Your Bullsh*t-Free Guide to Canadian Tax for Working Holidaymakers

OK, so we can probably all agree.

Tax is not the most exciting subject in the world!

And it's pretty likely that you won't want to spend too much time thinking about tax when you're planning an exciting working holiday to Canada.

But it's important to understand your tax rights and obligations. By doing so, you can keep your tax affairs in order, avail of every relief you're entitled to and even get a Canadian tax refund.

With this in mind, we've summed up what all working holidaymakers need to know about tax in Canada.

Canadian Tax Basics

And now, let's get down to the tax stuff!

The Canadian Tax year

The Canadian tax year runs from 1st January – 31st December.

With each payslip your employer will deduct taxes from your income. After the end of the tax year you should file a Canadian tax return in order to check if the correct amount of tax has been deducted over the course of the year.

In a case where your income is below the tax-free threshold it is possible to get a refund of all of the tax that you paid.

Where you have underpaid tax (less tax has been deducted on your payslips than there should have been) during the year, you are legally obliged to file a tax return and to pay the balance due.

The Canadian tax season usually starts in February for the preceding year.

In 2023, 30 April is Sunday and that's why the tax deadline is 1 May 2023 for individuals. 15 June 2023 is the Canadian tax deadline for self-employed.

More information on important tax dates in Canada can be found here.

Canadian tax refund

Every year thousands of working holidaymakers overpay tax in Canada and are entitled to a tax refund when they file their tax return. Whether or not you are eligible for a refund depends on three main factors:

- Overpayment of income tax

- Overpayment of Canadian Pension Plan (CPP)

- Overpayment of Employer Insurance (EI)

Taxback's average Canadian tax refund for working holidaymakers is $998!

One quick way to establish whether or not you are due a tax refund is by using Taxback's online Canada tax calculator.

The average Canadian tax refund is $998

Tax refund from your home country

If you travel to Canada during the tax year in your home country, you may not have used up your full tax credits for that year and you could be entitled to a tax refund.

You should claim any refunds directly from the tax authorities in the country where the tax was paid. In other words you will have to file separate tax returns in your home country as well as Canada.

Your usual country of residence may have a double taxation agreement with Canada. A double taxation agreement ensures that you don't get taxed twice on the same income.

Canada's double taxation agreements

Double taxation agreements ensure that non-residents don't get taxed on the same income twice. For example, an Irish citizen on a working holiday in Canada should not be taxed twice (in Canada and Ireland) on their income because Ireland and Canada have signed a double taxation agreement.

Canada have agreed double taxation agreements with the countries below.

| Algeria | Argentina | Armenia |

| Australia | Austria | Azerbaijan |

| Bangladesh | Barbados | Belgium |

| Brazil | Bulgaria | Cameroon |

| Chile | China (PRC) | Colombia |

| Croatia | Cyprus | Czech Republic |

| Denmark | Dominican Republic | Ecuador |

| Egypt | Estonia | Finland |

| France | Gabon | Germany |

| Greece | Guyana | Hong Kong |

| Hungary | Iceland | India |

| Indonesia | Ireland | Isreal |

| Italy | Ivory Coast | Japan |

| Jordan | Kazakhstan | Kenya |

| Korea | Kuwait | Kyrgyzstan |

| Latvia | Lithuania | Luxembourg |

| Malaysia | Malta | Mexico |

| Moldova | Mongolia | Morocco |

| Netherlands | New Zealand | Nigeria |

| Norway | Oman | Pakistan |

| Papua New Guinea | Peru | Philippines |

| Poland | Portugal | Republic of the Ivory Coast |

| Romania | Russia | Senegal |

| Serbia | Singapore | Slovak Republic |

| Slovenia | South Africa | Spain |

| Sri Lanka | Sweden | Switzerland |

| Taiwan | Tanzania | Thailand |

| Trinidad and Tobago | Tunisia | Turkey |

| Ukraine | United Arab Emirates | United Kingdom |

| United States | Uzbekistan | Venezuela |

| Vietnam | Zambia | Zimbabwe |

Tax Residency Status in Canada

Before you file your tax return, you'll need to determine your Canadian residency status for tax purposes.

It's important to file your Canadian tax return under the correct residency status so that you can remain compliant and in line with the Canadian tax authorities.

There are a number of factors to consider when determining your residency status including:

- the residential ties you have in Canada

- the purpose and permanence of your stays abroad

- and your ties abroad

Non-Resident vs Resident

You are a non-resident for tax purposes if:

- you normally, customarily, or routinely live in another country and are not considered a resident of Canada

Or - you do not have significant residential ties in Canada

And - you lived outside Canada throughout the tax year

Or - you stayed in Canada for less than 183 days in the tax year

If you've never before filed a tax return in Canada, you're on a 1 or 2 year Working Holiday Visa, and you plan on staying for that amount of time and then leaving Canada, it's very likely that you should file as a non-resident for tax purposes.

You are an ordinary resident in Canada for tax purposes if:

Canada is the place where you, in the settled routine of your life, regularly, normally or customarily live.

Generally residents can tick the majority of the boxes below.

You should have the following residential ties to Canada:

Significant ties:

- A spouse or common law partner

- A house or apartment (own or renting)

- Dependents

Secondary ties:

- You are planning on staying in Canada past your working holiday visa and are applying for Permanent Residence

- Canada should be the place where you customarily live

If any of the above residential ties are unfamiliar to you and you're on a working holiday visa, you should file as a non-resident.

Case studies

John is from England. He never lived outside his home country until he moved to Canada on a working holiday. He has no relations or significant ties in Canada and is not considered a citizen of Canada.

When John files his annual tax return, he should file as a non-resident for tax purposes.

Originally from France, a number of years ago Jane moved to Canada and successfully applied for permanent residency. Having bought an apartment in Toronto, Canada has become the place where Jane resides in the settled routine of her life. She will be considered a resident for tax purposes.

Sales Tax

In Canada, all consumers are charged sales tax when they pay for goods and services.

Depending on the province or territory in which you pay for the goods, you will also pay GST (Goods and Sales Tax), or PST (Provincial Sales Tax), a combination of both or HST (Harmonized Sales Tax).

HST combines PST and GST to create one tax.

HST participating provinces collect sales tax at the following rates:

- New Brunswick: 15%

- Newfoundland and Labrador: 15%

- Nova Scotia: 15%

- Ontario: 13%

- Prince Edward Island: 15%

Those in the below provinces pay 5% GST as well as provincial sales tax at the following rates:

- British Columbia – 7% provincial sales tax (PST) on retail price only

- Manitoba – 7% retail sales tax (RST) on retail price only

- Quebec – 9.975% Quebec sales tax (QST) on retail price only

- Saskatchewan – 6% PST on retail price only

Four provinces of Canada (Northwest Territories, Nunavut or the Yukon) do not collect sales tax on goods and services beyond the 5% GST.

The sales taxes paid for purchases are not refundable for individuals in Canada.

