Should the Irish government be doing more to help renters?

The Rent Tax Credit is needed 'now more than ever'

€1,169.

That's the average amount Irish tenants were forking out in rent each month in Q1 2019, according to the RTB Rent Index.

This represents an 8.3% increase (€90) on 2018 and a 2.1% increase quarter-on-quarter.

Almost 900,000 people rent property in Ireland and it's widely accepted that rents are crippling many individuals and families alike throughout the country. Thousands of young people are trying to balance high rents with the need to save for the deposit for a house, while many families are also grappling with a rental market that is short on supply and high in demand – pushing prices up and making the market very competitive.

And with rents on the rise, in the latest Taxback.com Taxpayer Sentiment Survey we asked 2,500 people nationwide for their thoughts on what could be done to ease pressure on renters.

Their response was unequivocal; the government should be doing more to help out.

The Rent Tax Credit

The Rent Tax Credit is currently being phased out. In 2016 the relief was worth €400 - €800 per year to single renters (depending on circumstances) and as much as €1,600 to widows, widowers and married couples over the age of 55.

While the credit wasn't a hugely lucrative relief – it did provide at least some financial respite – particularly to those struggling with high rents – by allowing them to reduce their income tax bill.

Today relief can only be claimed for the 2015 – 2017 tax years, but only if you were renting property on 7 December 2010.

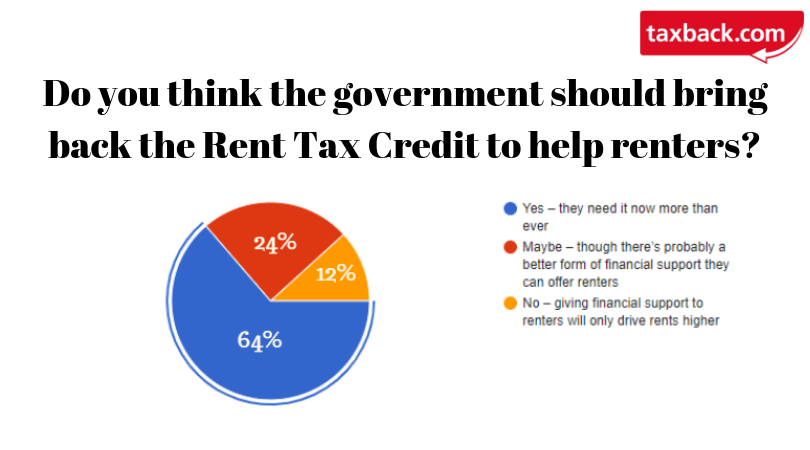

The majority of Irish people are now calling on the government to reinstate the credit, with 64% of survey respondents saying the credit is 'needed now more than ever'.

The average Irish tax refund is €1,880

A further 25% were open to the idea of the reintroduction of a Rent Tax Credit but believe that there may be a better type of financial support that the government could offer to renters.

Meanwhile, 11% did not think the government should bring this credit back – stating that such financial supports would only drive rents even higher.

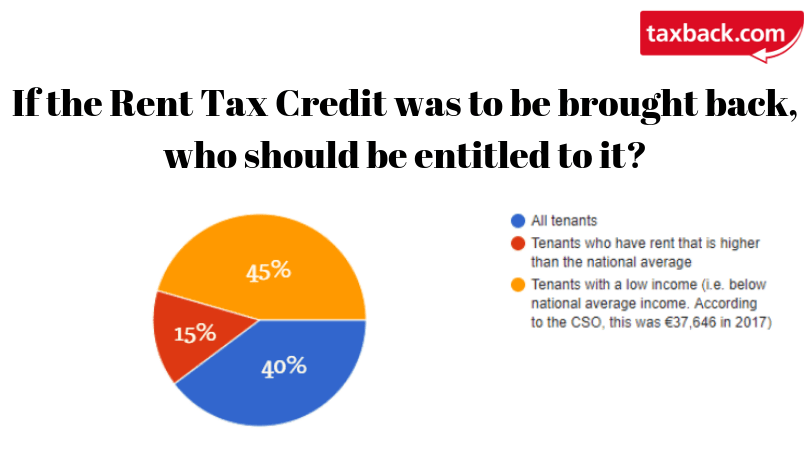

And when asked "If the Rent Tax Credit was to be brought back, who should be entitled to it?" – 45% of respondents indicated that the credit should be earmarked for tenants with a low income, while 4 in 10 respondents believed that the credit should be available to all tenants. Finally, 15% said the credit should be for tenants who have rent that is higher than the national average.

There is little doubt that the survey points to a definite appetite for change in the Irish rental market.

There had been some speculation ahead of Budget 2019 that the government were considering the reintroduction of a Rent Tax Credit. Ultimately the powers that be decided against bringing back the old relief. Whether the government will use Budget 2020 as an opportunity to offer relief to renters, only time will tell.

PS: We'll have tonnes of Budget 2020 coverage across our blog and social media over the coming weeks. Stay tuned!

Yes, Rent Tax Credit is gone. But are you sure you're taking advantage of your tax entitlements?

Thousands of Irish people are entitled to tax relief each year.

And yet, here at Taxback.com, we know that many people miss out on claiming what they're owed and leave their money behind with the tax man.

This can be attributed to a number of factors – from of a misunderstanding of tax entitlements to a belief that the process of claiming what they're owed will be too complicated or time consuming.

But if you think that you will not be due a tax refund, think again!

A wide range of common everyday expenses can qualify for tax relief.

Worked in Ireland, full or part-time? Been to the doctor recently? Paid college fees in the last four years?

There's a good chance you're due tax back!

The truth is that the average PAYE tax refund is €1,880 - so it's definitely worth your while finding out what you're owed!

And it could not be easier to claim back what you're due.

In fact, here at Taxback.com we've got a team of experienced tax professionals who are dedicated to helping people just like you to maximise their tax refund!

The average Irish tax refund is €1,880

You won't have to worry about filling out any tricky or confusing tax forms.

Our team will take care of all of the paperwork for you, ensure you avail of every tax relief you're entitled to and transfer your tax refund straight to your bank account.

Simples!

All you need to do to get started is fill out the short form here (it's really easy!).

So what are you waiting for?