |

|

Employer’s or pension provider’s contribution to an approved retirement benefit scheme is not liable to the Universal Social Charge, but the employee's contributions are |

| Department of Social Protection pensions or similar pensions from abroad are exempt |

| The USC is only payable on lump sum pension payments on the The USC is only payable on lump sum pension payments on the portion over €500,000 |

| Blind Welfare Supplementary Allowance |

| Community Employment Scheme |

| Fund for Students with Disabilities |

| Job Initiative Scheme |

| Mobility Allowance |

| Vocational Training Opportunities Scheme (VTOS) |

| Income where DIRT (Deposit Interest Retention Tax) has already been paid |

| Certain salary sacrifice schemes, such as the TaxSaver Commuter Ticket Scheme and the Cycle to Work scheme |

| Income qualifying for Childcare services relief |

| Foster care payments |

| Child Benefit |

| Income qualifying for Rent a Room Relief |

| Income from scholarships |

| Youthreach Training Allowance |

| Early childhood and education scheme |

How maintenance payments are treated for Universal Social Charge purposes largely depends on whether they're voluntary or legally enforceable payments.

If you’re the one making payments to a spouse, you’re entitled to an exemption on the portion of your income on the maintenance paid to your spouse, however there’s no exemption for any portion of maintenance payments paid towards the maintenance of children.

The spouse who receives payments is subject to the Universal Social Charge on the portion of maintenance payments they get, however any portion of maintenance payments paid towards the maintenance of children won't be subject to the Universal Social Charge.

There are a couple of items subject to different rates of USC, these include:

On non-PAYE income above €100,000, there's a surcharge of 3% per year.

A rate of 45% applies to bonuses paid to employees of building societies and banks that received state financial support. If the payments are €20,000 or less in a year, standard rates of USC apply. If the payments exceed €20,000 in a year, the full amount is charged at 45% USC.

This applies to:

-

Allied Irish Bank

-

Anglo Irish Bank

-

Bank of Ireland

-

Educational Building Society

-

Irish Nationwide Building Society

An additional 5% rate of USC applies to taxable income that is 'sheltered' by property reliefs. This includes property-based capital allowances and relief for residential lessors known as 'section 23-type' relief. The property relief surcharge doesn’t apply if your gross income is less than €100,000.

-

Capital allowances made in or carried forward to the 2012 tax year and any later tax year

-

Any losses carried forward to 2012 or a later year that are due to section 23-type relief

Any income you earn is charged at the standard rate of 20% up to a certain amount. This amount is called your standard rate cutoff point. Anything you earn above this amount is charged at a higher rate of tax, which is currently 40%.

So how much tax you pay mainly comes down to how much you earn and your circumstances, e.g. are you single or married, do you look after dependents, and more. You'll see how much tax you pay on your payslip.

Please note that the Irish Government announced in Budget 2024 that all standard rate cut-off points will increase by €2,000. This will kick in for the 2024 tax year.

| Your status | Income | Rate |

| Single person without dependents or children | €42,000 | 20% |

| One parent family | €46,000 | 20% |

| Married Couple/civil* partners one income | €51,000 | 20% |

| Married Couple/Civil partners, two incomes | Up to €84,000 (increase limited to the amount of the second income) | 20% |

| All Categories | Earned Income remainder | 40% |

Your liability for income tax is also reduced by any tax credits and reliefs you can claim each year. Eligibility often depends on your personal circumstances, so if you're looking after someone in your own home, paying for your own healthcare or are recently married, you may be able to get relief to reduce the amount of tax you pay. Tax credits will reduce the amount of tax you need to pay and are deducted after tax by the amount of credit.

Depending on your personal circumstances, you may be entitled to a number of tax credits.

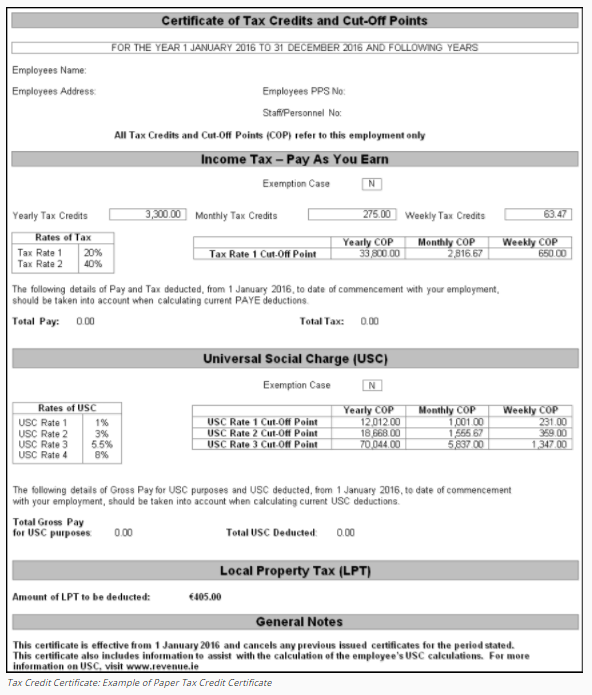

Each year Revenue will send a summary of tax credits and standard rate cut-off point to your employer so they can deduct the correct amount of tax. If your circumstances change during the year, Revenue will issue a revised certificate.

This is why it’s really important that you ensure you’re getting the correct amount of credits and tell Revenue if your personal circumstances have changed. For example if you get married you should tell them because this could reduce the amount of tax you need to pay each year.

You can find more details on different types of tax credits and reliefs here.

Can I get a refund of unused credits?

You can’t get a refund of any unused non-refundable tax credits or carry them over into another tax year. And if you change jobs, you must give your employer your P45 so they calculate the correct amount of tax. If they don’t receive this information, then you’ll be taxed on a temporary basis called ‘emergency tax’.

Your tax credits are normally given for a full tax year on a 'cumulative basis'. This means that whether you start work in the first week or the 30th week of the tax year, you’ll still get the full year's tax credits.

If you’re on emergency tax or a ‘Week 1 basis’ (the 'non-cumulative basis'), different rules apply.

Under the PAYE system, tax credits, and deductions are spread evenly throughout the year. So if you’re working for the full year, your tax credits are divided into 52 weekly or 12 monthly equal amounts, depending on how often you’re paid.

There may be times you end up paying too much tax! I think we can all agree we don't want to end up in this situation so in this case it's important to check your payslip and P60. Taxback can also tell you if you overpaid tax for the last four tax years.

- You got taxable benefits from the Department of Social Protection and the tax paid was calculated incorrectly by your employer, i.e.

- Your personal circumstances changed during the year (marital status or if you claimed tax credits and relief you were actually not entitled to)

- You switched jobs during the year

You can contact Revenue for your Tax Credit Certificate to see if you’re availing of all applicable reliefs or contact Taxback for assistance and we’ll check for you.

If you think you're due tax back, you can go back up to 4 years to claim a refund, so for example if you have medical expenses, you can claim them from 4 years back.

Just remember that the deadline for filing your tax return is 31 October each year (this date is extended if paying and filing with Taxback and the Revenue online service). It's important to keep receipts for things like medical expenses in case Revenue ever requests them.

So for example, if you want a tax refund from 2020, then 2024 is your last year to make this claim.

The average Irish tax refund is €1,880

2. What do I pay tax on?

You’ll need to pay tax on almost all types of income. For example you must pay tax on wages, fees, perks, profits or pensions, benefits-in-kind, rental income, and many social welfare payments. We've listed some of them below.

Benefit in Kind is a non-cash benefit typically given by employers to employees. If the total value is more than €1,905 then you must pay tax on the benefits. However, employers can give their employees a once-off benefit with a value of up to €500 per year, tax-free.

For anything over this amount, tax must be paid.

If employers receive a repayment from an employee for the benefit, the value is reduced by that amount. Benefits given to an employee’s spouse, civil partner, family members, or dependents are also taxable.

Examples of benefits-in-kind include:

- Company cars and vans (for mostly private use)

- Living accommodation

- Loans

- Holidays

- Payment of bills

- Prizes

- Medical insurance premiums

- Childcare facilities

The value of a benefit is generally calculated as the higher of:

● Employer's cost in providing the benefit

● The value of the benefit if it can be converted into money (less any payment you make to your employer for the benefit)

If you use a company car, you can reduce the amount assessed for tax if you have mileage for business purposes and this can be reduced ever further if you contribute to insurance costs, motor tax, or petrol.

A ‘preferential loan’ means a loan from your employer to you/your spouse/civil partner on which no interest is payable or interest is payable at a rate lower than the ‘specified rate’. An employee who gets a preferential loan is charged income tax on the difference between the interest actually paid and the amount which would have been payable at the 'specified' rates of interest for the loans.

The current rates are:

- Qualifying loan for home (principal residence): 4%

- Other loans: 13.5%

You can get a small non-cash benefit from your employer without paying PAYE, USC and PRSI. However the benefit must have a value of €500 or under (€250 up to 21 October 2015). This treatment doesn't apply to cash payments, which are taxable in full.

You can only avail of this relief once in a tax year and if the benefit is more than €500 in value (€250 up to 21 October 2015), then the full value of the benefit is subject to PAYE, USC and PRSI.

|

Bus/train passes for 1 month or more |

|

Non-cash personal gifts |

|

Employer's contribution to approved pension schemes |

|

Mobiles, computer equipment, and home high-speed internet connections provided for business use (where private use is incidental) |

|

Private use of company van for the purposes of work: Private use is prohibited |

|

Bicycle and safety equipment as part of the Cycle to Work Scheme |

|

Certain share and approved profit sharing schemes |

|

Canteen facilities |

|

Reimbursement of expenses incurred in the course of employment |

|

Some accommodation provisions |

|

Lump sum and certain redundancy payments |

|

Working clothes |

*This is not an exhaustive list and restrictions or conditions may apply

Cycle to Work Scheme

This initiative was designed with the aim of encouraging people to cycle to work.

Under the scheme, your employer can buy a bicycle and safety equipment for you and it will not be considered a taxable benefit-in-kind (subject to a €1,000 per bicycle limit).

Alternatively, you can approve a 'salary sacrifice' with your employer over an agreed period of time (no longer than 12 months) to cover the cost of the bike. Under such an arrangement, you will only have to pay Income Tax (IT), Universal Social Charge (USC) and Pay Related Social Insurance (PRSI) on the balance of your salary.