Canadian Tax rates per province/territory

| Province | Type | PST | GST | HST | Total Tax Rate | Notes: |

|---|---|---|---|---|---|---|

| Alberta | GST | 5% | 5% | |||

| British Columbia | GST + PST | 7% | 5% | 12% | ||

| Manitoba | GST + PST | 7% | 5% | 12% | As of July 1, 2019 the PST rate was reduced from 8% to 7%. | |

| New Brunswick | HST | 15% | 15% | As of July 1, 2016 the HST rate increased from 13% to 15%. | ||

| Newfoundland and Labrador | HST | 15% | 15% | As of July 1, 2016 the HST rate increased from 13% to 15%. | ||

| Northwest Territories | GST | 5% | 5% | |||

| Nova Scotia | HST | 15% | 15% | |||

| Nunavut | GST | 5% | 5% | |||

| Ontario | HST | 13% | 13% | |||

| Prince Edward Island | HST | 15% | 15% | |||

| Quebec | GST + *QST | *9.975% | 5% | 14.98% | ||

| Saskatchewan | GST + PST | 6% | 5% | 11% | ||

| Yukon | GST | 5% | 5% |

Income Tax Rates

The Canadian Government collects income tax on behalf of all provinces (except Quebec – which has its own tax system).

There are two different types of income tax – Federal and Provincial.

All taxpayers are entitled to a tax-free allowance of $15,000 for 2023 ($14,398 for 2022). This means that you can earn up to this amount without paying federal tax on your income.

Canadian tax rates are progressive. In other words, the more you earn (over the tax-free allowance), the more tax you're obliged to pay. For example, Federal tax deductions start from 15% on the first $50,197 of taxable income, with the provincial tax (applied in addition to federal tax) depending on the province that you work in.

More information on income tax rates in Canada can be found here.

Filing Canadian Tax Returns

Every taxpayer in Canada, including those on temporary visas (such as a working holiday visa) are legally obliged to file a tax return where they have had to pay tax for the year.

Tax deadline

The deadline for filing your tax return and paying any balance of tax due is usually April 30th of the following tax year. (This year, it's 1 May as mentioned above). The tax return that you file on or before this date will relate to the previous year's income. In other words, a tax return filed on 1 May 2023 must related to 2022 earnings.

While the deadline to file is 1 May you can choose to file from around mid-February. It is always advisable to file as early as possible and to avoid the 'deadline rush'.

If you miss the deadline you may be penalised by the Canadian Revenue Office in a case where there is a balance of tax due. If you don't file your tax return on time, you could incur a penalty fee of 5% on top of anything you may owe to the Canadian government. If you are getting a refund for the tax year there is no penalty for filing late and the term for filing your tax return is 10 years after the end of the tax year.

You could be due a tax refund

One of the main positives about filing a tax return is that there is a good chance that you overpaid tax and are entitled to a tax refund.

By filing your tax return, you can apply for your tax refund and get your tax back.

You can choose to file your tax return yourself, or alternatively, you can use a registered agent like Taxback to help file your Canadian return.

Tips for filing a Canadian tax return

1) Determine your residency status

Your tax obligations are determined by your residency status. In other words, you'll need to know your status before you can work out what your tax responsibilities are.

There are a number of factors involved in determining your status, including your residential ties with Canada, length of stay, the purpose of your stay, and more.

If you're on a working holiday in Canada, you'll generally be classified as a "non-resident" or "deemed non-resident" for tax purposes.

You can read more about residency status here.

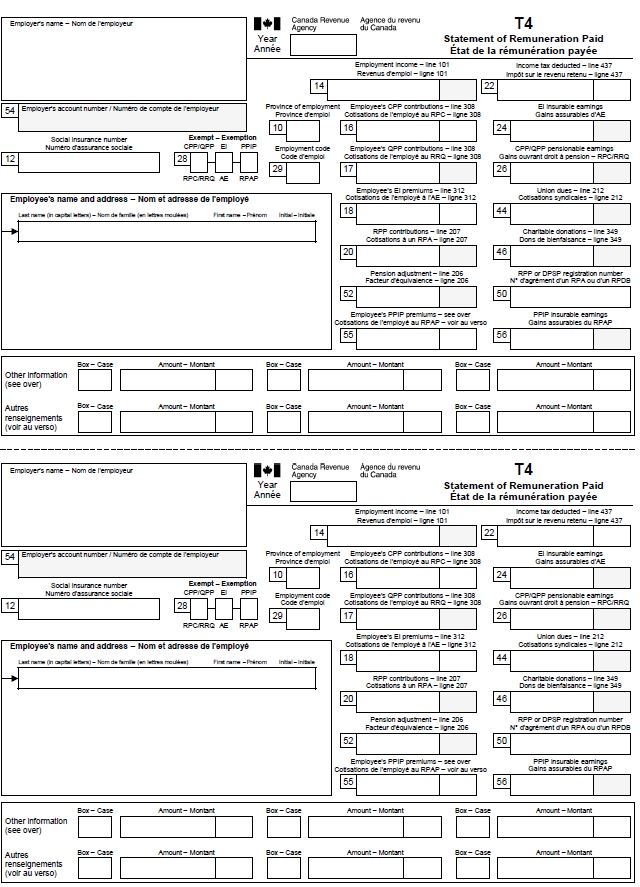

2) SIN and T4

You will need to have a T4 document (or a final cumulative payslip) and your Social Insurance Number (SIN) in order to file a tax return.

You must apply for a SIN before you start a job in Canada and include your SIN on your T4 slip. The T4 slip is a statement of your income and what tax you have paid and it is given to you by your employer after the end of the tax year (usually in February).

If you have had multiple employers during the year you will need to ensure that you get a T4 from each of them.

You can find more information on your SIN and T4 here.

Need a hand getting a SIN?

Taxback can help you:

- Apply for your first SIN

- Apply for a replacement SIN card in the event that yours was lost or stolen

- Apply for a date change for your SIN expiry

3) Understanding the tax that you pay

Generally speaking, you'll pay three types of taxes.

- Income tax (displayed in box 22 of your T4)

- Canadian Pension Plan (CPP – box 16)

- Employer Insurance (EI – box 18)

If you have overpaid any of these taxes, you will be entitled to a tax refund.

Find more information on tax rates here.

4) Understanding your expenses

If you earned over the tax free allowance, then you may be able to claim on the cost of certain expenses to reduce your overall tax liability.

Examples of eligible expenses include:

- Medical (for example - visit to the doctor, prescriptions, and surgery)

- Travel

- Tuition fees

- Donations

- Union dues

- Business (for example - rent, supplies, travel, and professional fees)

If you intend to use expenses to lower your overall tax liability you will need to ensure that you have proper documentation for each cost. So keep any receipts you have safe!

Read more about eligible expenses here.

5) How to file a Canadian tax return on a Working Holiday visa

You can apply directly with the Canadian tax office, or you can use a Canadian tax agent such as Taxback.

The main benefit of applying directly yourself is that it is free.

The main downside is that you will have determine your residency status and gather all the necessary documents yourself. Also, the responsibility of the correct filing of your tax return will lie with you.

