A Helping Hand: Tax Relief for Care

It can be a huge financial burden when a child or relative is ill and it often falls on family to look after them. In fact there is a huge amount of people in Ireland caring for or paying for care for those with disabilities. While many of us do this out of love, it doesn’t change the fact that it can be an expensive undertaking.

Luckily there is tax relief available for people who pay for the cost of caring for a dependent relative such as a child or ill parent. The main issue is that many of these reliefs are going unclaimed, with taxpayers missing out on 1000’s of euro.

The average Irish tax refund is €1,880

Examples of areas where reliefs are going unclaimed include:

- Medical and dental expenses

- Home carer’s tax credit

- Nursing home care fees

- Stay-at-home parent credit

- Incapacitated child credit

By researching the numbers, we’ve discovered that up to a third of eligible Irish taxpayers simply don’t claim the tax reliefs either because they are unaware of or don’t realise they qualify!!

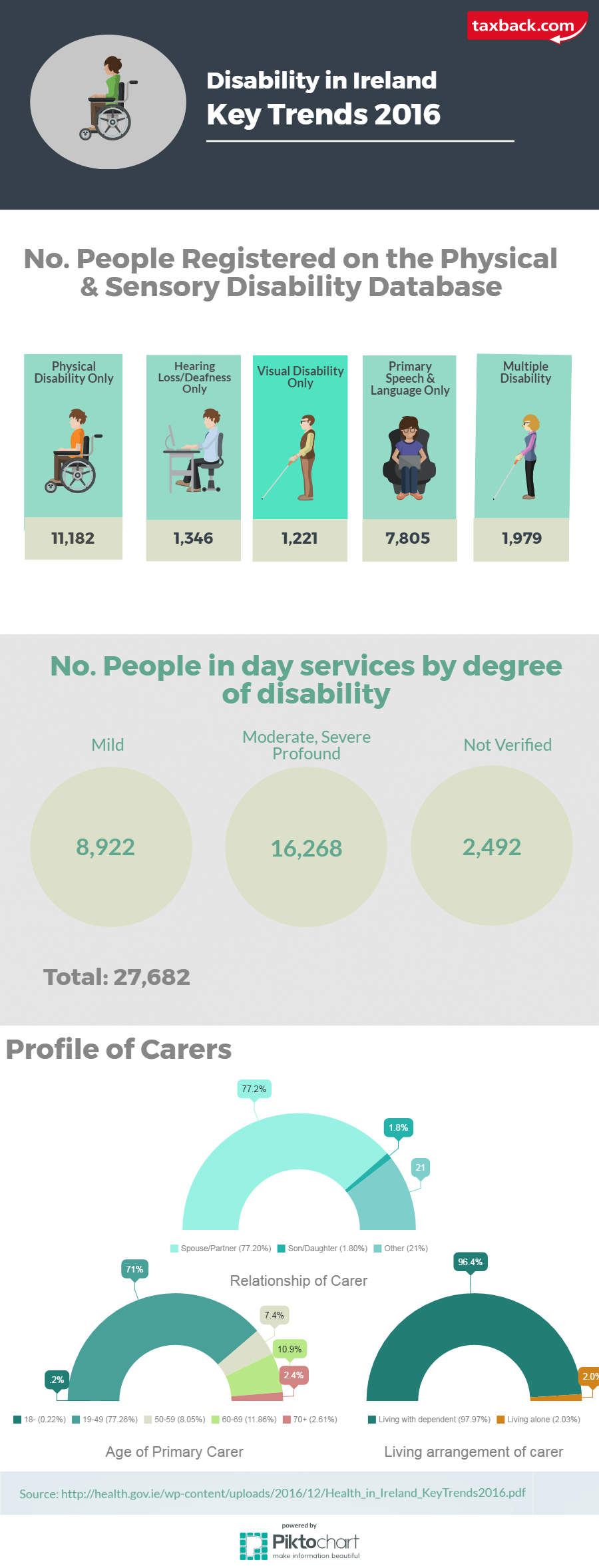

Just take a look at the numbers of people in disability services in Ireland:

The costs associated with caring for someone with a permanent disability can be high and unavoidable. But if you’re in this position, you should find out about the reliefs available to help offset the costs.

