The Most Frequently Asked Questions About Irish Tax

As Albert Einstein once said, "The hardest thing in the world to understand is the income tax."

We know that tax can sometimes be perplexing and challenging to understand. In this blog, we have answered some of the most common questions we get asked about Irish tax.

Q: Am I due tax rebate?

A: Many workers in Ireland are entitled to a tax refund. You may be entitled to a tax rebate if you changed (or had gaps in) your employment, didn’t avail of all of your tax credits or are entitled to claim tax relief on eligible expenses (such as medical expenses, flat rate expenses, tuition fees and much more). Large numbers of people who have worked abroad are also entitled to a tax refund, without even realising it. You can check out our Irish tax refund calculator to find out how much you can claim.

Q: How to claim tax back?

A: Many people in Ireland are confused about how to get a tax refund. You can claim a rebate either by filling out forms yourself with Revenue or easily online with Taxback.com. You can go back four years to claim your entitlements. We can claim back all additional credits or deductions you are entitled to. If you aren’t due any tax back, there’s no fee applied.

Q: How to check my tax refund?

A: The average Irish PAYE tax refund a Taxback.com customer receives is €1076. Find out how much you’re due by using our online tax calculator.

Q: Where is my tax refund?

A: When you apply with Taxback.com you can track the progress of your tax refund by using your Tax Tracker account. The average Irish tax refund is €1,880

Q: How to get the maximum tax refund?

A: Many people overpay taxes without even realising it and are not aware that they might be due a tax refund or that there are tax credits they can claim. You can file a return by yourself, but if you are not familiar with the reliefs you are entitled to, contact Taxback.com. Our team of experienced tax agents will guide you through the entire process and ensure you get back your maximum Irish tax rebate.

Feel free to use our FREE tax refund calculator to find how much tax rebate you are due!

Q: How far back can I claim a tax refund?

A: You can claim a tax rebate for the previous 4 years.

Q: How to claim an emergency tax refund?

A: Always remember to provide your PPS number to your new employer. If you can’t supply your PPS number, a larger amount of tax will be deducted from your income than normal – this is known as emergency tax. The easy way to check if you are on the emergency tax rate is to look for “emergency tax” on your pay slip. If you are unsure how to claim the emergency tax back, contact our experienced tax experts who will guide you through the process.

Q: How much tax will I pay?

A: PAYE (Pay As You Earn) is the name of the Irish income tax system. Every time your salary is paid, your employer deducts Income Tax, Universal Social Charge and Pay Related Social Insurance from your earnings. The amount of tax you pay depends on the amount of income you earn and your tax credit entitlement. A wide range of tax credits and reliefs can be claimed to reduce the tax you must pay. A few are awarded automatically, and others must be claimed by taxpayers.

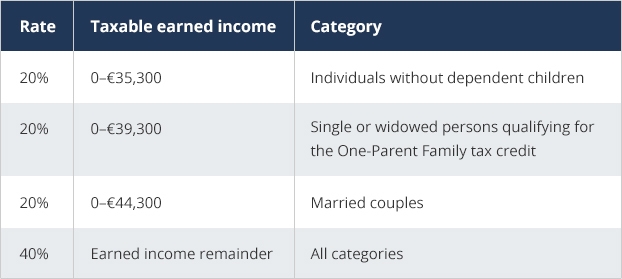

The rate of tax that you have to pay depends on the amount of income that you earn and on your personal circumstances. Here are the PAYE tax rates for single individuals and married couples.

Universal Social Charge

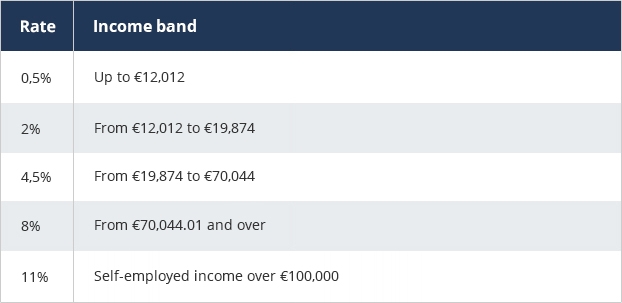

It is also likely that USC will be deducted from your income. The amount of USC you must pay depends on how much you earn and your personal circumstances. If your income is €13,000 or less you do not have to pay Universal Social Charge (USC).

