Not so fast!

Oops - you've skipped a bit! Please fill it in so we can move on!

Oops - you've forgotten to fill out some info and entered your {[field_name]} incorrectly. Please correct them so we can move on!

Oops - you've used the wrong format for your {[field_name]}. Please enter your {[field_name]} in the format shown so we can move on!

Oops - you've used the non-latin symbols in your {[field_name]}. Please enter your {[field_name]} in with English letters only so we can move on!

Register to get a Call Back or Apply for your free estimation now!

* This calculator is for illustrative purposes only and should not be used as a substitute for consultation with a professional tax advisor.

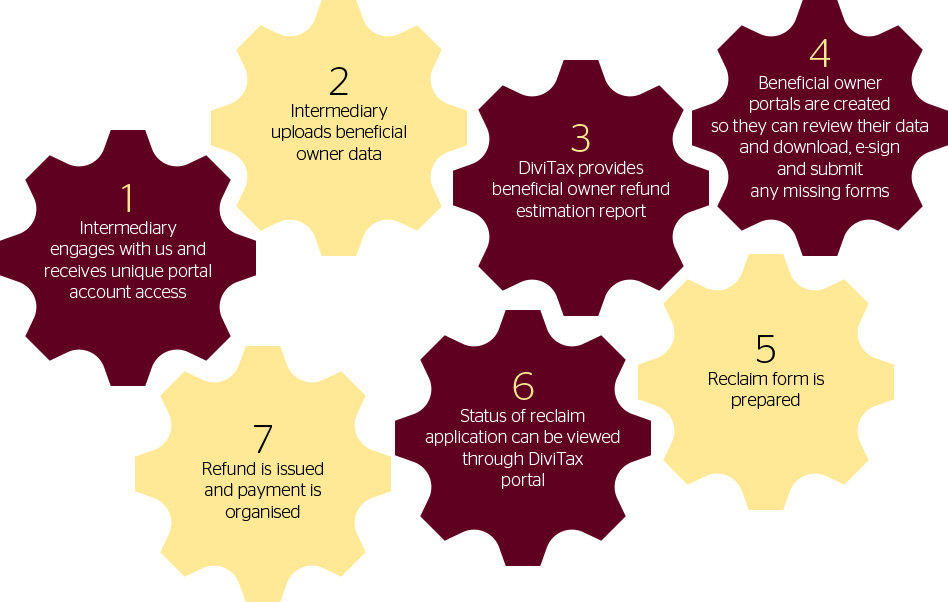

DiviTax is software designed and developed by Taxback.com which facilitates the withholding tax reclaim process and guarantees complete compliance. DiviTax is suitable for investors, intermediaries and financial institutions.

![]()

Countries regularly enter into bilateral agreements called income tax treaties.

Withholding tax reclaims arise because the rate permitted under the terms of the treaty is less than the default rate applied by most foreign governments. In most cases the only way to obtain your legal entitlement is to file a reclaim.

The calculator above allows you to calculate how much you may be due back if you received dividends from foreign shares.

Get answers to all your questions about our DWT Refund service here

Got questions? Don’t hesitate to contact us. We are here to help

Sprintax from Taxback.com is our online self-preparation tool for US federal and state tax returns.

It's fully guided, more cost-effective for you, and will guarantee you stay fully compliant with US tax laws.

By using Sprintax, you will also get the maximum US tax refund.