By applying with Taxback you can enjoy a fast and stress-free service.

Taxback will handle all of the tax return paperwork, ensure you avail of every expense and relief you are entitled to and retrieve your maximum legal tax refund.

What's more, we can help you to locate any tax documents that you have lost.

File your Canadian Tax Return easily online

Taxpayers with employment income in Canada are liable to pay both Federal and Provincial tax on their earnings.

The Federal Government collects personal income taxes on behalf of all provinces except Quebec which has its own tax system.

As mentioned above, there is a tax-free allowance of $15,000 in 2023 which means you can earn up to this amount without paying federal tax on your income. This is crucial information for working holidaymakers in Canada.

The more you earn over this figure, the more tax you're obliged to pay. Federal tax rates start at 15% on the first $50,197 of taxable income and provincial tax rates depend on the province where you work. Understanding these rates is essential for working holidaymakers to manage their finances effectively during their stay in Canada.

Federal Tax Rates and Brackets in Canada

| Tax rate | Income bracket |

|---|---|

| 15% | Up to $50,197 |

| 20.50% | $50,197 - $100,392 |

| 26% | $100,392 - $155,625 |

| 29% | $155,625 - $221,708 |

| 33% | Above $221,708 |

Provincial Tax Rates for 2023

Alberta Personal Income Tax Rates

| Tax rate | Taxable income |

|---|---|

| 10.00% | $0 - $142,292 |

| 12.00% | $142,293 - $170,751 |

| 13.00% | $170,752 - $227,668 |

| 14.00% | $227,669 - $341,502 |

| 15.00% | Over $341,503 |

British Columbia Personal Income Tax Rates

| Tax Rate | Taxable income |

|---|---|

| 5.06% | $0 to $45,654 |

| 7.70% | $45,654.01 to $91,310 |

| 10.50% | $91,310.01 to $104,835 |

| 12.29% | $104,835.01 to $127,299 |

| 14.70% | $127,299.01 to $172,602 |

| 16.80% | $172,602.01 to $240,716 |

| 20.50% | Over $240,716 |

Manitoba Personal Income Tax Rates

| Tax rate | Taxable income |

|---|---|

| 10.80% | $0 - $36,842 |

| 12.75% | $36,843 - $79,625 |

| 17.40% | Over $79,626 |

New Brunswick Personal Income Tax Rates

| Tax rate | Taxable income |

|---|---|

| 9.40% | $0 - $47,715 |

| 14.00% | $47,716 - $95,431 |

| 16.00% | $95,432 - $176,756 |

| 19.50% | Over $176,757 |

Newfoundland & Labrador Personal Income Tax Rates

| Tax rate | Taxable income |

|---|---|

| 8.70% | $0 - $41,457 |

| 14.50% | $41,458 - $82,913 |

| 15.80% | $82,914 - $148,027 |

| 17.80% | $148,028 - $207,239 |

| 19.80% | $207,240 - $264,750 |

| 20.80% | $264,751 - $529,500 |

| 21.30% | $529,501 - $1,059,000 |

| 21.80% | Over $1,059,001 |

Northwest Territories Personal Income Tax Rates

| Tax rate | Taxable income |

|---|---|

| 5.90% | $0 - $48,326 |

| 8.60% | $48,327 - $96,655 |

| 12.20% | $96,656 - $157,139 |

| 14.05% | Over $157,140 |

Nova Scotia Personal Income Tax Rates

| Tax rate | Taxable income |

|---|---|

| 8.79% | $0 - $29,590 |

| 14.95% | $29,591 - $59,180 |

| 16.67% | $59,181 - $93,000 |

| 17.50% | $93,001 - $150,000 |

| 21.00% | Over $150,001 |

Nunavut Personal Income Tax Rates

| Tax rate | Taxable income |

|---|---|

| 4.00% | $0 - $50,877 |

| 7.00% | $50,878 - $101,754 |

| 9.00% | $101,755 - $165,429 |

| 11.50% | Over $165,430 |

Ontario Personal Income Tax Rates

| Tax rate | Taxable income |

|---|---|

| 5.05% | $0 - $49,231 |

| 9.15% | $49,232 - $98,463 |

| 11.16% | $98,464 - $150,000 |

| 12.16% | $150,001 - $220,000 |

| 13.16% | Over $220,001 |

Prince Edward Island Personal Income Tax Rates

| Tax rate | Taxable income |

|---|---|

| 9.80% | $0 - $31,984 |

| 13.80% | $31,985 - $63,969 |

| 16.70% | Over $63,970 |

Quebec Personal Income Tax Rates

| Tax rate | Taxable income |

|---|---|

| 15.00% | $0 - $49,275 |

| 20.00% | $49,276 - $98,540 |

| 24.00% | $98,541 - $119,910 |

| 25.75% | Over $119,911 |

Saskatchewan Personal Income Tax Rates

| Tax rate | Taxable income |

|---|---|

| 10.50% | $0 - $49,720 |

| 12.50% | $49,721 - $142,058 |

| 14.50% | Over $142,059 |

Yukon Personal Income Tax Rates

| Tax rate | Taxable income |

|---|---|

| 6.40% | $0 - $53,359 |

| 9.00% | $53,360 - $106,717 |

| 10.90% | $106,718 - $165,430 |

| 12.93% | $165,431 - $235,675 |

| 12.80% | $235,676 - $499,999 |

| 15.00% | Over $500,000 |

Canada Pension Plan

The Canada Pension Plan (CPP) provides contributors and their families with partial replacement of earnings in the case of retirement, disability or death. Almost all individuals who work in Canada outside Quebec contribute to the CPP. In Quebec, the Québec Pension Plan (QPP) provides similar benefits.

For working holidaymakers, understanding the implications of CCP contributions is essential. The CPP contribution rate will remain at 5,95% for employers and employees, and 11,9% for self-employed people, unless their earnings exceed the earning limit.

Employment Insurance (EI)

The employee EI premium rate in 2023 will be $1,63 per $100.

The EI program provides temporary income support to unemployed workers while they look for employment or to upgrade their skills. The EI program also provides special benefits to workers who take time off work due to illness; pregnancy; caring for a new-born or newly adopted child (and more).

Many working holidaymakers are entitled to a tax refund on their CPP & EI contributions. Discover how to maximize your returns with our guide on getting your working holiday tax refund!

Get your working holiday tax refund!

What to declare on your Canadian tax return

Employment income

The first thing you will need to report on your tax return is the total amount of employment income that you have earned during the tax year. This is crucial information for working holidaymakers seeking clarity on their tax obligations.

Expenses and deductions

If you are availing of any expenses or deductions you will need to declare these on your tax return. This is a key aspect for working holidaymakers aiming to optimize their returns.

Other income

You'll need to report employment income that is not recorded on your T4 slip – for example, tips and occasional earnings. Working holidaymakers should be mindful of all income sources.

The average Canadian tax refund is $998

Income from Self-employment

You'll should report any income earned (or loss made) from self-employment.

You should also include a statement with your return which shows your income and expenses.

