Taxation and Maternity Leave in Ireland - Will I be taxed on the money I receive?

Maternity leave in Ireland is a crucial period for parents who are expecting children as it provides them with the necessary time to adapt to life with their newborn.

In Ireland, maternity benefits are subject to specific rules and regulations regarding taxation and many new parents have questions about their tax obligations and entitlements.

In this article, we'll address some of the most common questions and concerns related to taxation and maternity leave in Ireland.

When should I take maternity leave in Ireland?

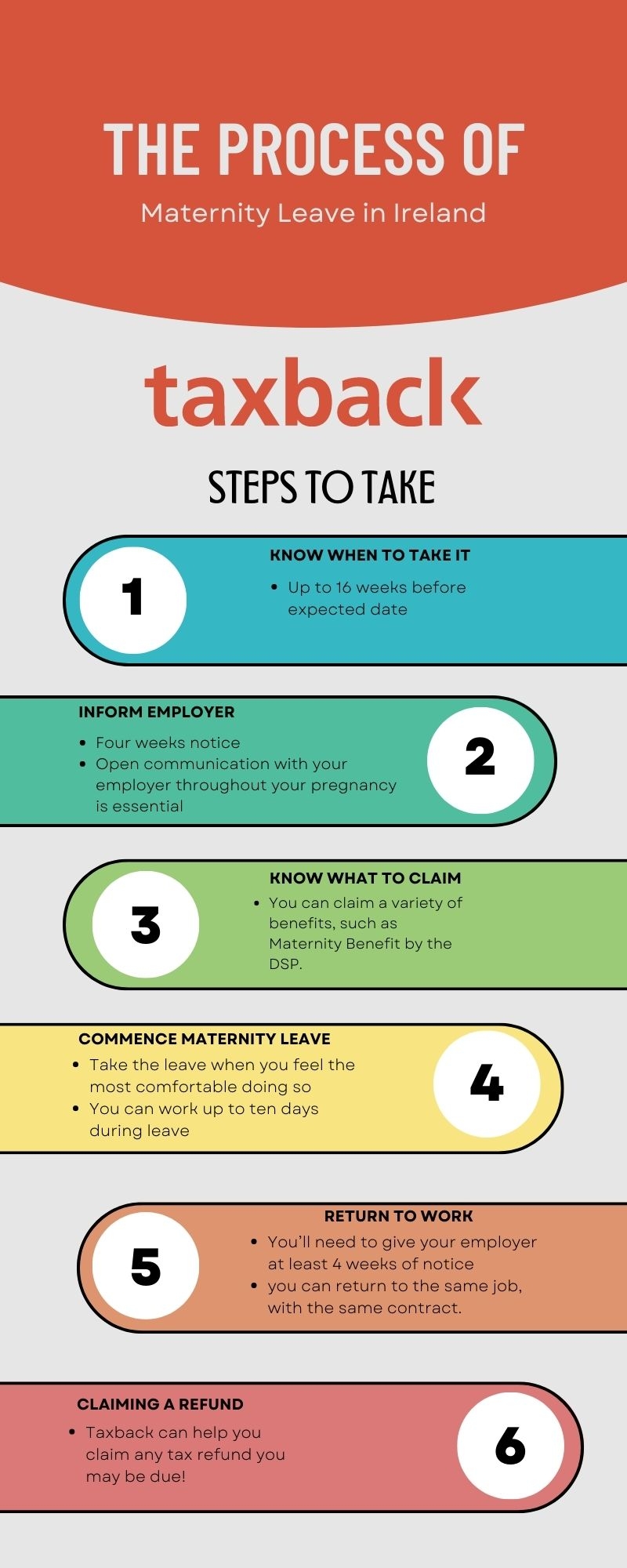

In Ireland, it is possible to start maternity leave up to 16 weeks before the expected week of childbirth.

However, you'll need to take at least two weeks of leave before the birth and at least four weeks after the birth.

The average Irish tax refund is €1,880

Can you work during maternity leave in Ireland?

While on maternity leave, you have the option to work under certain circumstances.

According to Irish law, you can work for up to ten days during your maternity leave without affecting any of your entitlements.

However, you will need to let your employer know you are returning to work.

It's also worth remembering that if you return to work full-time, your maternity benefit will cease.

