In this guide, you will learn how to view online (print/save) your Employment Detail Summary (previously known as P60) step by step, and we will answer some of the most frequently asked questions regarding the P60 document.

Table of Contents Show

What is a P60 replacement?

Paper-based P60s and P45s were replaced by an online system as part of PAYE innovation in Ireland. 2018 was the last year that P60s were issued to employees.

Now the document is known as Employment Detail Summary (P60 replacement) – and both names are still often used interchangeably by taxpayers.

A P60 is no longer issued at the end of the year. Traditionally, taxpayers used their P60 in Ireland to apply for tax refunds, loan and mortgage applications, and other queries relating to pay and tax.

How to get your P60 online?

P60 is now known as Employment Detail Summary (EDS) and can be accessed online. You will need to register with Revenue’s myAccount service.

You will be able to do it and access your P60 online unless you are exempt from using Revenue’s online service. (Link and steps below).

If you’ve been granted an exemption, you can request your P60 / Employment Detail Summary by calling or mailing your local tax office. Then, you will receive a printout at your home address.

To find your P60 online you need to go through these steps:

1. You should enter your personal profile on the Revenue website

2. In the Pay As You Earn section you should find the information for the taxes for the previous 4 years.

3. Go to the section for your documents

4. Select the period you want to look at

5. Click on the “View PDF link”

Then the PDF will open in a new tab/window in your browser. Now you can view online/ print or save your Employment Detail Summary – P60.

If you want to save time and stress, our team can access your pay and tax details on your behalf and claim your refund.

The average Irish tax refund is €1,880

How do I get a copy of my P60?

Paper-based P45s and P60s were replaced by an online system as part of PAYE innovation as we already discussed. 2018 was the last year that P60s were issued to employees.

A P60 is no longer issued at the end of the year. Instead, you can use Revenue’s myAccount tool to obtain an Employment Detail Summary (Take a look at the steps above).

What is P60?

Once a key tax document, the so-called “P60 (Ireland)” was typically issued by employers at the end of a tax year. Taxpayers used their P60 to apply for tax refunds, loan and mortgage applications and other queries relating to pay and tax.

The P60, also known as the end-of-year certificate, was a summary given to you by the employer each year. It outlined all of your pay and the tax that was deducted by your employer during the year.

So, was the P60 a payslip?

The P60 form was a summary of the payslips you received during the year. It used to contain the total number of pay and taxes including the National insurance taken.

Every employee is entitled to receive a P60 from his employer if he/she was employed on the last day of the year i.e. 31 December.

If you leave employment during a tax year, you will receive a P45 when leaving instead.

All employees should receive their P60 by 15 February, however, many employers will issue P60s before this.

The average Irish tax refund is €1,880

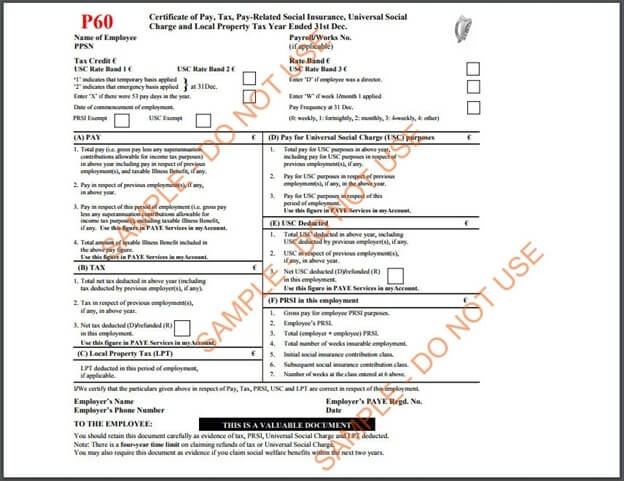

What did a P60 used to include and look like?

Taxpayers found sections to account for each tax withheld from their income, including:

- Pay As You Earn (PAYE)

- Pay Related Social Insurance (PRSI)

- Universal Social Charge (USC)

- Local Property Tax (LPT).

Who received a P60?

Before 2019, all employees received a P60 from their employer at the end of the year.

Most self-employed workers did not receive one, as they typically do not have an employer.

It was also possible to get a P60 from your previous employer. The employee had to ask for the document and the employer was obliged to supply it.

The average Irish tax refund is €1,880

Why was the P60 important and what was it used for?

P60s were important for a variety of reasons.

- Firstly, the document was useful in determining whether or not you had overpaid tax during the previous year.