Even if the cost of the bicycle and safety equipment was less than €1,000, employees can only avail of this scheme once every five years.

Note

The scheme does not cover:

• motorbikes, scooters or mopeds

• second-hand bicycles or equipment

• bicycle parts or associated equipment

Some types of income are exempt from tax. These include things like social welfare payments, lottery wins, compensation, and scholarships. You may also be exempt from tax due to your circumstances, for example if you're a certain age or if you earn under a certain amount.

We've listed reasons and items in the table below.

|

Payments to approved pension schemes |

|

Statutory redundancy payments |

|

Certain social welfare payments |

|

Scholarship income |

|

Licensed lottery wins |

|

Certain army pensions and allowances |

| HSE payments to foster parents |

|

Some compensation payments under employment law |

|

Compensation for a personal injury |

|

If you’re on low pay, you may not be liable to pay any tax because your tax credits and reliefs are more than or equal to the tax you owe. There’s no income tax exemption for low income earners under 65 |

|

If you’re over 65 and your income is below certain limits. If your income is over the limit then you may benefit from marginal relief |

| Interest from savings certificates and Savings Bonds and National Instalment Savings Schemes, within limits |

| Certain earnings by artists |

| Certain payments in respect of disabilities linked with Thalidomide |

In the case of tax exemption you’re given a standard cutoff point and tax credit on your Tax Credit Certificate and the higher rate of tax applied is the marginal relief rate, currently 40%.

| Status | 2024 |

| Single, widowed or surviving civil partner | €18,000 |

| Married/civil partnership | €36,000 |

| First two children | €575 each |

| Subsequent children | €830 each |

Some employees are also exempt from USC where employers are instructed not to deduct it. This will all depend on your income and any other circumstances.

If you earn more than the exemption limit, you may be able to claim marginal relief. This means your tax is calculated in a different way in order to limit your tax liability. The relief is only be given when it’s more beneficial than calculating the tax due in the standard way and using your tax credits. The marginal relief rate is 40%.

Example:

Mary (67) is married with 2 qualifying children and an income of €38,000 in 2024 with a total tax credit of: €6,115

Mary’s Tax Credits:

Personal Tax Credit: €3,750

Age Tax Credit: €490

PAYE tax credit: €1,875

Her exemption limit is €36,000 + €575 + €575 (for each child). Total exemption is €37,150.

Income: €38,000

Tax at 20%: €7,600

Deduct tax credits of: €6,115

Tax Due: €1,485

Income: €38,000

Less Exemption at: €37,150

Excess: €850

Total tax due at 40%: €340

In this case it’s better for Mary to be taxed at the marginal relief rate because the tax due is less than when she uses the tax credits.

Even if you’re a PAYE employee, there may come a time when you earn extra income on the side. In most cases you must pay tax on this income and often if you earn over a certain amount, you’ll need to file a self-assessed tax return.

This typically depends on the source of the income and amount earned.

| Rental income |

| Gifts/sponsored ads and content from blogging |

| Share-economy: e.g. hassle, deliveroo, done deal |

| Interest from deposits |

| Pension scheme contributions |

| Dividends from stocks and shares |

● A licensed bank of any of EU States

● A building society of any of the EU States

● Trustee savings bank

● Post Office Savings Bank

● Credit union

Capital Gains is a tax on the gains when you dispose of an ‘asset’ such as land or property. When you own or part own an asset, you may sell, gift or exchange it and this is called a ‘disposal’.

| Land |

| Buildings (houses, apartments, commercial property) |

| Company shares (resident or non-resident) |

| Assets such as goodwill, patents, and copyright |

| Currency (other than Irish currency) |

| Assets of a trade |

|

Foreign life insurance policies and offshore funds

|

| Capital payments (in certain situations) |

| You may also have to pay CGT on gains for other types of assets such as jewellery, antiques, paintings, etc. |

| Cryptocurrency |

Some gains are not subject to CGT and some are exempt only in certain circumstances.

Up to a certain amount is your Personal exemption |

You don’t need to pay CGT on the first €1,270 of your gain for each year |

Disposing of your Principal Private Residence |

You also don’t need to pay tax on the disposal of a property which you occupied or was occupied by a dependent relative as a sole or main residence. (Restrictions may apply where the property was not fully occupied as a main residence throughout ownership or where the sale price reflects development value). If you let out your home at any point while you owned it, you can claim a partial exemption. The Rent-a-Room scheme doesn’t affect your claim for full exemption. You may sell your home and surrounding land of up to 1 acre for its development value. In this case, the exemption will apply to the value of the house or land without its development value. You may have to pay CGT on the value of the house or land over that amount. |

Lottery wins |

Gains from betting, lotteries, sweepstakes, and bonuses payable under the National Instalments Savings Scheme and Prize Bond winnings aren’t liable to CGT |

Stocks and securities |

You don’t need to pay CGT on gains on Government Stocks and other securities (e.g. securities issued by certain semi-state bodies) |

Disposal of wasting chattels (e.g. animals, private motor cars, etc) |

A wasting chattel is a tangible moveable property that’s a ‘wasting asset’. Examples of wasting assets include bloodstock, livestock, motor cars and household furniture, and appliances (besides antiques). The exemption doesn’t apply to wasting chattels for business purposes to the extent that the expenditure on the assets qualified for capital allowances. Neither does the exemption apply to commodities. |

Life Assurance policies |

Unless purchased from another person or taken out with certain foreign insurers on or after 20 May 1993.

|

Tangible movable property |

E.g. household furniture, where the consideration doesn't exceed €2,540. |

If you transfer land to your child to build a house which will be used as your child’s only or main residence, you won’t have to pay CGT on the transfer. A transfer in this case includes a joint transfer by you/and your spouse/civil partner to your child. This also includes a child whom you fostered.

This must have been for at least 5 years before the child reached the age of 18. You must support the claim that you fostered the child by evidence from more than one person.

- Be 1 acre or less

- Have a value of €500,000 or less

1. Without having built a house on that land or

2. If they built a house on the land, having not occupied that house as their only or main residence (this must be for a period of at least 3 years).

This rule doesn’t apply if the child disposes of the land to their spouse or civil partner.

This type of tax is a self-assessment tax and you must calculate the gain or loss arising on the asset you sold. Irrespective of whether a gain or loss was realised, you must report the gain or loss on a tax return.

Just remember that you don’t need to pay tax on the first €1,270 of your gain.

| Date | CGT |

| 6 December 2012 – present | 33% |

| 7 December 2011 – 5 December 2012 | 30% |

| 8 April 2009 – 6 December 2011 | 25% |

| 15 October 2008 – 7 April 2009 | 22% |

| Up to and including 14 October 2008 | 20% |

● Gains from foreign life policies and foreign investment products are charged at 40%

● Gains from venture capital funds are charged at 12.5% (individuals and partnerships) and 15% (companies)

● Windfall gains are charged at 15%

The gain/profit is usually calculated by the difference between the price you paid for the asset and price you sold it for.

In some cases, for example where an asset is disposed of by gift or acquired on the death of the previous owner, the market value is substituted for the sale proceeds and actual cost.

- Cost of acquisition

- Inflation index if the asset/property was purchased before 2003

- Expenditures incurred for the purpose of enhancing the value.

- Incidental expenses incurred on acquisition or disposal, such as solicitor's fees, advertising costs, auctioneer's fees, accounting fees, etc

Special rules apply if you calculate CGT on gains from the disposal of shares.

A chargeable gain on the disposal of company shares is arrived at by deducting the cost of the shares (adjusted for inflation, as appropriate) from the net consideration received for the disposal of the shares.

The calculation is relatively straightforward where a person acquires one block of shares and at a later date, without there having been any changes in the number or type etc. of the shares held, sells all or part of that holding.

Often there will be increases in the shareholding, either because a person purchases additional shares of the same type or they receive additional shares under bonus or rights issues. There are special capital gains tax rules for these situations.

If you need more information, you can contact our advisors at Taxback about your particular situation.

There are a number of reliefs available relating to CGT in certain circumstances. This will help reduce the amount of tax due on the disposal. We've listed them below.

Also known as ‘inflation relief’, this may be claimed if you owned the asset before 2003 and the market value of the asset at the time you became the owner is increased based on inflation calculated by the Central Statistics Office.

For example, if land is being used for development, relief applies to the value that the land would have had at the date you became the owner when it wasn’t development land.

Indexation relief was abolished for the tax year 2003 and any year thereafter, however you can get indexation relief up to and including 2002. If you acquired the property in 2003 or any subsequent year, then you can't avail of this relief.

If you dispose of land to make your farm more efficient, you you may be able to claim this relief. Teagasc (the Agriculture and Food Development Authority) must issue a certificate in order for you to claim this relief.

This certificate must state that you carried out the transaction for farm restructuring purposes.

- The first sale or purchase must be from 1 January 2013 - 31 December 2022

- The next sale or purchase must be within 24 months of the first sale or purchase

- You may also be able to claim relief where you exchanged land with another person

● Land you purchased

● Land you received in exchange for your land

This relief is for you if you made gains from the disposal of business assets. There is a lifetime limit of €1 million for this relief on gains made on or after 1 January 2016. This relief replaced a relief that applied for the years 2014 and 2015.

With this relief, you must pay CGT at the rate of 10% on gains from the disposal of business assets. This is reduced from the normal rate of 33%. Up to 31 December 2016, gains from such disposals are charged at 20%.

You must pay CGT if you receive compensation or insurance money, however if you use the money to replace an asset you may defer the CGT.

The compensation you get reduces the cost of the asset. It can also reduce the replacement cost of the asset if you have lost it or it was destroyed.

Matthew receives compensation from his insurance for damage as a result of a recent flood. If he uses the money to repair damage to the property he can defer the CGT payment until the property is sold.

If you dispose of land between 7 December 2011 and 31 December 2014 then you may be due relief on CGT. You must have owned the land or buildings for at least 7 consecutive years.

You can reduce the gain by the number of years you owned the property divided by 7 years, so if you owned land or buildings for 10 years, the gain will be reduced by seven tenths.

You can claim this relief in respect of land or buildings in this country or in any European Economic Area (EEA) state.