At Taxback.com we can access your circumstances and let you know if you’re due any of these reliefs or any refunds from the last 4 years. We’ve outlined some of the main ones below.

The average Irish tax refund is €1,880

1. Nursing Home Fees

30,000 people are in nursing homes in Ireland as part of the State’s Fair Deal scheme. However not everyone qualifies for this scheme and instead must bear the cost of the fees, which can be huge.

But even if this is the case, you can still apply for relief on any fees you pay for yourself or for someone else staying in a nursing home. Tax relief on nursing home fees is still given at the higher rate of income tax you pay up to 40%.

When can I claim?

Generally the relief is granted at the end of the year, however in some cases you can claim it during the year, based on your circumstances. For example if the nursing home provides qualified nursing care onsite on a 24-hr basis then you may be able to claim throughout the year.

You may also be able to claim on the cost of treatment in a nursing home outside the state. To qualify, it must be carried out on the advice of a practitioner. In this case a ‘’practitioner’’ is someone who is entitled under the laws of that country is to practice medicine.

Do contributions under the Nursing Homes Support Scheme qualify for tax relief?

The contributions paid by the state don’t qualify for relief, however if the contributions are deferred until after death, any deferred payments by the estate of the deceased deemed to be paid immediately before or after death may be claimed as health expenses.

2. Employing a Home Carer

If you hire a carer to look after yourself or a family member in your own home, then there is tax relief available to help with the cost of this. In this case a ‘’family member’’ is a spouse, civil partner, child or relative, including a relation by marriage or civil partnership.

It’s up to you whether you employ the carer directly or use an agency, but be warned that if you employ a carer yourself, you must register as an employer and will be responsible for their tax and social insurance.

If you go through an agency, then they’ll take care of tax and social insurance, so while you might pay a little more, it can be worth it to remove the burden of these obligations!

To qualify, the person being cared for should be incapacitated for the full tax year, however the carer isn’t required to be employed for the full year.

If you hire a qualified home nurse, then you should be able to provide Revenue with:

- Medical cert from doctor with nature of illness and confirmation that consistent nursing care is required, covering the full period of the tax relief

- Receipts for payments to nurses

Rates

The maximum amount of relief for employing a carer in 2017 is €75,000 (€75,000 in 2016 and 2015 and €50,000 in 2014 and previous years).

How to apply

You need to apply for the cost of hiring a carer each year and if you’re a PAYE taxpayer, your certificate of tax credits will be increased to include the relief so you pay less tax each week. You can apply using a form Hk1 sent to Revenue. You can also claim it at the end of the year using your P60. For self-assessed taxpayers, you should attach a form HK1 to your tax return.

To find out if you’re qualified, you can get a free estimate from Taxback.com first here!

3. Home Carer’s Tax Credit

The Home Carer’s Tax Credit is available for married couples or those in a civil partnership where one of you stays at home to mind a relative, including a child.

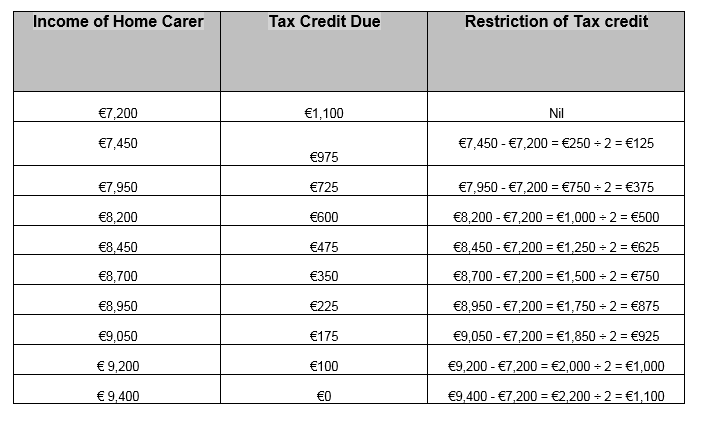

The credit is available to any jointly assessed couple with one or more dependents where the carer has an income of less than €7,200. However if you’re income is between €7,200 and €9,400, then you’re still entitled to a reduced credit.