- The P60 provided an outline of the amount of tax you have paid in the tax year.

- Taxpayers typically needed their P60 when applying for their tax refund, a loan or other scenarios in which proof of pay and tax were required.

Why was the P60 abolished?

In 2018 the P60 document was abolished by Revenue as part of an effort to modernise their processes by removing much of the paperwork. The idea was to provide more accurate and up-to-date information for employees, employers and Revenue.

Along with the P45, the P60 was removed and replaced by an online, real-time summary of employment. Known as an Employment Detail Summary, the new system provides a complete outline of taxes paid during the year.

The information contained within the new document can be used in the same manner as Form P60, for example, as proof of income for a third party.

You will also no longer need a P60 form when applying for a tax refund relating to tax years after 2018.

Apply with Taxback now!

What is the P60 replacement?

Many people ask what is P60 called now. P60’s new name in Ireland is Employment Detail Summary and it is the replacement of the old form.

You can view the P60 replacement for each year on the Revenue website.

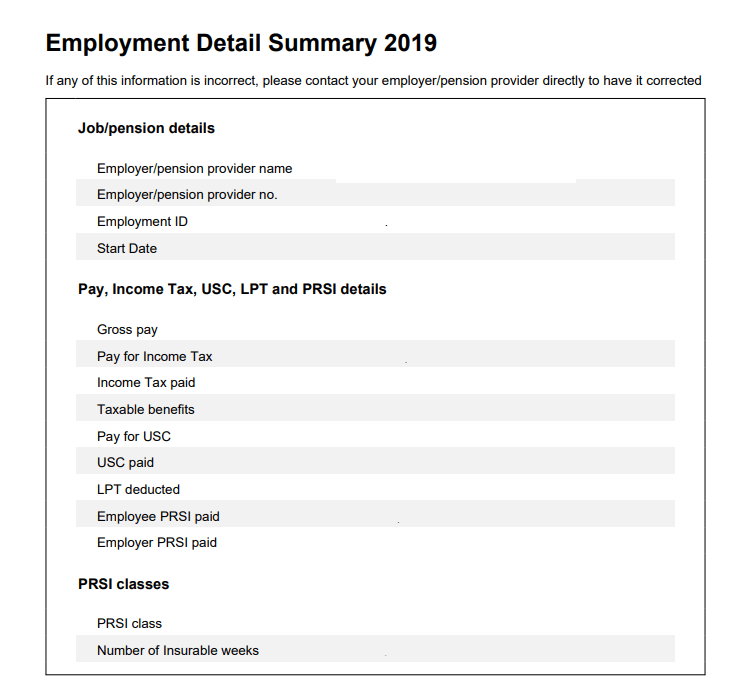

Much like the P60, an Employment Detail Summary outlines your pay and statutory deductions for the tax year as reported by your employer or pension provider.

Most of these documents are available at the beginning of the tax year, but it is recommended that an employee waits until the middle of January to request them as their employer may have to submit a correction.

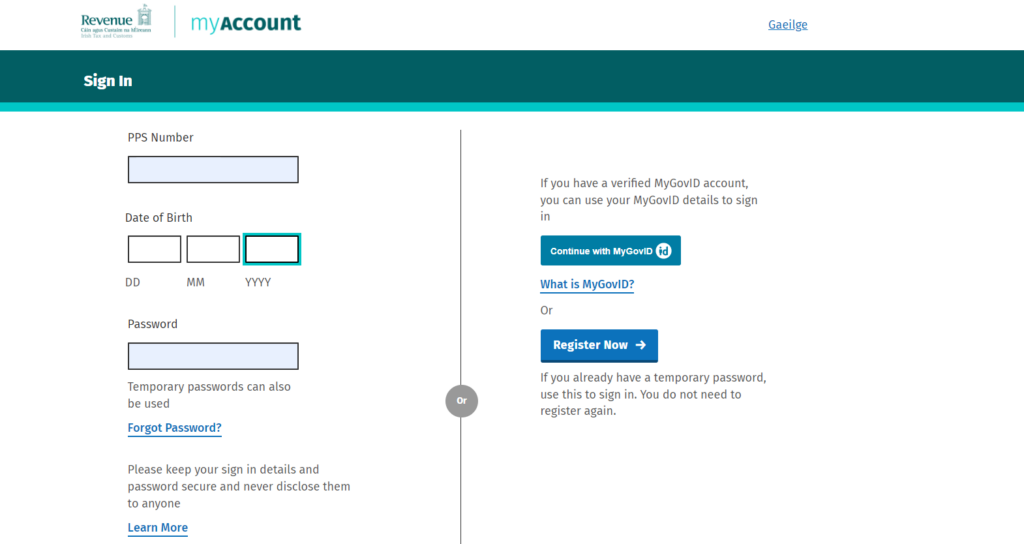

How can I view my P60 online?