What benefit can I claim if I am pregnant?

Expectant mothers in Ireland are entitled to various benefits and allowances during pregnancy and the early stages of childcare.

These include the Maternity Benefit, which is a payment made by the Department of Social Protection.

This benefit is designed to support women during their pregnancy and maternity leave, providing financial assistance when needed.

Can I claim medical expenses during pregnancy?

There are also some medical expenses you can claim in Ireland if you are expecting.

Tax relief is available at a standard rate of 20% on all maternity care.

This includes the cost of all GP and hospital visits, as long as they haven't already been reimbursed or covered by medical insurance.

This also includes IVF– the cost of which can range anywhere between €5,000 - €40,000!

With this in mind, it's easy to see how tax refunds can be substantial. It's always worth checking what you're owed.

Claim tax back on your dental expenses

Is Maternity Benefit a social welfare payment in Ireland?

Yes - Maternity Benefit, also known as maternity pay, in Ireland is a social welfare payment that is provided by the Department of Social Protection.

It is designed to aid women during their maternity leave period by providing some financial security.

Naturally, Maternity Benefit helps to replace some of the employment income which is not paid during the time off work for childbirth and caring for a newborn.

How long do I need to have been working to get maternity pay?

In order to qualify for maternity pay in Ireland, you'll need to have been working for your employer for at least 26 weeks by the end of the 'Qualifying Week' (which is 15 weeks before the expected week of childbirth).

Essentially, this means at least 41 weeks service by the due date.

How is Maternity Benefit calculated in Ireland?

Maternity Benefit in Ireland is calculated based on your average weekly earnings in the relevant tax year.

To be eligible to claim this benefit, you'll need to have made at least 39 weeks of PRSI (Pay-Related Social Insurance) contributions since you first started working.

The Department of Social Protection uses a specific formula to calculate your entitlement, taking into account your PRSI contributions and average weekly earnings.

How much is maternity pay in Ireland 2023?

The amount of maternity pay you will receive in Ireland depends on your average weekly earnings.

Currently, the maximum weekly rate of Maternity Benefit is €262.

Additionally, some employers offer additional maternity benefits, so it is worth checking with your employer to see if they provide any other payments.

How much of the Maternity Benefit is taxed in Ireland?

The DSP will provide Revenue with the details of any Maternity Benefit payment.

If you receive the Maternity Benefit and are a Pay As You Earn (PAYE) taxpayer, Revenue will collect the tax due.

When you go on maternity leave you can qualify for up to 26 weeks of Maternity Benefit.

With the standard rating being €262 each week, you will be paid €6,812 of Maternity Benefit in total.

The tax paid on the weekly Maternity Benefit is at the standard rate (€262 x 20% = €52.40). This will be taken from your tax credits each week and the full amount of Maternity Benefit will be taken from your weekly cut-off point.

Coming back to work after maternity leave in Ireland

You'll need to give your employer at least four weeks of written notice outlining your intention to return to work.

When you return to work, the law clearly states that you can return to the same job, with the same contract.

Also, if you were due to be given a pay rise/ improved conditions, you are also entitled to receive these when you return.

Does a father receive paternity leave or benefit in Ireland?

Fathers can receive up to two weeks unpaid and conditional paternity leave if their spouse is expecting a baby.

The government does offer a Paternity Benefit payment to fathers in order to help cover some expenses to be expected during this period.

The average Irish tax refund is €1,880

Can I get a maternity pay refund in Ireland?

This depends.

In some cases, if your employer proceeds to pay your normal weekly wage while you are on maternity pay, you may be entitled to a tax and PRSI refund.

If you believe this applies to you, you should wait until your Maternity Benefit has finished, contacting the Maternity Benefit Section online in order to request an MB21 Statement, which you should then send to Revenue to get a tax refund!

Can Taxback get me a maternity pay refund?

Yes!

If you are due a maternity pay refund, we will get it back for you.

Remember, when you apply for an Irish tax refund with Taxback, we will carefully analyze your situation to ensure you are getting your MAXIMUM amount of tax back.

Remember, you may be able to claim plenty of expenses, and it is FREE to check out what you can claim when you use Taxback.

Furthermore, if you've got any tax questions, you can easily contact one of our experienced professionals at info@taxback.com!