If you’re 55 or older, you may be able to claim relief on disposing any part of your business or farming assets. Although this is called Retirement Relief, you don’t need to retire to avail of it.

● You’re unable to continue farming due to ill health

● You reach the age of 55 within 12 months of the disposal

For disposals made up to and including 31 December 2013, you can claim full relief if the market value at the time of disposal doesn’t exceed €750,000.

● The disposal takes place on or after 1 January 2014, and

● you’re 66 or older

If the market value is more than the above threshold, marginal relief may apply which limits the CGT to half the difference between the market value and the threshold.

The threshold of €750,000 (€500,000 after 1 January 2014 for persons aged 66 or older) is a lifetime limit. If you exceed this threshold, relief will be withdrawn on earlier disposals.

If you dispose of all or part of your business or farming assets to your child, you may be entitled to relief from CGT.

● A child of your deceased child

● A niece or nephew who worked full-time in the business or farm for at least 5 years

● A foster child whom you maintained for at least 5 years

● Up to 31 December 2013, you may claim full relief if you’re 55 or older

● From 1 January 2014, you may claim full relief if you’re between 55 and 65

● If you’re 66 or older the relief is restricted to €3 million

If your child disposes of the asset within 6 years, relief will be withdrawn and your child must pay CGT on the original disposal by you, in addition to the CGT on their own disposal.

● You sell an asset on or after 25 March 2002 for over €500,000

● You sell a house or apartment on or after 1 January 2016 for over €1 million.

The buyer is obliged to withhold 15% of the purchase price from you if you don’t have a CG50A Form. The buyer will then give you a Form CG50B. This will allow you to reclaim the amount withheld by them from Revenue at a later date.

● Be resident in the country

● Have paid CGT on the disposal, if it’s due

● A current Tax Clearance Certificate

● A certificate of authorisation (C2 cert)

● A Tax Clearance Certificate issued specifically for the purpose of Section 980, Taxes Consolidation Act 1997

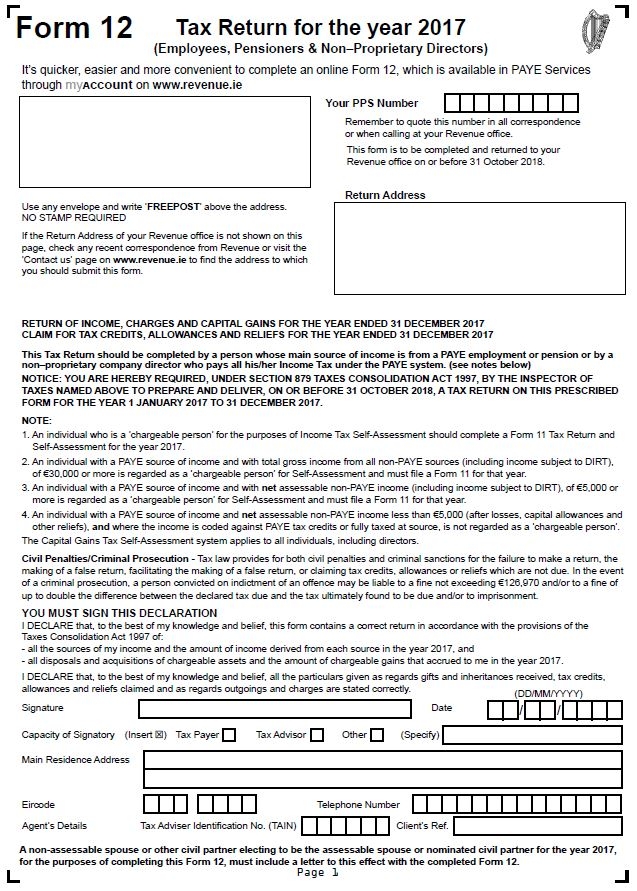

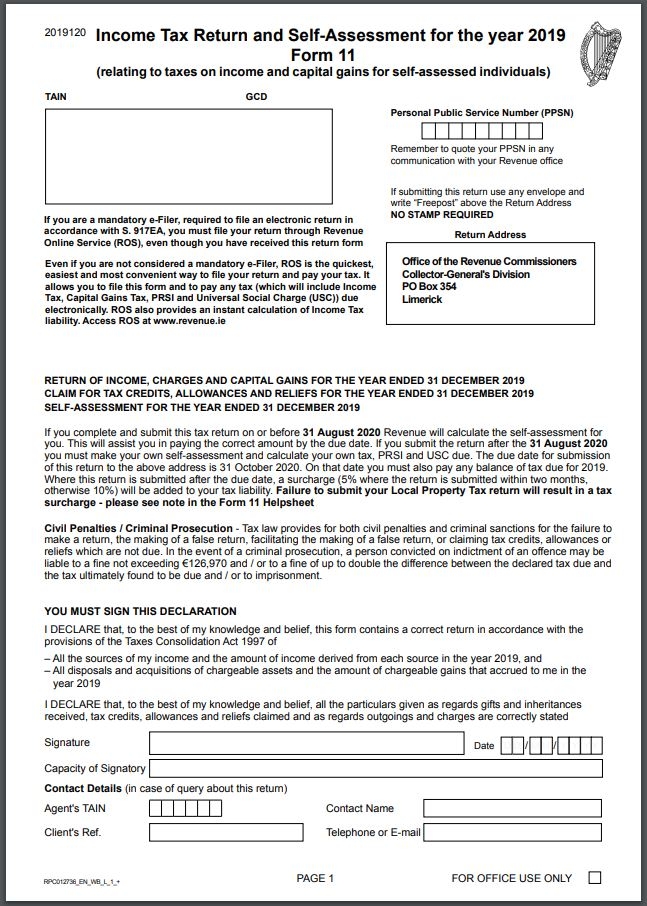

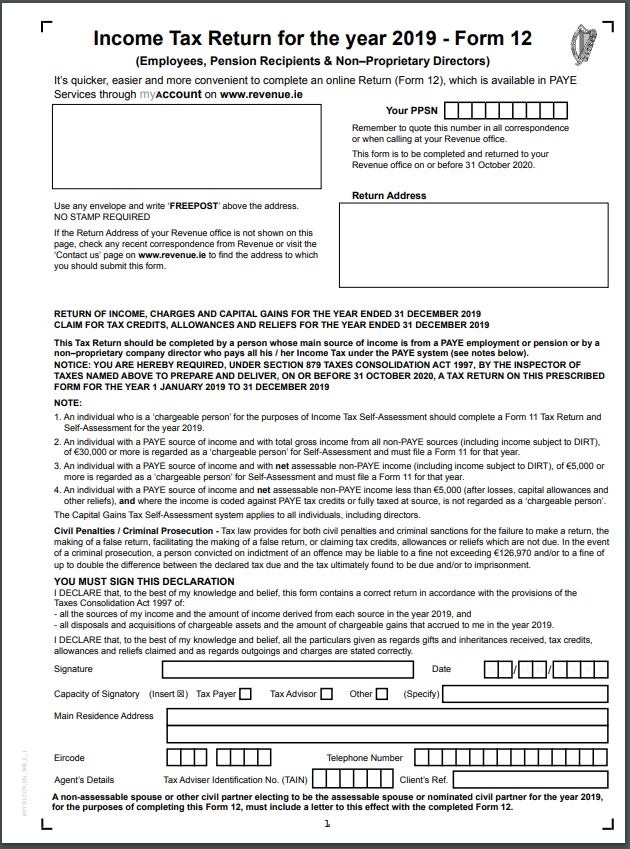

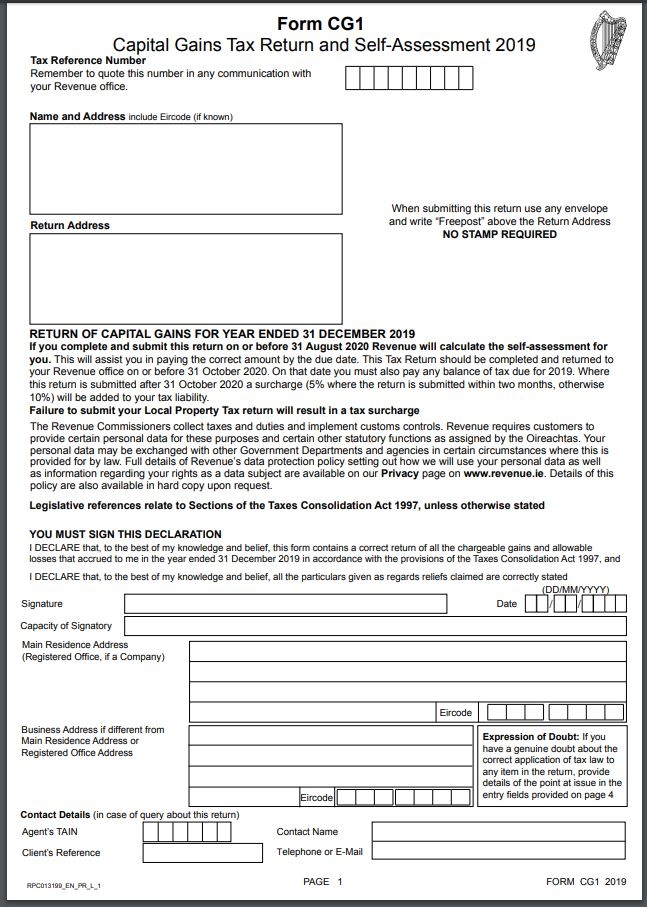

If you're registered for income tax, you must report the capital gain/loss on a Form 11. If you're not registered for income tax, you can report it with Form 12 or complete a CG1 form.

Having calculated the tax due you should send a cheque for that amount to the Collector General's office in Limerick (the payment should be sent with a CGT payslip with relevant details on the payment).

CGT can also be paid online.

Whether you submitted a payment or whether the gain is relieved from tax or a loss arises on the disposal, you must submit a tax return or CG1 Form to Revenue to declare any disposals.

For 2009 and subsequent years the tax year is divided into a set of 2 periods for CGT payment purposes:

You must pay CGT by 15 December of the same year.

You must pay CGT by 31 January of the next year.

For disposals made under a written contract, the time of disposal is usually the date of the contract.