While the P60 has been abolished, you can now view your Employment Detail Summary online on the Revenue website.

So how to get p60 on revenue?

- Sign in to MyAccount section of the website

- Go to the “PAYE Services” section where you can click on “Review you tax Year X-Year Y”

- Click on “My Documents” which should be on the upper right corner of your screen.

- You have to pick the specific year from the folder “Tax year”

- Click “View PDF” and you should see the EDS (Employment Detail Summary)

If you would like to find your P60 for 2018 or earlier tax years, Taxback can help you find it.

I’ve lost my P60. Can I claim a tax refund without it?

To claim a refund in Ireland, you can go back a maximum of four years. That means that, in 2022, the earliest you will be able to apply for a refund is 2018.

If you would like to apply for your 2018 tax refund you may need your 2018 P60. If you have lost your P60 from your previous employer, the Taxback team can help you locate it! For tax years after 2018, you will not need to request a P60 to apply for your refund.

The average Irish tax refund is €1,880

I see ‘tax credit’ on my P60. What does this mean?

Tax credits reduce your income tax liability. The amount of credits available to you depends on your personal circumstances.

Not all tax credits will be factored into payroll and, in some cases, additional tax credits may be claimed after the year-end resulting in a refund.

Tax credits represent euro for euro the actual money in your pocket i.e. a tax credit of €100 means a tax saving of €100 meaning €100 more in your pocket!

What are tax rate bands?

Tax rate bands were also typically outlined on the P60 document.

There are currently two rates of income tax in Ireland. The first band is the standard rate of 20%. The higher band is 40%.

For a single individual the first €44,000 of your income is taxed at the standard rate and the balance of income earned above this amount is taxed at 40%.

The bands are allocated on an annual basis but it is divided out into weeks or months to help spread your tax evenly.

Analyzing your P60

The best way to fully explain the P60 is to provide some examples with explanations. Below we have therefore marked up 4 sample P60s highlighting various issues.

First, let’s take a look at some common terms that were included on the P60.

PPS Number

This is your unique identification number for all dealings with the Public Service (i.e. Revenue, Department of social protection, health and education services).

Pay As You Earn (PAYE)

Employees typically pay income tax through the PAYE system.

Each time you are paid, your employer will deduct income tax, PRSI and USC and transfer your deductions to Revenue.

Pay Related Social Insurance (PRSI) class

PRSI is the main source of funding for social welfare payments. Each time you are paid, both you and your employer will make a PRSI contribution to Revenue. The value of this payment is based on the amount of your pay.

P60 documents listed each employee’s PRSI ‘class’. Your specific PRSI class was determined by factors such as your level of earnings, whether you are an employee or self-employed and whether you are a private or public sector worker.

Your PRSI class will determine the rate at which you pay PRSI and the amount of income you can earn without incurring the charge.

Universal Social Charge (USC)

If you earn more than €13,000 (gross) per year, you must also pay USC.

This is a tax paid on gross income, including notional pay (such as benefit-in-kind), after any relief for certain capital allowances.

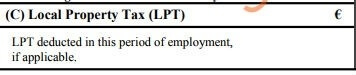

Local Property Tax (LPT)

This is a self-assessed tax charged on the value of Irish properties. This means that you need to self-assess the value of your property each year and pay your tax to Revenue.

What did a P60 document look like?

P60s were divided into various sections such as:

Top portion

This part of the P60 contained your personal details i.e. your name, address, PPS number, tax credit and rate band information. It is important to remember that the tax credit and band here is merely a summary of what has been applied via the payroll.

Also, it is important to look into this top section of the P60 to confirm which year the P60 relates to. This information is found at the very top of the P60.

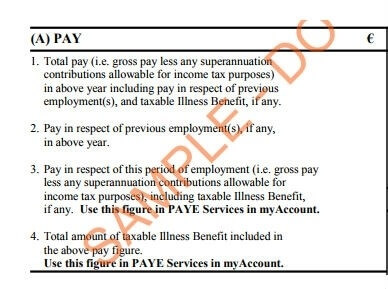

Section A

This part of the P60 confirms your gross taxable pay for the year.