The ‘’dependent’’ person in this case could be a child in receipt of child benefits, a person aged 65 or over, or someone with a disability requiring care. However the dependent cannot be a spouse or civil partner.

So the main conditions to qualify are:

- The couple should be in a marriage or civil partnership and jointly assessed for tax

- Home carer must care for one or more dependents

- Home carer’s income should not exceed €7,200 for the tax year. Where it exceeds this amount then the credit will be reduced.

Dependent person can be:

- A child for whom child benefit is payable

- Can be a person aged 65 or over

- A person permanently incapacitated by reason of mental/physical infirmity

Normally, the dependent must be living with the couple or in a neighbouring residence on same property or within 2 km of claimant.

Rates:

If the credit is granted one tax year but the next year your income exceeds the limit, (say €9,200 in 2013 and €6,000 in 2014-2015), you can still avail of the credit the next year as long as:

- The qualifying conditions are met

- The tax credit was granted for the previous year

You cannot claim both the Home Carer’s Tax Credit and the increased Standard Rate Brand for dual income couples at the same time, however you claim whichever of the two is most beneficial. The accountants at Taxback.com can help you determine which is best for you.

4. Incapacitated Child Credit

If you live with a child who is permanently physically or mentally incapacitated, then you may qualify for the Incapacitated Child Credit. For 2016 and 2017 the Incapacitated Child tax credit is €3,300.

To qualify, the child should:

- Have become incapacitated by 21 or

- Became so after reaching 21, but while still in fulltime education or training for a trade or profession for a minimum of 2 yrs.

Examples of disabilities deemed as permanently incapacitating include:

- Cystic Fibrosis

- Spina Bifida

- Blindness

- Deafness

- Down Syndrome

- Spastic paralysis

- Certain forms of schizophrenia

- Acute autism

(Not an exhaustive list)

You can also claim the credit for:

- A stepchild

- Adopted child

- Any child of whom you have custody, who you maintain.

The average Irish tax refund is €1,880

Rates:

The Child Tax credit is €3,300 in 2017.

Note: You can only claim the credit on the cost of care you pay yourself and not if the child is fully maintained at the public or charitable expense.

5. Medical and Dental Expenses

If you pay for medical and dental treatments and medications, you may be able to claim on the cost of these. The relief is given at the standard rate of tax at 20%, so for example if you got braces at a cost of €1600, then you’re entitled to claim 20% which is €320.

Unfortunately a lot of people with medical and dental expenses in Ireland don’t claim this back! Luckily if you still have receipts for these expenses, you can go back 4 years for a refund.

Items that qualify:

- Doctor and consultant fees

- Items or treatments prescribed by a doctor or consultant

- Maintenance or treatment in a hospital

- Costs of speech and language therapy carried out by a speech and language therapist

- Transport by ambulance

- Educational and psychological assessments

- Certain items for a child suffering from a serious life threatening illness

- Kidney patient expenses

- Routine maternity care

- In-vitro fertilisation

- Specialised dental treatment

Medical treatment abroad:

You can also claim tax relief on the cost of medical treatment out of the state. It must be performed by a recognised practitioner in that country.

Health Insurance:

If you pay for health insurance where the tax relief is not granted at source, then you can apply for a health insurance tax credit.

Claiming the Reliefs

When you pay for the cost of caring of a loved one, it can be difficult to know what reliefs you qualify for and there are also certain reliefs you cannot claim while you are claiming others. Our ISO certified tax specialists at Taxback.com can send you a no-obligation estimate of any refunds due and will go back 4 years, so you could end up claiming a sizeable amount. It’s not just tax relief for health expenses, there could be many reasons you’re due a refund!

Check out our video to see why:

When you apply with Taxback.com you get:

It can be confusing to know exactly what you're entitled to when it comes to your taxes, and you certainly cannot expect the taxman to check all your circumstances and tell you how much you're owed! Luckily at Taxback.com our certified accountants can check exactly how much you could be due in refunds from the last 4 years! Even if you're not ready to apply, we can give send you a free, no-obligation estimate of any tax due back! Here's what you'll get with Taxback.com.

- Free, no-obligation estimate

- Personal Account manager

- Experienced specialised tax accountants

- Online updates

- 24/7 online chat help

- Maximum refund guaranteed