A. If you make a loss on the sale of a property, you still need to declare it. However, it can be utilised against any capital gain incurred in the same or subsequent period. For example even if a loss was realised on the sale of your house, it can be used against any chargeable gain incurred on the sale of other assets such as shares, land etc.

A. Yes, you must pay CGT on any gain in this instance. The gain you make in this case is the difference between the purchase price and sale price.

A. The market value at the date of the gift is used as sales proceeds and CGT is then calculated in the normal manner.

A. You must pay CGT on the gains if the development land exceeds €19,050. Normally your main residence has principal private residence relief, however if the garden is sold for greater than its current use value, then this constitutes the sale of development land.

The difference between the consideration and the current use value is liable to capital gains tax.

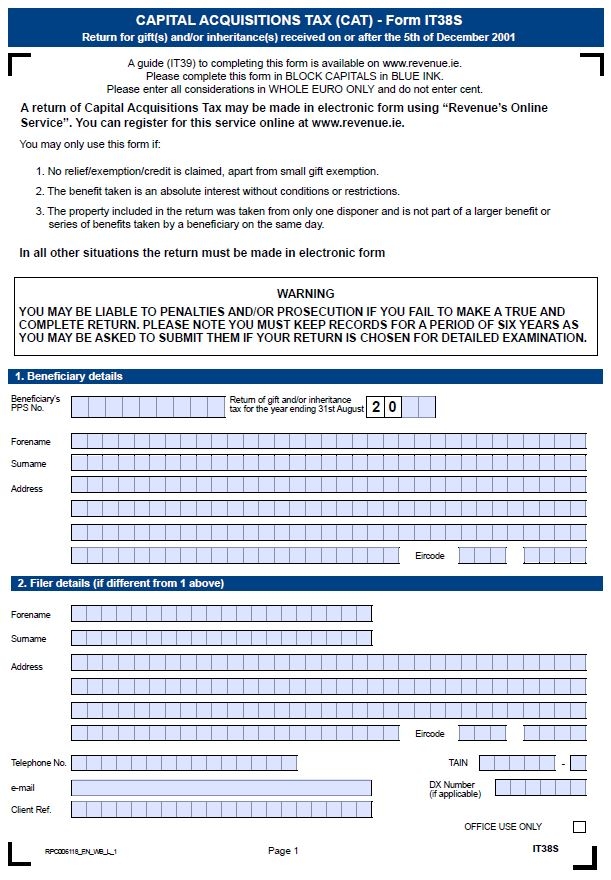

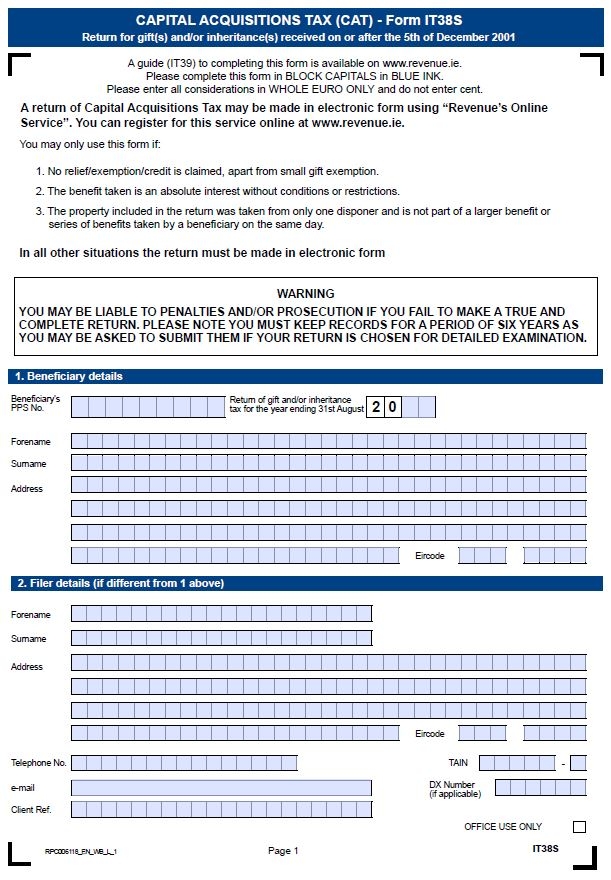

If you receive a gift, you may need to pay a 'gift tax' on it called Capital Acquisitions Tax. For example, if you receive an inheritance following a death, it may be liable to inheritance tax. These taxes are types of Capital Acquisitions Tax.

When do I need to pay CAT?

You’ll pay Capital Acquisitions Tax if a gift is valued over a certain limit and various thresholds apply, depending on the relationship between you (the beneficiary) and the gift giver (the disponer).

Exemptions and reliefs

There are also a number of exemptions and reliefs depending on the type of gift or inheritance. For example, if you receive a gift or inheritance from your spouse/civil partner, then you’re exempt from Capital Acquisitions Tax.

Also, the tax applies to property in Ireland even if the property isn’t in Ireland when either the person giving the benefit or the person receiving it are resident or ordinarily resident in Ireland for tax purposes.

Different thresholds apply based on the relationship of the giver and the person who receives the gift.

These thresholds apply for gifts/inheritance on or after 12 October 2019.

| Group A: €335,000 | Applies when the person receiving the benefit is a child of the person giving it. This includes a stepchild or adopted child. |

| Group B: €32,500 | Applies where the beneficiary is a brother, sister, niece, nephew or lineal ancestor or lineal descendant of the disponer |

| Group C: €16,250 | All other cases |

Group A

This includes a stepchild or adopted child. It can also include a foster child if the child resides with you and was under your care at your own expense for a period or periods totalling at least 5 years before the foster child became 18.

This minimum period doesn’t apply in the case of an inheritance taken on the date of death of the gift giver or disponer. In this case the Group A threshold will apply provided that the foster child was placed in the care of the disponer prior to that date.

Group A also applies to parents who take an inheritance from their child but only where the parent takes full and complete ownership of the inheritance. If a parent doesn’t have full and complete ownership of the benefit, or if a parent receives a gift, Group B will apply.

Applies where the beneficiary is a:

Parent (however if a parent inherits from their child with full and complete ownership of the inheritance then it’s exempt from tax if in the previous 5 years, the child took an inheritance or gift from either parent that wasn’t exempt from Capital Acquisitions Tax. In this case, no tax needs to be paid even if the inheritance from the child is over the threshold).

Grandparent, grandchild or great-grandchild (If a grandchild is a minor (under 18 years of age) and takes a gift or inheritance from his or her grandparent Group A may apply if the grandchild's parent is deceased).

Brother or sister, and nephew or niece of the giver (Group A may apply if the nephew or niece has worked in the business of the person giving the benefit for the previous 5 years and meets the following criteria:

- The nephew or niece is a blood relation rather than a nephew or niece-in-law

- The gift or inheritance consists of property used in connection with the business, including farming, or of shares in the company.

- If the gift or inheritance consists of property then the nephew or niece must work more than 24 hours a week for the disponer at a place where the business is carried on, or for the company if the gift or inheritance is shares. However if business is carried on exclusively by the disponer, their spouse and the nephew or niece then the requirement is that the nephew or niece work more than 15 hours a week.

The relief doesn’t apply if the benefit is taken under a discretionary trust.

Applies to any relationship not included in Group A or Group B.

If you receive a benefit from a relation of your deceased spouse or civil partner, you can be assessed in the same group as your spouse or civil partner would have been if they were receiving a benefit from their relation.

For example, if you get a benefit from the father of your spouse/civil partner, the group threshold would be Group C.

However, if you receive a benefit from the father of your spouse/civil partner and your spouse/civil partner is deceased, then the group threshold would be the same as for a child receiving a benefit from a parent, Group A.

The valuation is the day that the market value of the property comprising the gift/inheritance is established. In the case of a gift, the valuation date is normally the date of the gift.

● Date the inheritance can be set aside for or given to the beneficiary

● Date it’s actually retained for the benefit of the beneficiary

● Date it’s transferred or paid over to the beneficiary

● Gift made in contemplation of death (Donatio Mortis Causa)

● Where a power of revocation hasn’t been exercised-This could happen if a person makes a gift of property but reserves the power to take back the gift. If he or she dies and this power ceases, the recipient then becomes taxable as inheriting the benefit.

If the beneficiary had free use of the benefit before this, he or she will be taxed as receiving a gift of the value of the use of the property.

A gift acquires its market value at the time you become entitled to it. The value that’s taxable is then the market value after following deductions:

- Any liabilities

- Costs and expenses that are properly payable

- Including debts due to the inheritance or gift-for example, funeral expenses, costs of administering the estate or debts owed by the deceased

- Stamp duty, legal costs.

If you make a payment for the benefit or some other contribution in return for it, this may be deducted and is known as a 'consideration' and could be a part payment or payment of debts of the donor.

If you don’t get full ownership but instead receive a benefit for a limited period, then a number of factors are taken into account to calculate the value.

Capital Acquisitions Tax is charged at 33% on gifts or inheritances made on or after 6 December 2012 (the rate was formerly 30%).

This only applies to amounts of capital gain over the group threshold.

| Gifts/inheritances from a spouse/civil partner |

| Payments or compensation for damages |

| Benefits used only for the medical expenses of permanently incapacitated person |

| Benefits taken for charitable purposes or received from a charity |

| Lottery, sweepstake, game, or betting winnings |

| Retirement benefits, pension, and redundancy payments are usually not liable |

If you receive a gift or inherit a house that was your main residence, it may be exempt from tax if you don’t own or have an interest in another house, however there are conditions on how long you should be resident before and after receiving the benefit.

If a parent receives inheritance from his/her child and takes complete ownership of the inheritance, it’s usually taxable under Group A. However it’s exempt if in the previous 5 years, the child took an inheritance or gift from either parent and it was not exempt from Capital Acquisitions Tax.

Other exemptions relate to certain Irish Government securities, bankruptcy, heritage property, and support of a child or spouse.

If you're confused about Capital Acquisitions Tax you can email us at info@taxback.com or live chat with one of our friendly advisors here.

The average Irish tax refund is €1,880

3. Starting work in Ireland

When you start employment in Ireland under the Pay As You Earn (PAYE) system you’ll immediately begin to pay tax (including PAYE, PRSI, and USC) on your income.