The figure here will be after the deduction of any pension contributions you will have made via the payroll. This may explain any difference when you compare this figure to the gross pay per your contract.

If you changed employment during the year your pay details in this section will be subdivided into the salary paid to you by your previous employer (s) and that paid to you by your current employer.

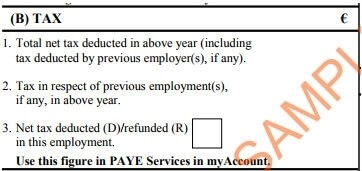

Section B

This part of the P60 confirms the total tax deducted in the year.

Again, if you changed employment during the year the tax paid details will be subdivided into that paid in your previous employment (s) and that paid in your current employment. Thus giving a total summary for the year.

Section C

This part of the P60 provides details of the PRSI paid in your current employment.

This section is different to the last 2 sections in that PRSI paid in previous employments is not recorded here. The first item in this section is the employee PRSI for the year i.e. the PRSI that was actually deducted from your salary.

This amount would also have included health levy and this made the calculation a little more complicated but now that the health levy has been abolished this part of the P60 is a lot easier to understand.

The second item in this section is total PRSI i.e. employer and employee PRSI.

If you deduct the figure from the first item from this total figure you will have the total PRSI paid on your behalf by your employer in the year. Section C also contains details regarding your PRSI class etc.

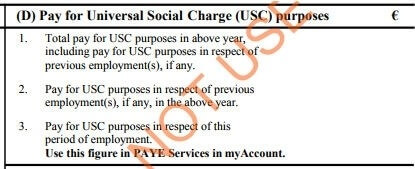

Section D

This is a new section and confirms the amount of pay subject to USC in the year.

This figure may not be the same as the amount of pay subject to tax as it will be prior to the deduction of pension contributions. In addition, this section is somewhat similar to the PRSI section of the P60 as it contains details for this employment only.

Finally, this section confirms the amount of USC deducted from you in this employment.

The bottom section!

The bottom of the P60 will show details of your employer’s name, registration number and address.

The average Irish tax refund is €1,880

P60 Examples:

Example A – Jane

Jane is married and her husband stays at home to take care of their two sons. He does not work outside the home. Jane is a company director with a 70% shareholding in the company. Her P60 may look something like the below.

Name, address and PPS Number

It is always important to check your name and PPS number is correct! Jane will also find the address her company has on file. If Jane is not happy that the address is correct she should tell her employer to update their records.

Tax Credit

Jane has been allocated a tax credit of €3,300. She is entitled to the married person’s personal tax credit but not the PAYE credit as she is a proprietary director.

It is clear from her P60 she was not allocated the Home Carer Tax Credit. As the tax year is now over, Jane may now be entitled to claim this credit as a tax refund. The Home Carer Tax Credit is worth €1,950 in 2025.

Rate Band

Jane has been allocated the tax rate band appropriate to her circumstances i.e. €53,000 (in 2025) for a married couple with one income. This means that any income she earns up to €53,000 is taxed at 20% and any income over that amount is taxed at 40%.

Total pay

€60,000.

Employee’s PRSI

As Jane is a company director, she is class S1 (see below). This means that she pays PRSI on her entire pay at a rate of 4%.

As you will see from the other examples, this is different to the method of calculation of PRSI for an employee whereby they are entitled to a PRSI free amount each month. Jane’s PRSI is, therefore, €60,000 X 4% = €2,400.

Total Income Tax

This is the total tax that Jane has paid during the year. If Jane has income other than that detailed on this P60 (eg. Rental income) she will need to report this on her tax return and it is likely that she will have to pay additional tax i.e., this figure is merely confirmation of the tax paid over to date.

Example B – Michael

Michael is married and both himself and his wife work outside of the home. His wife works part-time and has allocated some of her bands and credits to Michael.

However, as his hours were reduced during the year he has not utilised these in full and it would be advisable for his wife to now check her P60 to determine whether or not she paid any tax during the year.

If she did pay any tax it is likely that she will be due a refund. Michael’s payslip might look like the below:

Tax Credits

In Micheal’s case he has been allocated a tax credit of €6,000.

By checking his Revenue account online we were able to determine that this is the married person’s personal tax credit of €4,000 plus the PAYE tax credit of €2,000.

Michael’s wife, therefore, should expect to see a tax credit of €2,000 i.e. just a PAYE credit as Michael has utilised her personal tax credit.