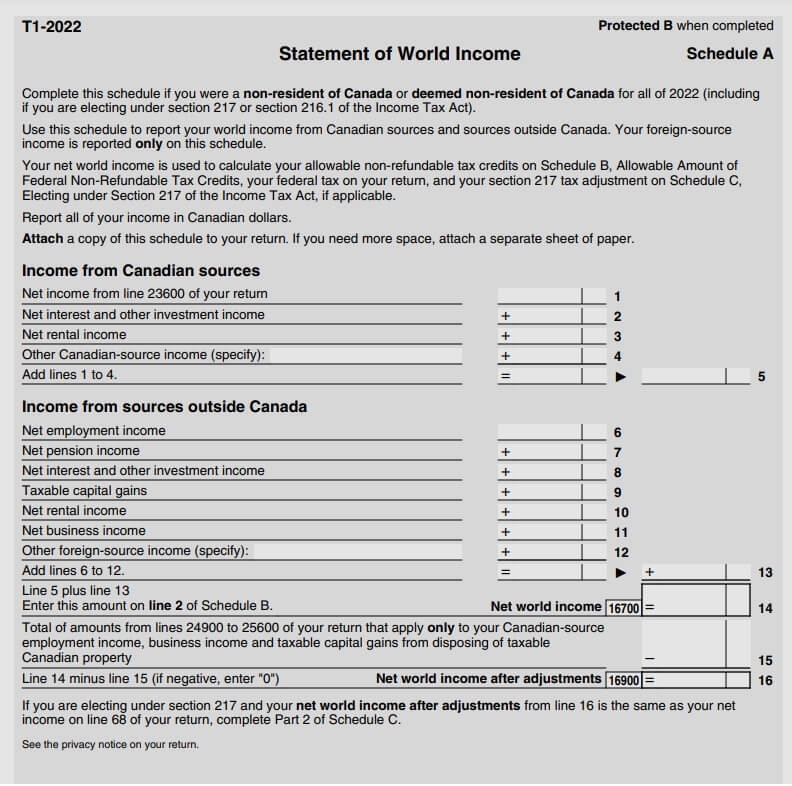

Statement of World Income

Your net world income is used to determine your allowable non-refundable tax credits. This is why, if you earn income outside Canada, you will need to declare this on your Canadian tax return. This step is vital for working holidaymakers with global income.

Details of your Canada Pension Plan (CPP) and Employment Insurance (EI) contributions

In general, workers are required to contribute 5.1% of gross pay in CPP and 1.62% of gross pay in EI for each pay period.

Claiming dependents

If your spouse is in your home country while you work in Canada, you can claim them as a dependent on your Canadian tax return if:

- Your spouse or civil partner's income in the tax year (Jan 1-Dec 31) is less than the tax-free allowance in Canada or had no income at all

- Your spouse can obtain a document from their home countries tax office for the amount of income earned (or lack of income) in the Canadian tax year

Remember to keep any evidence that you supported them financially while you worked in Canada (bank statements, money transfers, etc.).

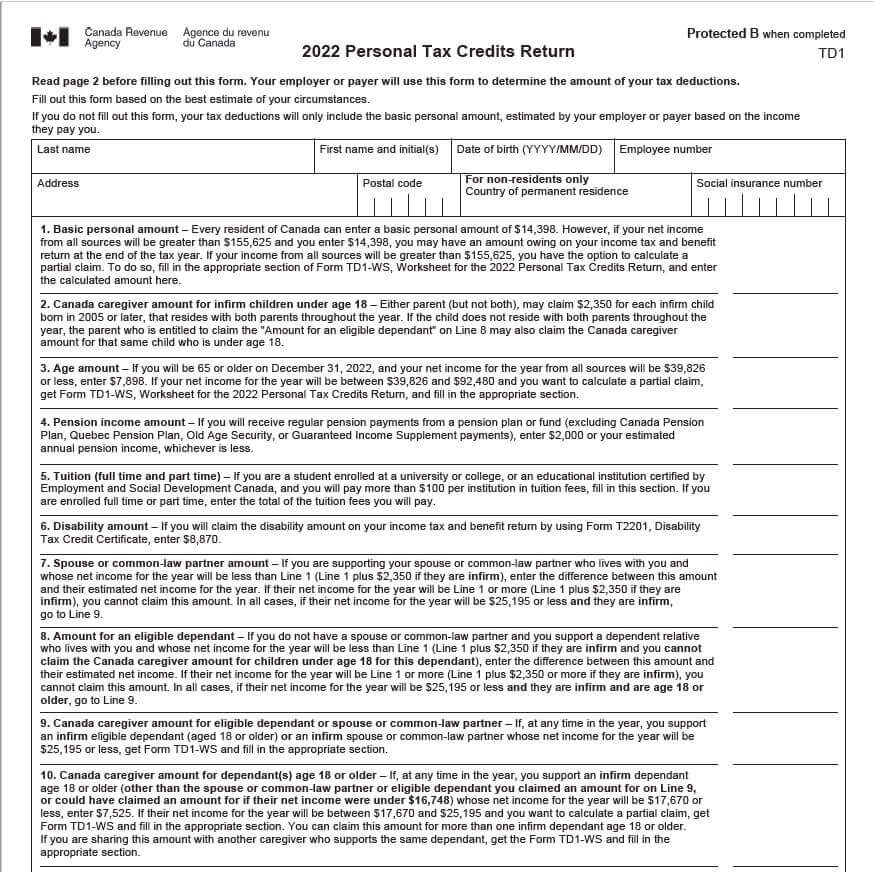

Personal Tax Credits

In Canada, there is a tax-free allowance (or personal tax credit) which allows an individual to earn $15,000 in 2023 (or $14,398 in 2022) without paying tax.