You’ll have to pay a number of different taxes and the amount of tax you pay depends on your salary and personal circumstances. Tax is normally withheld from your wages and your employer then submits the tax to Revenue.

Download your FREE Irish Tax Guide

Pay As You Earn Tax (PAYE)

PAYE is charged on the basis of your gross income. How it’s calculated depends on your yearly tax credits and income tax rate band. It can be calculated in 3 ways.

Your yearly tax credits and income tax rate bands are evenly distributed over the course of the tax year.

2. Month 1/Week 1 Basis

Tax is deducted on a week 1 or month 1 basis. You're only entitled to 1 week or 1 month’s tax credits and income tax rate band. Unlike the cumulative basis, your tax credits and income tax rate band are not distributed evenly through the year.

3. Emergency Basis

You can be taxed on an emergency basis if you don't give your new employer a P45 or Tax Credit Certificate. You can read more about it here.

The average Irish tax refund is €1,880

Pay Related Social Insurance (PRSI)

PRSI is paid by employees between 16 and 66 years with very few exceptions. Your employer deducts this from your and makes PRSI payments on your behalf to Revenue/Department of Social Protection.

PRSI is calculated as a percentage of your earnings, before any of your pension payments, and allocated to the Social Insurance Fund. These contributions may entitle you to claim benefits such as Jobseeker’s Benefit, Illness Benefit, and State Pension. You can view your contributions on your payslip.

USC

You must pay Universal Social Charge (USC) if your gross income is more than €13,000 per year. USC is taxable on gross income (this also includes any additional pay such as Benefit-in-Kind and is calculated before any relief for certain capital allowances and pension contributions i.e. there is no relief from USC on pension payments).

Tax Credits

Tax Credits are used to reduce your income tax liability and the amount of credits available to you depends on your personal circumstances. However, everyone in PAYE employment is entitled to a PAYE credit of maximum €1,875 in 2024.

Anyone with an annual PAYE income (employment income, DSP income) under €9,375 is entitled to 20% of his/her income as PAYE credit (for example a person with total employment income for a year of €7,000 will be entitled to a €1,400 PAYE credit).

Not all tax credits will be factored into payroll and in some cases additional tax credits may be claimed after the year end resulting in a refund. Tax credits represent euro for euro the actual money in your pocket i.e. a tax credit of €100 means a tax saving of €100.

Read more about different types of tax credits and reliefs here.

In the Budget 2024, the Irish Government announced increases to tax credits. Most will see an increase of €100 but some will increase by €200.

Tax Bands

There are currently 2 rates of PAYE tax in Ireland, the standard rate of 20% and the higher rate of 40%. The first portion of your income is taxed at the standard rate and once you’ve earned a certain amount, everything after that is taxed at 40%.

Your tax band confirms the amount you can earn before being taxed at 40% and this band is allocated on an annual basis, divided out into weeks or months to help spread your tax evenly.

How is your tax calculated?

When you’re being paid, your employer will apply PAYE and USC tax based on information from Revenue on your employee Tax Credit Certificate. If Revenue doesn’t have up-to-date information on your personal circumstances (marital status, dependents, etc.), this could result in the incorrect allocation of tax bands and credits.

So for example, if you get married/enter into a civil partnership, you should inform Revenue (with your PPS numbers) as quickly as possible because you could end up paying more tax than necessary.

The purpose of the PAYE system is to ensure that an employee's tax liability is spread out evenly over the year. To ensure this, PAYE is normally calculated on a cumulative basis. This means that when your employer calculates your tax liability, they actually calculate the total tax due from 1 January to the date on which the payment is being made.

The tax to be deducted in a particular week or month is the cumulative tax due from 1 January to that date reduced by the amount of tax previously deducted. The cumulative system operates for both tax credits and standard rate cut-off points.

Any tax credits and/or standard rate cut-off point which aren’t used in a pay period are carried forward to the next pay period within that tax year.

Another feature of the cumulative basis is that refunds can be made to an employee where, for example, the employee's tax credits and standard rate cutoff point have been increased.

Tax is calculated at the standard rate of tax on pay up to the amount of your standard rate cutoff point. Any balance of pay above the cumulative standard rate cutoff point is taxed at the higher rate of tax.

The tax calculated at the standard rate is then added to the tax calculated at the higher rate to arrive at the gross tax figure. The gross tax figure is then reduced by the amount of your individual tax credits to calculate how much tax due in that pay period.

So, for example:

Standard rate cut-off point = €42,000 (per year), €807.69 (per week) Tax credits -= €3,750 (per year), €72.11 (per week)

In certain circumstances Revenue may direct your employer to deduct tax on a week 1 or month 1 basis. Where the week 1/month 1 basis applies, your pay, tax credits, and standard rate cutoff point are not accumulated for tax purposes.

Your pay for each income tax week or month is dealt with separately. The tax credits for week 1 (or month 1) are applied to pay for each week (or month) and tax is deducted accordingly. You can’t receive any tax refunds in such cases.

Where your employer holds a Tax Credit certificate on a cumulative basis and they subsequently receive a Tax Credit Certificate or tax deduction card issued on a week 1/month 1 basis, the new basis will apply from the first payday after the date of issue printed on the certificate.

3. Temporary basis & Emergency basis

Your employer must use the temporary tax deduction basis if they’ve been given parts 2 and 3 of a current year or preceding year form P45, stating:

-

Your PPS number and

-

that you weren’t on the emergency basis

-

And the employer has sent part 3 of the form P45 to Revenue and is waiting for a Tax Credit Certificate from Revenue.

Entries on the temporary tax deduction card are made on a non-cumulative basis (week 1/month 1 basis) and the calculation of tax due each week (or month) is done on the same basis as in the week 1/month 1 procedure outlined above.

Your employer should give you weekly or monthly tax credits and standard rate cut-off point shown on form P45 on a non-cumulative basis (week 1/month 1 basis).

You can’t receive a refund of tax while using a temporary tax deduction card.

If you can’t supply your P45 and PPS number when you start a new job, your employer will be obliged to deduct tax on an emergency basis. In short, this will mean you will pay a higher level of tax until you can supply your P45 and PPS number.

What happens when I start work for the first time?

When you start your new job, your employer must deduct tax from your pay under the PAYE system. To make sure your employer deducts the right amount of tax, you should register the details of your new job with Revenue.

It’s best to do this as soon as you accept an offer, even if it’s only part-time or holiday employment. This gives your employer and the tax office time to get things sorted out before your first payday.

Revenue will then send a Tax Credit Certificate to you and your employer which shows the total amount of your tax credits and rate band. You should ask your employer if they have received this a week or two after you have registered the new job with Revenue or provide them with the one you received.

When do I start paying income tax?

You’ll typically pay tax from your first payday. The amount depends on your income and tax credits. If your pay on any payday is less than your tax credits then you don’t pay tax on that day. If your pay is more than your tax credits, you pay tax on the difference.

If you start work in the first week/month of the tax year your employer will deduct 1 week’s/month’s fraction of your annual tax credits from your first week’s/month’s pay and will deduct tax from the balance.

So for example, if you start work in the 27th week of the tax year your employer will calculate your gross tax on your wages but you’ll have 27 weeks of tax credits to offset against this liability. This will continue until you utilise all your unused tax credits.

What do I pay tax on?

You pay tax on earnings of all kinds arising from your job including bonuses, overtime, and non-cash pay and you can read more about it here.

You don't pay tax on:

-

Scholarship income

-

Interest from Savings Certificates, Savings Bonds, and National Installment Savings Schemes with An Post

-

Payments to approved pension schemes

1. Give your PPS number (Personal and Public Service Number) to your employer so they can inform the tax office that you’re working.

2. Apply for a Tax Credit Certificate by registering for myAccount on the Revenue website. When you receive your myAccount password, you can register your new job using the Job and Pension service in myAccount. The tax office will then issue a Certificate of Tax Credits and cut-off point in two working days, which you can give to your employer.

When you start your new job, you should give your employer your P45 (parts 2 and 3) and your PPS number. Your P45 is a statement of your earnings, tax, Universal Social Charge, and PRSI deducted in your last job. When your new employer gets your P45, they’ll inform the tax office so a credit certificate can be sent to them.

The best place to get your P45 is from your previous employer and your PPS number can be found on tax documents or communications from a social welfare or tax office. It may also be on payslips from previous employment. If you don't know your PPS number, you can contact your local social welfare office.

If you can’t supply your P45 and PPS number, your new employer will deduct tax on an emergency basis and give you a temporary tax credit for the first month of employment, but tax deductions will be increased progressively from the second month onwards.

The effect of the emergency basis is that after 4 weeks no tax credits are given and tax is paid at the higher rate from week 9, regardless of the level of pay.

If you’re starting your job for the first time, you should contact Revenue to request a Tax Credit Certificate to give to your employer.

The average Irish tax refund is €1,880

Where you can’t supply a PPS number, your employer is obliged to calculate your tax at the higher rate with no tax credit. When you subsequently provide your PPS number, the normal emergency basis will apply to the earnings in that and subsequent weeks.

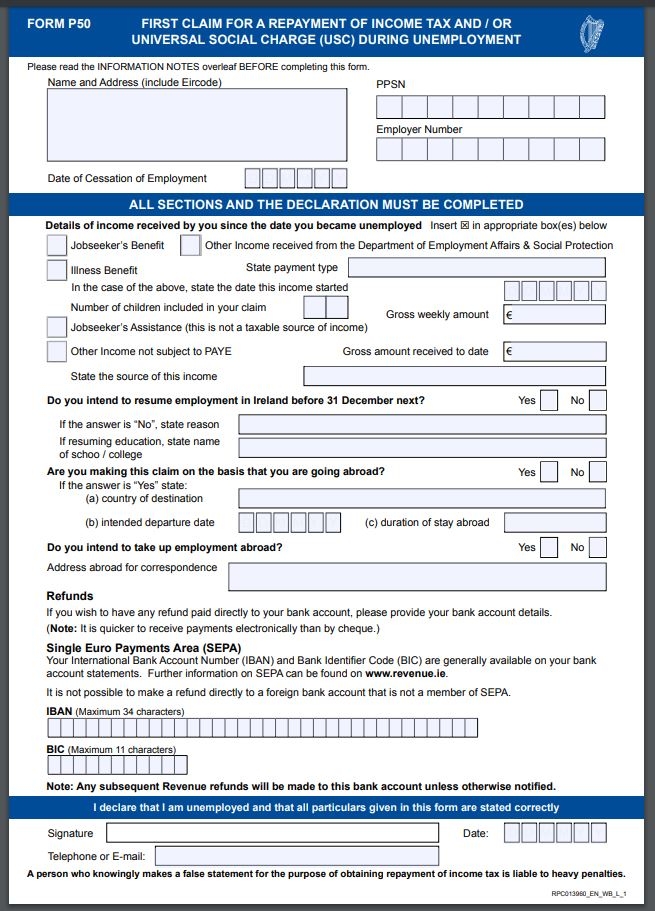

If emergency tax was deducted from you, you can apply for a refund as soon as you become unemployed. Alternatively this can also be repaid via payroll if you provide your new employer with your P45.