*tax credits listed are for 2025 tax year

Rate Band

Michael and his wife are entitled to a rate band of €53,000 plus an amount up to €35,000 or his wife’s income whichever is the lower.

Michael and his wife chose to have this band allocated in full to Michael.

Total net tax deducted

As Michael’s earnings were less than his rate band his income was taxed in full at 20% i.e. €18,408 X 20% = €3,682.

After this the tax credits of €6,000 were deducted. As the tax credits were greater than the tax he paid no tax during the year.

Note: you may hear of tax credits being referred to as “non-refundable tax credits”.

This means that if your tax before the deduction of credits is less than the credits your tax will be reduced to nil rather than a negative figure.

If he earned no other income and his wife’s earnings were too low for her to have incurred a tax charge via the payroll this will be his final position for the year.

The average Irish tax refund is €1,880

Example C – Mary White

Mary is unmarried. In addition to her employment income, she earns €10,000 each year from another source.

PAYE is not applied to this €10,000 and therefore Mary has asked the Revenue to make adjustments to her tax credits and rate band in order to ensure that the tax on this income is collected throughout the year and to avoid a tax liability at the year end.

Mary needs to check her records each year to ensure that the correct adjustments have been made:

Tax Credit

Mary has been allocated the single tax credit of €2,000 plus the PAYE tax credit of €2,000. Giving a total tax credit of €4,400.

This has, however, been reduced by her non PAYE income multiplied by the standard rate of tax i.e. 20%.

Therefore, her total credits of €4,000 have been reduced by €2,000, leaving her with annual tax credits of €2,000.

Rate Band

Mary has been allocated with a single person’s tax rate band of €44,000(2025).

This, has, however, been reduced by the amount of her non PAYE income i.e. €10,000 leaving her with a rate band of €34,000 for the year.

If Mary’s non PAYE income in 2025 was less than €10,000 she will be entitled to a refund of tax but if this income was greater than €10,000 in 2025 she will need to make an additional tax payment.

Employee’s PRSI

As an employee, Mary is entitled to a PRSI exempt amount of €551 per month.

Everything she earns over that amount is subject to PRSI at 4.1%. Her PRSI is therefore calculated as follows: (€72,000 – (€551 X 12)) X 4.1% = €2,952.

Total PRSI

As Mary is insured under class A1, employer’s PRSI was payable at a rate of 11.15%(2025).

The total PRSI figure therefore is calculated by multiplying her income by 11.15% and adding this to the employee PRSI amount to reach a total figure of €10,980.

PRSI class

Class A1 applies as she is an employee earning over €410 per week.

Total net tax deducted

This is calculated by firstly multiplying the rate band by 20% (i.e. €34,000 X 20% = €6,800).

We then deduct the rate band from the total income of €72,000, which gives us €38,000.

This amount is then multiplied by the higher rate of tax (€38,000 X 40% = €15,200).

The two amounts are added and the tax credit is deducted from the total i.e. €6,800 + €15,200 – €2,000 = €20,000.

D – Joe Bloggs.

Joe is single:

Tax Credit

Joe has been allocated the single tax credit of €1,700 plus the PAYE tax credit of €1,700.

Giving a total tax credit of €3,400. However, Joe has informed us that he has been paying rent for the past number of years.

In this regard, he is entitled to an additional tax credit of €320.

He has not received relief in respect of this during the tax year.

But, now that the year is over he may make a claim for this additional credit and this will result in a refund due to him.

As his total tax paid for the year is less than the tax credit to be claimed i.e. €288, he will be entitled to claim a full refund of his PAYE for the year.

Rate Band

Joe has been allocated with a single person’s tax rate band of €44,000 (slight rounding difference due to payroll software).

Employee’s PRSI

As an employee at class A0, Joe is exempt from employee PRSI.

Total PRSI

As Joe is insured under class A0, Class A0 applies to employees earning up to €410 per week(2025).

The average Irish tax refund is €1,880

Need help understanding your PAYE payslip?

How to get your Irish tax refund

Ready to claim your tax refund?

Great!

Thousands of Irish workers chose to file their tax return with Taxback each year – we’re the Irish tax experts!

We’ll take care of all the boring paperwork and make sure you’re availing of EVERY possible tax credit.

The average Irish tax refund with Taxback is €1,880 so it’s undoubtedly worth claiming back the tax rebate that you’re owed!

Apply online today!

Last Updated on October 29, 2025