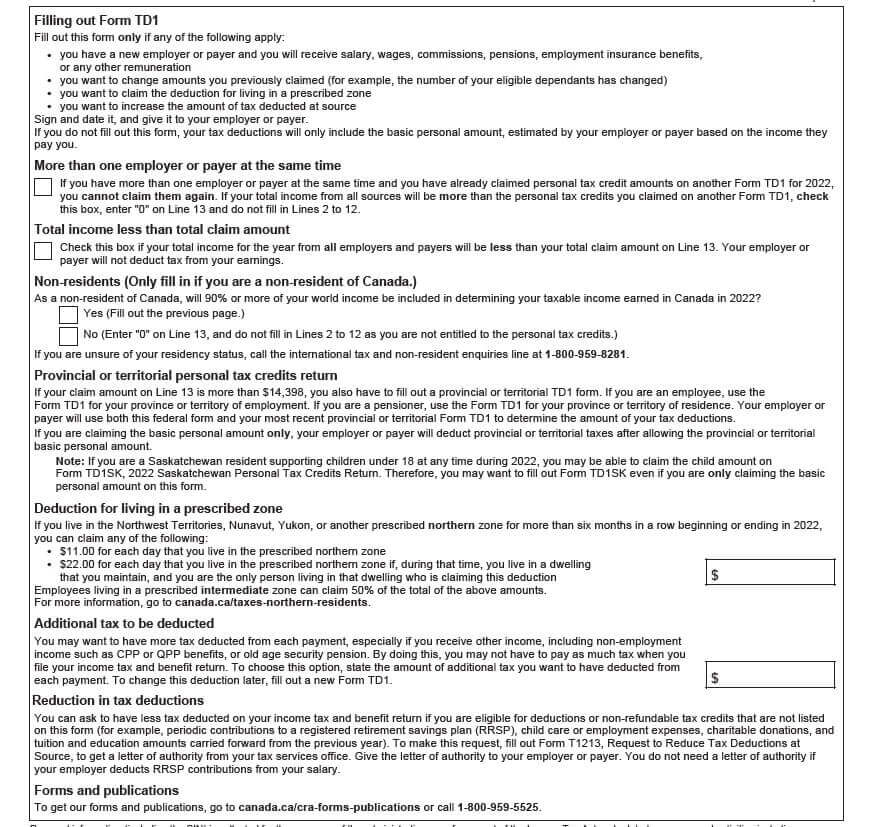

Your eligibility for personal tax credits is calculated on a form called TD1. You fill this out when you start a new job in Canada.

If you earned income from outside Canada in the same year, you earned income from Canadian sources then you might not be entitled to claim the personal tax credits that allow you to earn tax-free income in Canada. This is called the "90%" rule and you can read more about this below.

It's important to be careful not to claim your personal tax credit twice if you work in more than one job in Canada during the tax year.

If you do mistakenly claim the credit twice, it is best to speak with your HR manager and request to fill out a new TD1 form. You can do this any time of the year.

By claiming the credit twice, you may end up with an increased tax liability.

If you are working in two jobs in the same tax year and you're entitled to claim personal tax credits, it's best to claim them for the job that pays the highest.

You can find more information on the TD1 form here.

The 90% Rule

If you earned income from outside Canada in the same tax year (January – December) you earned income from Canadian sources, then you might not be entitled to claim the personal tax credits that allow you to earn tax-free income in Canada, incluidng the Canadian tax for working holidaymakers.

This will be particularly relevant to you if you, for example, worked in your home country in the same year that you came to Canada for a working holiday.

In cases such as these, it is important to keep the 90% rule in mind.

This rule basically means that if you earned more than 10% (net) of your income outside Canada, you can't avail of the personal tax credits.

However, if you earned 90% of your income within Canada, then you can claim the credits.

You should factor this rule in when you're filling in your TD1 form. In a case where you didn't earn 90% of your income in Canada for that year then you should enter 0 in box 13 and tick 'No' on the non-resident question on the form.

If you are unsure about this, then it's safer to not claim the credits. Even if you end up overpaying tax, you'll get a refund of this when you file your tax return. But if you don't fill out your TD1 correctly, you could end up owing more tax to the Canadian authorities.

Read more about the TD1 form here.

Case studies

In August 2022 Jack moves from his home in Paris to Banff. Prior to moving to Canada, Jack worked in a shop from January – July 2022 and earned €1,700 ($2,720) per month. Jack managed to secure employment in Banff which started in October 2022. In this role, he earned $2,500 per month until the end of the year.

When Jack files his tax return he should not claim the personal tax credit as he did not earn 90% of his income in 2022 within Canada.

Julia was working in a marketing role in Berlin and earning €2,000 ($3,200) per month before she moved to Vancouver in February 2022. In March 2022 she started employment in a similar marketing roll and earned $3,300 per month until the end of the year. Her total income for 2022 was $36,200. She earned $33,000 (or 91%) of this income in Canada. She is therefore entitled to the personal tax credit.

Declaring Foreign Income in Canada

If you earn income outside Canada you will need to declare this on your tax return.

Firstly, there are different rules for residents and non-residents.

Read more about your residency status here.

Non-Residents

Non-residents must declare any income earned outside of Canada on their tax return.

Income earned outside Canada will not be taxed if you're a non-resident, but it will affect how many non-refundable (personal tax credit / your tax-free threshold) tax credits you can claim (as per the 90% rule).

Residents

If you're a resident in Canada, you must also declare any income earned outside Canada on your Canadian tax return. This income will be taxed.

If you are an immigrant during the tax year (i.e. you move to Canada with the intention of settling and building a life there), you'll only be taxed on income you earn after you became a resident.

Anything earned up to that point should be declared, but you won't be taxed on it.

Missing the Deadline

The deadline for filing a tax return in 2023 is 1 May.

In other words, your income tax return for 2022 tax year should be filed on or before this date.

It is important to file your return by this date in order to avoid penalties and additional charges from the Canadian Revenue Office.

Penalties and additional charges are calculated in cases where there is a balance of tax owed to the tax office.

The penalty for late filing is 5% of your tax liability, plus 1% of your balance owing for each full month your return is late, to a maximum of 12 months.

Where you are entitled to a tax refund you can file your tax return within 10 years after the end of the relevant tax year. For example the deadline for claiming a refund for the 2013 tax year is 31 December 2023.

Making a Voluntary Disclosure

The Voluntary Disclosures Program gives you a second chance to change a tax return you previously filed or to file a return that you should have filed. You can apply to the Canada Revenue Agency (CRA) to ask for relief of prosecution and penalties.

The CRA may consider reviewing your file a second time in situations where the circumstances are beyond your control.

If you were due to file a tax return for a previous year and did not do so, you can voluntarily file or correct that return under the Voluntary Disclosures Program. By making a voluntary disclosure you will only be liable to pay the tax you owe (plus interest). You will not have to pay a penalty.

Changing a Canadian Tax Return

You may need to make a change to your tax return after you filed it.

It's important not to file another tax return for that year. Instead, wait until you receive your notice of assessment before requesting a change to a return.

You can only request a change to a return for a tax year ending in any of the 10 previous calendar years. In other words, a request made in 2023 must relate to the 2013 tax year, or a later tax year, to be considered.

Expenses, Deductions & Reliefs

If you earned over the tax free allowance ($15,000 in 2023), then you may be able to claim on the cost of certain expenses to reduce your overall tax liability.

If you intend to use expenses to lower your overall tax liability you will need to ensure that you have proper documentation for each cost. So it's important to retain all relevant receipts that you have.

Some expenses are general and can apply to all taxpayers while others are territory specific.

Usually, for an expense to be eligible, it must meet two conditions:

- Your employment contract requires you to pay the expenses

- You don't receive an allowance to pay the costs or, if you do receive an allowance, your employer adds it to your total income

General expenses

1) Medical Expenses

You can claim medical expenses paid for yourself, your spouse or common-law partner and certain related persons, such as those applicable to the Canadian tax for working holidaymakers.

If you have qualifying medical expenses you paid for yourself or a spouse, you should keep receipts for these. The total eligible medical expenses should be reduced by 3% of your net income or $2,352, whichever is less. The tax credit is then 15% of the amount remaining.