You can see the emergency rates in the tables below.

| Standard rate | 20% |

| Higher rate | 40% |

| Weekly Paid | Weekly Cutoff Point | Weekly Tax Credit |

| Weeks 1 to 4 | €808 | €0.00 |

| Weeks 5 onwards | €0.00 | €0.00 |

| Monthly Paid | Monthly Cutoff Point | Monthly Tax Credit |

| Month 1 | €3,500 | €0.00 |

| Month 2 onwards | €0.00 | €0.00 |

If you take up a second job, the PAYE system will treat one job as your main employment. Revenue will then give your tax credits and rate band to that job.

You should contact Revenue as soon when you start your second job to ensure you receive a separate Tax Credit Certificate for each employer. Without this, your new employer may deduct the incorrect amount of tax from your pay.

If you’re receiving a pension from a former employer (occupational pension), this is taken to be your main employment for tax purposes and any other jobs you have are treated as second or multiple jobs.

Splitting tax credits

When you start a 2nd job you can:

-

Leave all your tax credits, tax rate band, and Universal Social Charge (USC) rate band with your main job

-

Or divide your tax credits, tax rate band, and USC rate band between your jobs in any way you want

-

Or transfer any unused tax credits, tax rate band, and USC rate band to your other jobs

It’s important to remember that splitting your tax credits and rate bands between jobs won’t change the total amount of tax you pay. However it can ensure you pay an even amount of tax in each job and get the full benefit of your tax credits and rate bands during the year.

Some tax credits or deductions such as flat-rate expenses can’t be split as they are given only for specific jobs.

If you’ve been out of work for a while, you may not have a P45. In this case, you should contact your local revenue office as soon as possible so your tax credits and cutoff point can be accessed.

Your spouse/civil partner may be using the tax credits you’re due if you’re being assessed as a married couple. If your new role is temporary then it might not be worth looking at these tax credits for that year.

However, you’re entitled to a PAYE allowance and expenses in your own right if you qualify for them. These can be set against your income and aren’t transferable to your spouse. If your spouse isn’t in receipt of taxable income you may be able to claim additional tax credits.

Since 2019 you will no longer get a P45 when you leave a job. Instead, your employer will enter your leaving date and details of your final pay and deductions into Revenue's online system.

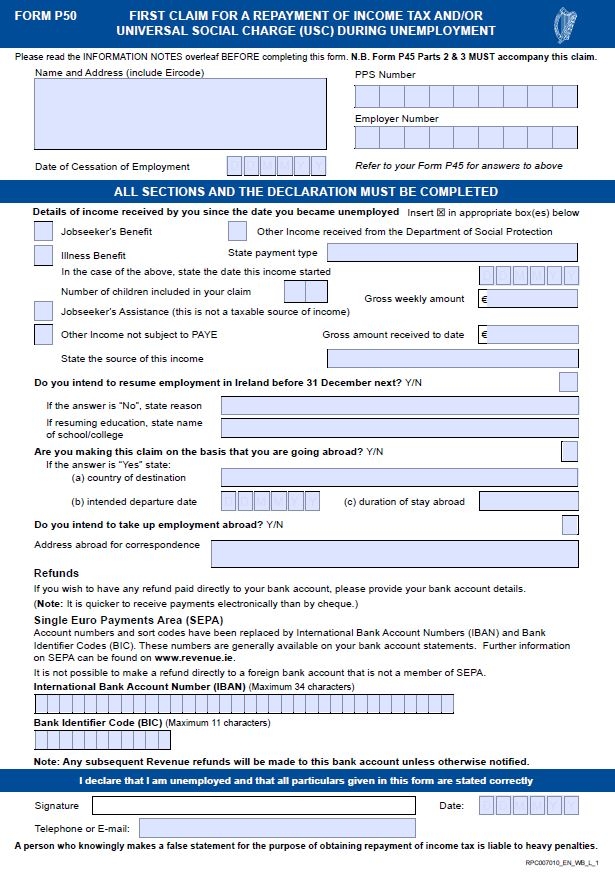

If you’re unemployed before starting your first job or unemployed between jobs, then you might be able to claim a tax refund immediately. This is typically the case if you were unemployed for a period of at least 4 weeks. If you were taxed on an Emergency basis you may apply immediately for a refund on becoming unemployed.

If you were unemployed between jobs, you may end up with unused tax credits, which could result in a tax refund, so it’s worth reviewing your tax position at the end of the year. If you were on Jobseeker’s Benefit or Illness Benefit while out of work, you should contact your local tax office when you resume employment.

If you’re returning to work after a significant gap, you need to ensure your tax and PRSI deductions from your wages are correct. Your new employer must deduct tax and USC from your pay from the beginning of your employment.

-

Give your employer your PPS number and ask for your Employer's Registered Number

-

Register the details of your new job with Revenue

Ideally you should take these steps as soon as you accept an offer of a job. This will give your employment and the tax office time to get things sorted.

When you’ve registered the details of your new job, Revenue will send your employer a Tax Credit Certificate showing the tax credits your employer deducts from your tax bill. Otherwise your employer will tax you on an emergency basis.

PRSI and unemployment.

Giving your employer your PPS number will also allow your social welfare contributions to be recorded along with any contributions you paid in previous periods of employment. If you’ve been out of work for a number of years however, you won’t qualify for short-term social welfare payments such as Illness Benefit immediately. You’ll be immediately covered for Injury Benefit if you’re unable to work due to an accident at work.

How soon you qualify for the various social welfare benefits will depend on the type of benefit and circumstances before returning to work.

Medical cards and unemployment

If you’re unemployed and returning to full or part-time work, you can keep your medical card for 3 years (from the date you start work) as long as you’ve been getting one of the following allowances or benefits for 12 months or more:

-

Jobseeker's Allowance

-

Invalidity Pension

-

Disability Allowance

-

Blind Pension or

-

Have been on an employment incentive scheme or educational opportunity scheme

Rent Supplement

When you re-enter employment, if you’ve been unemployed or not in full-time employment for at least 12 months and are assessed as in need of housing under the Rental Accommodation Scheme, you may be entitled to retain your Rent Supplement.