Standard rate of USC (2019)

PRSI

PRSI is another deduction you’ll see on your payslip each time you’re paid. This is a contribution to the Irish social insurance fund and most employees over 16 must pay this. How much PRSI you pay is largely based on your earnings and the type of work you do. Social insurance contributions are divided into different categories known as classes or rates of contribution. Most employees in Ireland are Class A and contribute 4% of their pay to PRSI.

Q: What are tax credits?

A: Tax credits reduce the amount of Irish income tax that you pay. Many credits are not applied automatically and must be claimed by individual taxpayers themselves. It’s worth investigating which credits you are entitled to. Most claimed tax credits are:

-Personal tax credit

-Employee tax credit

-Earned income tax credit

-Single parent tax credit

-Home carer tax credit

-Rent tax credit

Note: Tax credits are not refundable i.e. if you have not paid enough tax to cover the credit you won’t be refunded the balance. E.g. Tom is married and earns €20,000. His tax before credits is €4,000. He is entitled to the married credit €3,300 and the PAYE credit €1,650- total credits are €4,950, but his tax is only €4,000. The credits cover his income, reducing his tax payable to NIL, refunding him the tax paid of €4,000, but he does not get a refund of the €950 excess credits.

Q: What are tax deductions?

A: Tax deductions reduce the amount of income that you pay tax on.

Examples of tax deductions are flat rate expenses, personal pension contributions and more.

You can find more information about the tax reliefs at section 4.Tax Credits, Allowances and Reliefs.

Q: How to pay tax as a self-employed individual?

A: As a self-employed individual you pay tax under the self-assessment system and you must file your own end-of-year tax return Form 11.

You will need to do a self-assessment if you have:

- An income in addition to PAYE

- An Income from self-employment

- A rental income

You can find more information on our Self-assessed tax return service here.

You won’t need to file a self-assessment if:

- You have PAYE and non-PAYE income, but the non- PAYE income is below €5,000, but not nil or a negative amount

- If the non-PAYE income is coded in your tax credits or subject to DIRT

But you still have to report your non-PAYE income by filing a tax return Form 12.

For additional information, check out our Irish self-assessment tax guide.

Simply apply with Taxback.com and we can help you with your tax returns in Ireland - we'll take care of the messy tax paperwork so you don't have to!

Q: When are self-assessed taxes due?

A: The income tax return deadline in Ireland is 31st October following the end of the tax year. If you do not file by the deadline, you may be liable to pay penalty fees, surcharges and interest.

When will I get my tax refund?

A: Once we have submitted your application, it usually takes between 2-4 weeks before you will receive your refund. However, sometimes, depending on your personal circumstances it might take longer. We will keep you updated on the matter at all times.

Q:When is the last day to file taxes?

A: The last day to file a self-assessed tax return is 31 October. This can be extended to the middle of November if you file online. PAYE refunds can be claimed 4 years back. In general PAYE refunds are claimed for a tax year after the year ends e.g. after 31 December.

Q: How to file a tax return?

A: You can file a tax return directly yourself or you can ensure you avail of every tax relief and deductions you’re entitled to and maximize your tax refund by filing with Taxback.com.

Q: How to calculate tax?

A: The first €35,300 of your income will be taxed at 20%. This amount is called your standard rate cut-off point. Anything you earn above this amount is charged at a higher rate of tax - 40%. Our tax experts will review your tax records and calculate your tax refund.

Q: What is an excise tax?

A: Excise Tax (or Excise Duty) is a tax on the sale of particular goods such as alcoholic beverages and tobacco.

Q: How to get your income tax return?

A: If you are unsure how to file a tax return on your own, you can trust our experienced tax agents who will deal with all the paperwork and ensure you avail of every relief you’re entitled to.

Q: Where are my taxes?

A: Revenue collect tax on behalf of the Irish Government. You may be able to claim a tax refund through your tax reliefs. Our tax experts can apply and claim them.