Examples of qualifying medical expenses include:

- Doctor consultants

- Nurses' fees

- Prescription drugs and medications

- Premiums paid to private health insurance

- Costs related to the purchase of gluten-free food for coeliac

- Orthodontic work

Medical-related travel

If medical services are not available to you within 40 kilometres of your home, you may be able to claim the cost of your transportation to get these services somewhere else.

If you had to travel at least 80 kilometres from your home, you can claim accommodation and meal expenses in addition to transportation expenses.

2) Disability support deduction

Disability support deduction, relevant for individuals, including those on a working holiday in Canada, who have an impairment in physical or mental functions and have paid for certain medical expenses can, under certain conditions, claim the disability support deduction.

If you are eligible for this deduction, you may be able to deduct the expenses that you paid so that you could:

- work

- go to school

- do research for which you received a grant

Only the person with the disability can claim expenses for this deduction.

3) Moving Expenses

If you move from one location to another in Canada, perhaps as a working holidaymaker dealing with Canadian tax, you may be able to claim moving expenses on that tax year's return. You must have started a job or carried out a business at your new location and the new place must be at least 40km closer to your employment.

You can also claim eligible moving expenses if you moved to be a student in full-time attendance in a post-secondary program at a university, college or other educational institution. Your new home must be at least 40km closer to your new work or school.

4) Public Transport

You may be able to claim to cost of monthly/yearly transit passes within Canada and this holds true for individuals, including working holidaymakers navigating Canadian tax.

The cost of shorter passes can also be an eligible deduction as long as they allow you to have unlimited travel for at least 5 consecutive days and you have sufficient passes for unlimited travel for at least 20 days within a 28 day period.

You or your spouse can claim a tax deduction for the cost of transit passes for yourself/your spouse/child (if they are under 19 years on 31st December of the year to which the claim relates).

If you intend to claim a tax deduction for these costs, you'll need to keep all your passes and documents in a safe place for future reference.

5) Business expenses

If you are self-employed in Canada, which could be the case for working holidaymakers navigating Canadian tax, you may be able to claim a number of business expenses on your tax return.

In general, it's possible to deduct any reasonable expense you incurred in order to earn your business income. However, personal expenses are not eligible.

Some common examples of business expenses include:

- Legal and accounting fees

- Telephone and utilities

- Travel

- Meals and entertainment

- Insurance

- Property taxes

- Motor vehicle expenses

Again, make sure you keep receipts in case you are the subject of an audit.

6) Tuition expenses

If you study in Canada you can claim eligible expenses as a tax credit.

Generally, a course qualifies if it was taken at the post-secondary level or (for persons 16 years of age or older at the end of the year) if it develops or improves skills in an occupation and the educational institution has been certified by Employment and Social Development Canada.

In addition, you must have taken the course within the tax year you are applying for.

After you pay your tuition you should receive a T2202 (Tuition and Enrolment Certificate) from the educational institution and you should use this form in order to calculate your eligible tuition fee credit.

The amount of the tuition tax credit is calculated by multiplying the tuition you paid by the rate of the lowest federal tax bracket, which is 15% in 2023.

Not all fees can be claimed. To qualify, the fees you paid to attend a Canadian educational institution must be more than $100.

You must claim your tuition amount first on your own return, even if someone else paid your fees. However, you may transfer up to a maximum of $5,000 of your 2022 unused tuition amount to your spouse or common-law partner or to your or your spouse's or common-law partner's parent or grandparent.

Even if you have no tax to pay and you are transferring part of your tuition amount, file your return, so your records within the tax office are properly updated with your unused tuition amount available to carry forward to other years.

If you are transferring an amount to a designated individual, transfer only the amount this person can use.

That way, you can carry forward as much as possible to use in a future year. However, if you carry forward an amount, you will not be able to transfer it to anyone. You must claim your carry-forward amount in the first year you have to pay federal tax.

Feel free to use our Live Chat and we can help you with your T2202 or if you need help claiming your tax back, feel free to use our tax refund calculator to see how much you are owed.

7) Donation expenses

You can claim donations either you or your spouse or common-law partner made. All the eligible amounts of your donations to registered charities and other qualified donees made during the tax year plus donations made in any of the previous five years that have not been claimed before can be claimed on your tax return.

You do not have to claim the donations you made in 2022 on your 2023 tax return. It may be more beneficial for you to carry them forward and claim them on your return for any of the next five years.

No matter when you claim them, you can only claim them once.

8) Interest paid on student loans

You can claim a loan under the Canada Student Loans Act, the Canada Student Financial Assistance Act, the Apprentice Loans Act, or similar provincial or territorial government laws for post-secondary education. Only you can claim an amount for the interest you, or a person related to you, paid on that loan within the tax year or the preceding five years.

You can claim an amount only for interest you have not already claimed. If you have no tax payable for the year the interest is paid, it is to your advantage not to claim it on your student tax return. You can carry the interest forward and apply it on your return for any of the next five years.

You can't claim interest paid on any other kind of loan or on a student loan that has been combined with another kind of loan. If you renegotiated your student loan with a bank or financial institution or included it in an arrangement to consolidate your loans, the interest on the new loan does not qualify for this tax credit. In addition, you can't claim interest you paid because of a judgment obtained after you failed to repay a student loan.

The average Canadian tax refund is $998

Territory specific credits & deductions

Territory specific credits and deductions can only be claimed by residents in Canada. In a case where you are in Canada on a working holiday visa and you are not considered resident in Canada, you should not claim territory credits and deductions.

If you are confused about your residency status you can contact Taxback and get free tax status estimation now.

Tax Refund Calculator

Every year thousands of working holidaymakers over pay tax in Canada and are entitled to a tax refund.

Every taxpayer, including those navigating Canadian tax for working holidaymakers, can apply for their tax refund when they file their tax return.

To determine whether you are entitled to a tax refund you will need to work out whether you have overpaid:

- Income tax

- CPP (Canadian Pension Plan)

- EI (Employer Insurance)

You will then need to make the necessary adjustments and apply for your refund as you file your tax return.

One quick way to work out whether or not you are entitled to a Canadian tax refund is by using the Taxback Calculator. This will give you a free estimation of how much your refund is worth.

Then, if you are happy to proceed, Taxback will file your tax return and retrieve your maximum legal tax refund for you. Our average Canadian tax refund for working holidaymakers is $998!

Use our free Canada tax refund calculator to estimate your refund!

Social Insurance Number (SIN)

You can't legally work in Canada without a Social Insurance Number (SIN). So arranging your SIN will be one of your first tasks when you arrive in Canada.

A SIN is a nine digit number that government agencies use in order to identify you. You'll also need it in order to pay taxes, or access government programs and benefits, like Employment Insurance (EI) and the Canada Pension Plan (CPP).

But how can you organise your SIN?

The first step is to gather all the necessary documentation and bring these to your local Service Canada Office.

For example, temporary residents (such as working holidaymakers) will need to provide either their Canadian work permit, or their Canadian study permit which indicates that they may accept employment.

Temporary residents will be issued with a Social Insurance Number in Canada beginning with '9'. The confirmation of SIN Canada letter will have an expiry date which matches the end-date on the immigration document.