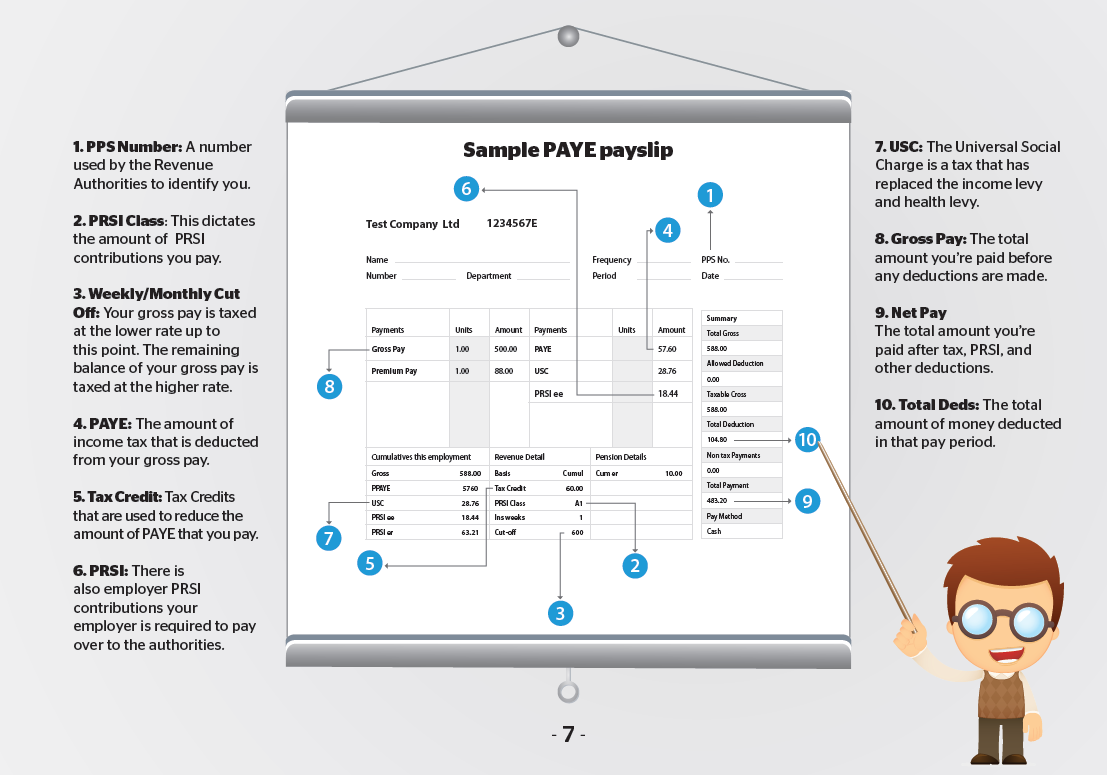

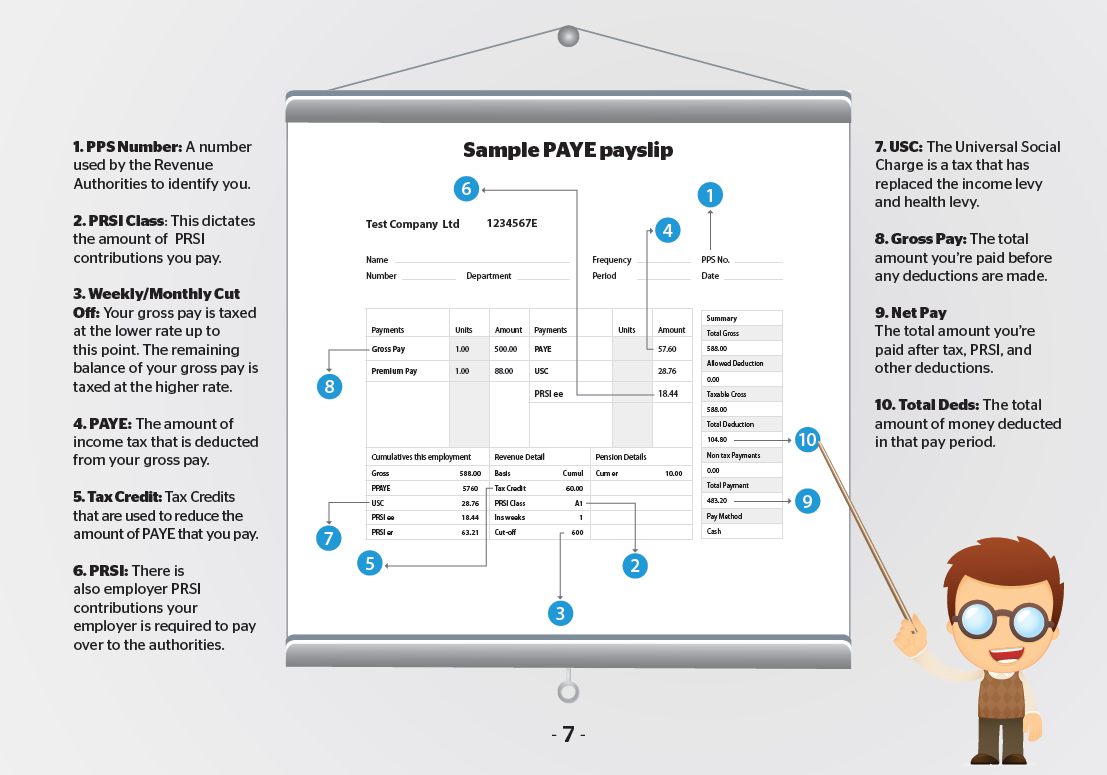

Your employer may prefer to pay your wages on a weekly or monthly basis. Regardless of how you’re paid, it’s likely your employer will send you a payslip when money is transferred into your account. We've explained the various terms that you'll see on your payslip below.

Your payslip will include a number of details including:

1. PPS Number

Your Personal Public Service (PPS) number is a unique identifier which is used for:

-

tax purposes

-

when you need to access social welfare benefits

-

and for public services and information in Ireland

2. PRSI Class

Your PRSI Class is dictated by your employment and influences the amount of PRSI contributions you pay. There are 11 different classes. See a list of classes here.

3. Weekly/monthly cut-off

The amount you earn each time you’re paid before you pay the higher rate of tax. Every time you’re paid, you pay tax at the standard rate up to your standard rate cut-off point.

4. PAYE

Pay As You Earn (PAYE) is a system of deducting income tax, PRSI, and USC from your income.

5. Tax Credit

Every person is entitled to tax credits. These credits differ from person to person and are based on personal circumstances. Your tax credits are allocated each year and tax is calculated as a percentage of your income.

Tax credits are deducted from this to leave the amount of tax you’ll pay. Any unused credits are forwarded to your next pay period(s), so the tax credit will reduce your tax by the amount of the credit.

6. PRSI

Most employees in Ireland need to contribute Pay Related Social Insurance (PRSI). These deductions go towards Social Welfare benefits and pensions. How much you pay depends on your job, earnings, and PRSI class.

7. USC

If you earn more than €13,000 per year (gross) in 2024, you’ll pay the Universal Social Charge (USC).

8. Gross Pay

Gross Pay is the total amount you’re paid before any deductions are made.

9. Net Pay

Here you’ll find the total amount you’re paid after tax, PRSI, and other deductions.

10. Deductions

The total amount of money deducted in that pay period.

| Company name | Your employer’s name |

| Current period | Indicates this payslip is for this pay period. |

| Emp name | Your name goes here |

| Frequency | How often you get paid. So, for example, M = Monthly, W = Weekly, F = Fortnightly, 4 = Four-Weekly, B = Bi-Monthly |

| Pps no | Your Personal Public Service Number |

| Emp no | If you have an employee number you can find it here |

| Dept | Department you work in will be detailed here |

| Cost | Details of the cost centre allocated to you by your employer |

| Pay period | Pay period the payment relates to. If you’re paid monthly the number 2 will indicate February. If you’re paid weekly, 2 will indicate the second working week of the year |

| Pay date | Date you would receive the net pay in your account is outlined here |

| T/N/G |

T =Taxable payment or deduction. N = net payment or deduction. G = gross deduction |

| Other deductions | These are voluntary contributions |

| Pension | Pension contributions you made |

| AVC | Additional Voluntary Contributions towards pension |

| Health | Health insurance contribution for dependents |

| Summary of pay | A Summary of your pay for this period |

| Gross pay | Total taxable income for this period |

| Total deds | Total deductions for this period. Statutory and Voluntary Contributions |

| Non-tax adj | Details of Non Taxable Adjustments |

| Rounding | If any rounding was carried out it will be detailed here |

| Net pay | Amount you’ll receive after paying all statutory taxes and voluntary contributions |

| Pay method | The way you get paid. PayPath directly to your bank or by Cheque |

| Cumulative details | This sections outlines your year-to-date earnings and tax allowance summary |

| Non-tax deds | Pension/PRSA and other gross deduction contributions this year |

| Taxable pay | Taxable earnings in the current year |

| Tax credit | Personal Tax Credit used this year |

| Std. Cut-off | Standard Rate Cut-Off Point used this year |

| Tax paid | Tax paid (PAYE) so far this year |

| Tax/PRSI Details | Tax Status and PRSI Contribution details |

| Tax code | Tax code used to calculate your PAYE tax. N = Normal/Cumulative Basis, W = Week 1/Month 1 Basis, E = Emergency Basis |

| Emr st period | Indicates if you started on emergency tax basis this year |

| Tax Credit Tp | Personal Tax Credit's value applied |

| Pay rel code | PRSI Class at which PRSI is calculated |

| Total ins weeks | Total number of insurable weeks to date you’ve been in this employment from start of the year |

| Comments | Outlines details of employer contributions |

| Emp'er PRSI per | Employer PRSI Contribution this period |

| Emp'er PRSI td | Employer PRSI Contribution for the year to date |

| Tp pener | Amount of Employer Pension/PRSA Contribution this period |

| Ty pener | Amount of Employer Pension/PRSA Contribution paid in the tax year |

| Bik ytd | Details of Benefit in Kind paid this year |

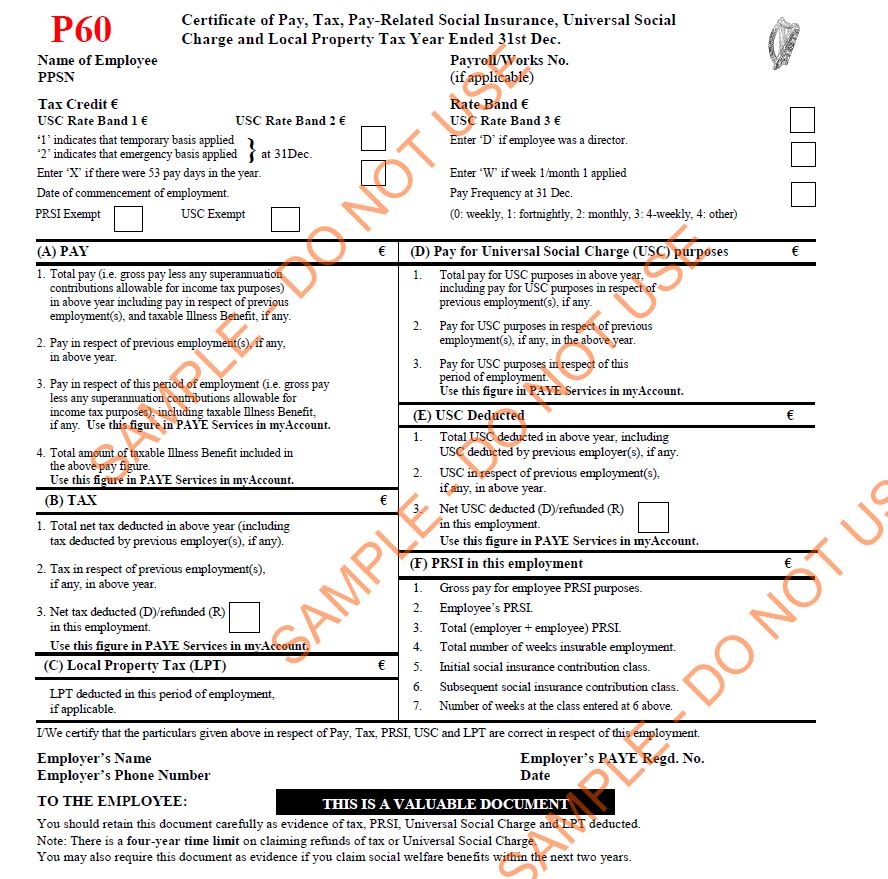

Understanding the P60 (NOTE: As of 1 January 2019, the P60 was abolished!)

Your P60 was basically a document that summarised your tax, PRSI and USC deducted by your employer in the relevant tax year. Workers usually received a P60 by 15 February each year from the employer if they were employed on the last day of that year i.e. 31 December.

If you left employment during the tax year, then you would have got a P45 instead.

Employers deducted tax based on the Tax Credit Certificate issued to them by Revenue.

A P60 wasn't a Revenue assessment of your position or an indication of your final tax liability for the year.

Article: Read how your P60 can make you money here

Sample of what a P60 looked like

Top portion – Personal details

Here you’ll find the year the file relates to as well as a number of your personal details including:

-

Name

-

Address

-

PPS number

-

Tax credit

-

Rate band information

Note: The tax credit and band are merely a summary of what’s been applied by payroll.

Section A – Taxable pay

Details of your gross taxable pay for the year. It’s important to remember the figure here will be after pension deductions or similar contributions made through payroll. Also, if you changed jobs during the year, your pay details in this section will be split into the salary paid by your previous employers and what you’ve been paid by your current employer.

Section B – Tax deduction

Details your total tax deduction in the year. Again, the tax paid details will be subdivided by your employer if you changed jobs during the year.

Section C – Local Property Tax (LPT)

Here you will find details of LPT deductions.

Section D – Pay for Universal Social Charge (USC)

In section your total pay for USC purposes is outlined.

Section E – USC Deducted

Here you'll see how much of your pay was subject to USC in the year. This figure may not be the same as the amount of pay subject to tax as it will be prior to the deduction of pension contributions.

Section F – PRSI in this employment

This outlines exactly how much PRSI you paid in the previous tax year.

The bottom section

The last section is where you can see details of your employer’s name, registration number, and address.

You can send your P60 to info@taxback.com to help us determine if you can claim a PAYE tax refund.

As part of PAYE modernisation, P45s and P60s have been abolished and replaced with an online system.

For the year 2019 and in future, you no longer get a P60 at the end of the year. Instead, an Employment Detail Summary will be available to you.

An Employment Detail Summary contains details of your pay as well as the income tax, PRSI and Universal Social Charge (USC) that has been deducted by your employer and paid Revenue. It also records your Local Property Tax (LPT) deductions (if you choose to have the LPT deducted from your pay).

It is based on information given to Revenue by your employer. You may have other tax liabilities that are not listed.

Check out this interactive example with full explanations here.

Calculating how much tax you'll pay in 2024

You can use our Budget 2024 tax calculator to find out how the announcement made in Budget 2024 will affect your pocket.

Leaving Ireland and tax

If you emigrate it’s a good idea to bring as many important documents with you as you can in addition to your passport.

| Your birth certificate |

| Driving licence |

| Student card |

| Any visas or work permits you may need |

| European Health Insurance Card |

| Any relevant certificates from education or training courses |

| References for work |

| A record of your employment and social insurance contributions in Ireland can all be extremely useful to have as you're setting up, you can do this by filling out a U1, see below |

Where can I find a record of my employment in Ireland?

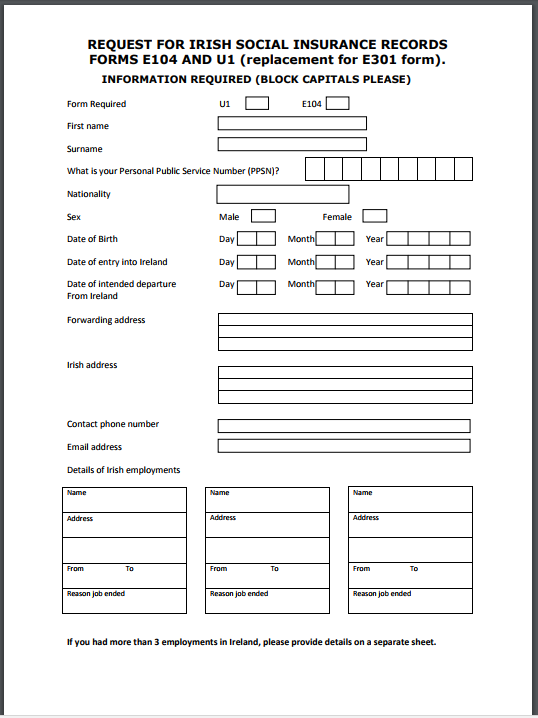

Before you leave Ireland, you should get a Form S1 (certificate of entitlement to healthcare if you don't live in the country where you're insured) and Form U1 (statement of insurance periods to be taken into account when calculating an unemployment benefit) from the Department of Social Protection.

These forms have details of your Irish social insurance record and you’ll need them if you want to claim sickness, maternity, or unemployment benefits in another European country.

This is what the first page of the U1 form looks like:

Processing your application can take a few months as sometimes the department needs to make enquiries with former employers. The more documents you can supply the easier it's to issue the forms!

If you don’t bring your S1 or U1 with you or if you haven’t received them and you need to claim a sickness or unemployment benefit in another European country, the country you’ve moved to can contact Irish authorities to get a record of your insurance contributions.

Is my Jobseeker’s Benefit payment transferable?

If you’ve been getting Jobseeker’s Benefit in Ireland for at least 4 weeks, it’s possible to transfer it to another European country for up to 13 weeks if you’re looking for work there. Your Jobseeker’s Benefit will be paid directly to you at the same rate as it was paid in Ireland.

How to transfer the benefit

To do this, you must inform your local social welfare office at least 4 weeks in advance of leaving Ireland and ask for a completed Form U1. You must bring this form to the social services office of the country you’re travelling to and register with the unemployment services there within 7 days of arrival.

You may transfer your Jobseeker’s Benefit payment more than once while you’re unemployed as long as you don’t exceed the total maximum of 13 weeks.

If you return to Ireland on or before the expiry of the 13 weeks in the other European country, you’ll still be entitled to Jobseeker’s Benefit in Ireland.

However, it’s important to be aware that if you transfer your Jobseeker’s Benefit payment to another European country and stay there for longer than 13 weeks, you’ll lose your entitlement to the payment if you return to Ireland. You’ll need to apply for a means tested payment instead (for example Jobseeker’s Allowance).

Means tested social assistance payments can’t be transferred to another country.

Reclaiming tax when leaving Ireland

If you worked and paid tax since 1 January and you’re now unemployed and/or leaving Ireland, you may be entitled to a tax refund if you have unused tax credits.

If you haven’t paid any tax, you won’t be due a refund.

The average Irish tax refund from Taxback is €1,880 so it’s worth your while investigating if you have any tax refund entitlements. You can use our calculator to estimate a refund.

Can I get a refund of my PRSI contributions?

You can only receive a refund of PRSI contributions in limited circumstances, usually in cases where contributions have been paid in error or paid at the wrong rate.

What happens to my PPS number when I leave Ireland?

In short, nothing. Your PPS number is your unique reference number and is yours for life. You can use the same number if/when you come back to Ireland.

Tax abroad

Tax laws vary from country to country and it’s important to be aware of them. Be aware that unless you reside for a whole year abroad, you may have to pay tax on your earnings in Ireland.

How much tax will I pay abroad?

You’ll have to pay varying levels of tax depending on the country you move to. For example, if you move to Dubai or the Cayman Islands it’s likely that you’ll pay very little income tax. However, you’ll find a relatively similar tax burden to Ireland in most other popular destinations.

You may be able to reclaim some tax if you work abroad. For example, the average tax refunds with Taxback are $2600 for Australia, £963 for the UK and $904 for Canada.

If you’re moving abroad and will be resident in Ireland the year you leave and non-resident the next year, you can claim 'Split-Year treatment' in the year of departure. This means you’ll be treated as a resident up to the date of your departure.

All employment income up to that date is taxed in the normal way and your employment income from the date of departure is ignored for Irish tax purposes. Generally, full tax credits are allowable on a 'cumulative basis' which means you receive a full year of tax credits even though you’ve been resident here for only part of the year.

Similarly, if you’re coming to live in Ireland or returning after living abroad for a few years and you’ll be resident here for the next year, you can claim Split-Year treatment in the year you arrive.

This means you’re treated as resident in Ireland from the date you arrive and all your employment income from that date is taxed in the normal way. Split-Year treatment only applies to employment income.

If you’re leaving Ireland, to qualify for SYT you must be resident in the year of departure and intend to be non-resident in the year following your departure. You don’t have to wait until the tax year following the year you arrive or depart. However you must satisfy Revenue that you fulfil the intended residence requirements for the following tax year. A letter confirming your employment or an employment contract are preferred forms of proof. If you're unsuccessful, you can reapply at the end of the following tax year.

If you have successfully qualified and fulfilled your intentions, you'll be taxed as resident in the state for the appropriate period. You should be aware that if you qualify for Split Year Treatment and don't fulfil your intention for some reason (e.g. ill health or cancellation of employment), the ruling will stand regardless. This could leave you liable to pay Irish tax on foreign employment income for the following year, if you were resident in the state for the previous tax year.

If you need help claiming Split-Year relief you can contact our friendly team at info@taxback.com

Tax treaties

Ireland has tax treaties with more than 70 countries to ensure if you earn income that is taxed in one country, it won’t be taxed again in another country.

Under a tax treaty, a tax credit or exemption from tax may be given on some kinds of income, in either the country of residence or the country where you earned the income.

Redundancy

If you’re made redundant, you may receive a lump sum payment from your employer however if all of your lump sum is statutory redundancy, (subject to a maximum lifetime tax-free limit of €200,000), no tax will be due.

You’re entitled to one of the following tax exemption options on your redundancy payment, whichever is the higher:

1.Basic Exemption

The Basic Exemption due is €10,160 plus €765 for each complete year of service (this doesn't include statutory redundancy which is tax-free).

2. Basic Exemption plus Increased Exemption

An additional €10,000 (called the Increased Exemption) is also available in 2 circumstances.

a. If you haven't received a tax-free lump sum in the last 10 years and you’re not getting a lump sum pension payment now or in the future.

b. If you’re in an occupational pension scheme, the Increased Exemption is reduced by any tax-free lump sum from the pension scheme you may be entitled to receive.

3. Standard Capital Superannuation Benefit (SCSB)

This is an additional relief that typically benefits people with higher earnings and long service. It can be used if the following formula gives an amount greater than either basic exemption or Basic Exemption plus Increased Exemption.

Calculation of tax in redundancy

As mentioned above, a certain amount of your redundancy payment is tax-free and the balance will be taxed as part of the current year's income. The amount of your lump sum subject to tax is not subject to PRSI, but the Universal Social Charge may be payable.

Leaving employment to returning to education

More and more people are choosing to leave employment and return to education. If you leave a job to upskill, you may also be entitled to claim tax back.

For example if you pay fees to attend college, university or a training course, you may be able to claim relief. The limit on tuition fees you can claim is €7,000 per course and you’ll receive relief at the standard rate of tax which is 20%.