You may apply for a SIN Canada by mail if:

- you live more than 100km from your nearest Service Canada office

Or - extenuating circumstances prevent you from presenting in person

And - another individual cannot submit an application on your behalf

Or - if you are applying from outside Canada

Once your SIN application is approved you will receive a Confirmation of SIN Number letter.

Protecting your SIN

Your SIN is confidential. If it fell into the wrong hands it could potentially be used maliciously to obtain private information about you. So it's important to only disclose your SIN when it's essential to do so.

Employers, financial institutions, and government agencies will usually require your SIN number for legitimate reasons, which include setting up your income tax and benefit arrangements.

It is not illegal for private companies to ask for your SIN in Canada, however it is discouraged. Examples where it is not required include property rental applications, credit card applications, subscribing to phone or internet providers, or applying to a college.

If you are unsure why your SIN Canada is being requested, it's a good idea to offer an alternative proof of identity, and ask to speak to a manager if this is not accepted.

T4

Your T4 is an important slip of paper that you will need in order to file your tax return in Canada.

A T4 is a summary of the income that you earned and the tax that you paid in a particular tax year. If you work in multiple jobs in Canada you will receive multiple T4 slips.

If you lose your T4, you should contact your employer directly. Alternatively, Taxback can help you to track down missing tax documents including T4s.

Elements of a T4

- You will find your Employers Name in the top left hand corner of your T4.

- To the right of the Employers Name, you'll find the Tax Year in question (i.e. 2023, 2022, 2021 etc.).

- Your name and address will be located on the left of the T4.

- Box 12 is where you will find your Social Insurance Number (SIN).

- The income you have earned in the job will be located in Box 14.

- The tax you paid on this income will be displayed in Box 22.

- Your Canadian Pension Plan (CPP) contributions are outlined in Box 16.

- And Box 18 is where your Employers Insurance (EI) contributions are detailed.

Tax refunds

There are three boxes on your T4 that relate to tax that can be refunded – Boxes 22, 16 and 18.

Generally speaking, if you earned under the tax free allowance for the tax year ($15,000 in 2023 or $14,398 in 2022) – based on a single person with no income outside Canada), you will be entitled to be refunded the majority if not all of your income tax.

You will also be entitled to a refund for any overpayment in CPP (Box 16) or EI (Box 18).

Taxback guarantee to retrieve your maximum legal tax refund. Our average Canadian tax refund for working holidaymakers is $998

TD1

When you start your first job in Canada you will be required to fill in a TD1 form.

This is a federal and provincial and personal tax credit form used to determine how much tax you should pay on your income.

Your TD1 is very important and it is vital that it is filled out correctly as this could mean the difference between you getting a tax refund or owing tax to the Canadian Authorities.

When to fill out a TD1 form

You'll need to complete a TD1 form:

- When you start a new job for the first time in Canada

- Anytime you have a new employer

- If you want to change the amounts from previous years

- If you want to claim the deduction for living in a prescribed zone

- If you want to increase the amount of tax deducted at source

The most common reason for filling out this form is when you change employers or start first-time employment in Canada.

There are two cases where you need to be extra vigilant when filling out the forms:

(1) You work outside Canada in the same tax year

If you earned income from outside Canada in the same year, you earned income from Canadian sources then you might not be entitled to claim the personal tax credits that allow you to earn tax-free income in Canada, especially when considering the nuances of Canadian tax for working holidaymakers.

The key is to watch out for the 90% rule. Basically, if you didn't earn 90% of your income in Canada for that year, then the Canadian tax authorities will not let you earn tax-free income for that year.

If you didn't earn 90% of your income in Canada for that year then you should enter 0 in box 13 and tick No on the non-resident question on the TD1 form.

If you don't fill this out correctly, you could end up owing money to the tax authorities.

Read more about the 90% rule here.

(2) You work two or more jobs at the same time in Canada

If you take up more than one job in Canada, then you'll be asked to fill out a TD1 form for each job.

The important thing to remember is that you can't claim personal credits twice.

So, if you're entitled to personal tax credits, you should only claim them for one job. Usually, it's most beneficial to claim the credits for the job the pays the most.

T1 Income Tax Return

The T1 Income Tax Return or 'T1' is the form used in Canada by taxpayers to file their personal income tax return.

Individuals with tax payable during a calendar year must use the T1 to file their total income from all sources, including:

- employment income

- self-employment income

- foreign income

- interest

- dividends

- capital gains

- rental income

After applicable deductions, the net income and taxable income are determined, and federal and provincial or territorial tax are calculated to give the total payable.

The deadline for filing this tax return is 1 May.

There are 6 main elements to a T1 Income Tax Return form:

- Identification – this is where you provide personal information like your name, address, Social Insurance Number and marital status

- Total income – here you declare your income from all sources

- Net income – here things like child care expenses and union dues are subtracted from total income

- Taxable income – where allowable deductions are subtracted from your net income

- Federal tax – table used to calculate the federal tax payable in Canada

- Refund or balance due – here your credits are subtracted from net federal and provincial or territorial tax. You can then determine if you owe more tax to the Canadian Authorities or you are entitled to a refund.

The T1 Income Tax Return form you fill in will be unique to you and your personal tax circumstances. There are a number of forms within the T1 that may need to be filled out depending on your circumstances.

For example, some of the most common forms for working holidaymakers are:

- 5015-R T1 Income Tax Return - Income Tax and Benefit Return - Version for AB, MB and SK only

- 5013-SA - Schedule A - Statement of World Income - Non-Residents of Canada

- 5013-SB - Schedule B - Allowable Amount of Non-Refundable Tax Credits - Non-Resident of Canada

Taxback

You can file your tax return directly with the Canadian tax office, or you can use a tax agent such as Taxback.

By applying with Taxback you can enjoy a fast and stress-free service.

Taxback:

- will handle all of your tax return paperwork

- guarantee to keep you compliant with the Canadian tax authorities

- help you to locate any tax documents that you have lost

- ensure you avail of every expense and relief you are entitled to

- retrieve your maximum legal tax refund

- can pay you your refund in any currency and save you money as you won't need to keep a bank account in Canada after you left the country

The average Canadian tax refund is $998

Key Terms

CPP

Almost all individuals who work in Canada contribute to the Canada Pension Plan (CPP) which provides partial replacement of earnings in the case of retirement, disability or death. Where you have paid overpaid CPP contributions during the tax year you will receive the overpaid amount back with your refund. You are not able to deduct the total amount of CPP you paid in Canada during your working holiday, but you can apply for and receive a full CPP retirement pension at age 65 or receive it as early as age 60 with a reduction, or as late as age 70 with an increase.

EI

The Employment Insurance (EI) program provides temporary income support to unemployed workers and workers who take time off work due to illness; pregnancy; caring for a new-born or newly adopted child (and more).

Federal & Provincial Tax

There are two different types of income tax that taxpayers pay – Federal (common tax rates across the country) and Provincial (differing depending on the territory where you work and live).

Residency status

It's important to file your tax return under the correct residency status so that you can remain compliant and in line with the Canadian tax authorities. Most working holidaymakers in Canada are considered non-residents for tax purposes.

SIN

Every working holidaymaker will need to obtain a Social Insurance Number (SIN) before they begin working in Canada.

T1 Income Tax Return

The T1 is the form used by taxpayers in Canada to file their personal income tax return.

T4

Your T4 is a summary of the income that you earned and the tax that you paid in a particular tax year.

Tax Deadline

The deadline for filing a tax return in Canada is usually 30 April. This year, it's 1 May.

Tax-free allowance

All taxpayers, including those navigating Canadian tax for working holidaymakers are entitled to a tax-free allowance of $15,000 for 2023 ($14,388 for 2022) tax year. This means that you can earn up to this amount without paying federal tax on your income.

Tax Refund

There are many reasons why an individual may pay too much tax. However, if you overpay tax in Canada you will be entitled to a refund. The average tax refund that Canadian working holidaymakers receive is $998.

The average Canadian tax refund is $998

Tax Year

The Canadian tax year runs from 1st January – 31st December.

TD1

TD1 forms are federal and provincial forms used to determine how much tax you should pay on your income before the start of your employment.

Voluntary disclosure

If you were due to file a tax return and didn't, you can avoid penalties by filing the return under the Voluntary Disclosures Program.

Working Holiday Visa Taxes FAQs

Q. Do I need to file a tax return in Canada?

A. Yes. Filing a tax return is part of your responsibilities as a taxpayer in Canada. Even if you had no income in the tax year, you still have to file a tax return.

Q. I'm thinking of moving to Canada on a Working Holiday Visa. How much tax will I have to pay when I'm there?

A. The amount of the tax you pay depends of the total of income you earned during the tax year. Generally speaking, you'll pay three types of income tax in Canada.

- Income tax (Federal and Provincial)

- Canadian pension plan (CPP)

- Employer Insurance (EI)

Further information on the amount of tax that you will have to pay can be found here.

Q. I earned income in my home country in the same year that I arrived in Canada. Do I need to put this on my Canadian tax return?

A. Yes. You should declare all of your income from inside and outside of Canada.

Q. I paid tax on this income in my home country. Will I have to pay tax on it again in Canada?

A. No. But the amount of money you earned outside Canada may have an effect on your entitlement to personal tax credits in Canada in that tax year. This is called the 90% rule.

Q. What is the 90% rule?

A. This rule basically means that if you earned more than 10% of your income outside Canada, you can't avail of the personal tax credits. However, if you earned at least 90% of the income within Canada, then you can claim the credits.

Further information on the 90% rule can be found here.

Q. Do I declare my Net or Gross income from my home country?

A. Declare your NET income (the amount you received in your bank account).

Q. How can I tell if I'm a resident or non-resident for tax purposes?

A. Firstly, most working holidaymakers are considered non-residents for tax purposes.

Generally you're considered a non-resident if:

- you normally reside in another country and are not considered a resident of Canada

Or - you don't have significant residential ties in Canada

And/or - you lived outside Canada throughout the tax year

Or - you stayed in Canada for less than 183 days in the tax year.

You're generally considered a resident if:

- Canada is the place where you normally live

- You have significant residential ties (spouse, dependents, own a home) in Canada

And - You are not considered a resident in any other country under a tax treaty with Canada.

Q. How can I tell if I'm entitled to a tax refund in Canada?

A. This depends on a number of factors including whether or not you overpaid tax.

Overpayments of tax in Canada can be broken into three categories:

- Overpayment of income tax

- Overpayment of Canadian Pension Plan (CPP)

- Overpayment of Employer Insurance (EI)

By using the Taxback online tax calculator here, you can easily get a free estimate of how much your refund will be worth.

Q. When can I apply for my tax refund?

A. The Canadian tax year runs from January 1 to December 31 and you can apply for your tax refund from mid of January of the following year. In other words, you can apply for your 2022 tax refund from 24 January 2023. And you have 10 years after the end of the tax year to apply for your tax refund.

The average Canadian tax refund is $998

Q. What is a TD1 and why do I need it?

A. A TD1 is a federal, provincial and personal tax credit form used to determine how much tax you should pay on your income.

You'll need to fill out a TD1 when you start a job for the first time in Canada and:

- anytime you have a new employer

- if you want to change the credit amounts from previous years

- if you want to claim the deduction for living in a prescribed zone

- if you want to increase the amount of tax deducted at source

Find out more about the TD1 Form here

Q. I have heard Social Insurance Numbers are just for Canadian citizens. Is this true?

A. No! Everyone who wants to work in Canada will need a Social Insurance Number (SIN). A SIN is a nine-digit number which government agencies will use to identify you. You will need it in order to pay tax and access government programs.

Q. What will I need in order to get a SIN?

A. Temporary residents (like Working Holidaymakers) will need to provide either their Canadian work permit or their Canadian study permit when they are applying for their SIN.

Find out more about SIN here

Q. I know I need a T4 document in order to file my tax return. But I don't know where to get it. Who can help me?

A. T4 is a summary of the income that you earned and the tax that you paid in a particular tax year. If you lose a T4, you should contact your employer directly. Alternatively, Taxback can help you to track down missing tax documents including T4s.

Q. What is a voluntary disclosure?

A. If you did not file a tax return in a year when you should have, you can voluntarily file or correct that return under the Voluntary Disclosures Program and pay only the tax owed (plus interest) without penalty.

To qualify for relief, the application must:

- be voluntary;

- be complete;

- involve the application or potential application of a penalty and, for GST/HST applications, the application or potential application of a penalty or interest;

- include information that is at least one year past due for income tax applications and, for GST/HST applications, at least one reporting period past due; and

- include payment of the estimated tax owing.

Q. Filing a tax return sounds very, very boring! Can't someone else do it for me?

A. Yes! You can choose to file your tax return with a tax agent like Taxback

By applying with Taxback you can enjoy a fast and stress-free service. We will manage all of your tax return paperwork so you don't have to! Plus, we guarantee to retrieve your maximum legal tax refund.

Sales Tax

In Canada, all consumers are charges sales tax when they pay for goods and services.

Depending on the province or territory in which you pay for the goods, you will also pay GST, or PST, a combination of both or HST.

HST combines PST and GST to create one tax. HST participating provinces collect sales tax at the following rates.

· New Brunswick: 15%

· Newfoundland and Labrador: 15%

· Nova Scotia: 15%

· Ontario: 13%

· Prince Edward Island: 15%

Those in the below provinces pay 5% GST as well as provincial sales tax at the following rates:

British Columbia – 7% provincial sales tax (PST) on retail price only

Manitoba – 8% retail sales tax (RST) on retail price only

Quebec – 9.975% Quebec sales tax (QST) on retail price only

Saskatchewan – 6% PST on retail price only

Three territories of Alberta (Northwest Territories, Nunavut or the Yukon) do not collect sales tax on goods and services beyond the 5% GST.

The sales taxes paid for purchases are not refundable for individuals in Canada.