File your Irish tax return and claim everything you’re entitled to

- Claim every tax entitlement you’re due

- Comprehensive four-year tax review

- Simple online service

- Tax return preparation fees starting from €99

Super easy tax refund applications from just €99!

File with Taxback today and our expert team will look after all the paperwork. 100% compliance with Revenue guaranteed!

Average refund: €1,880

Our Irish tax services

Claim your Irish PAYE tax refund and file your self-assessed tax return

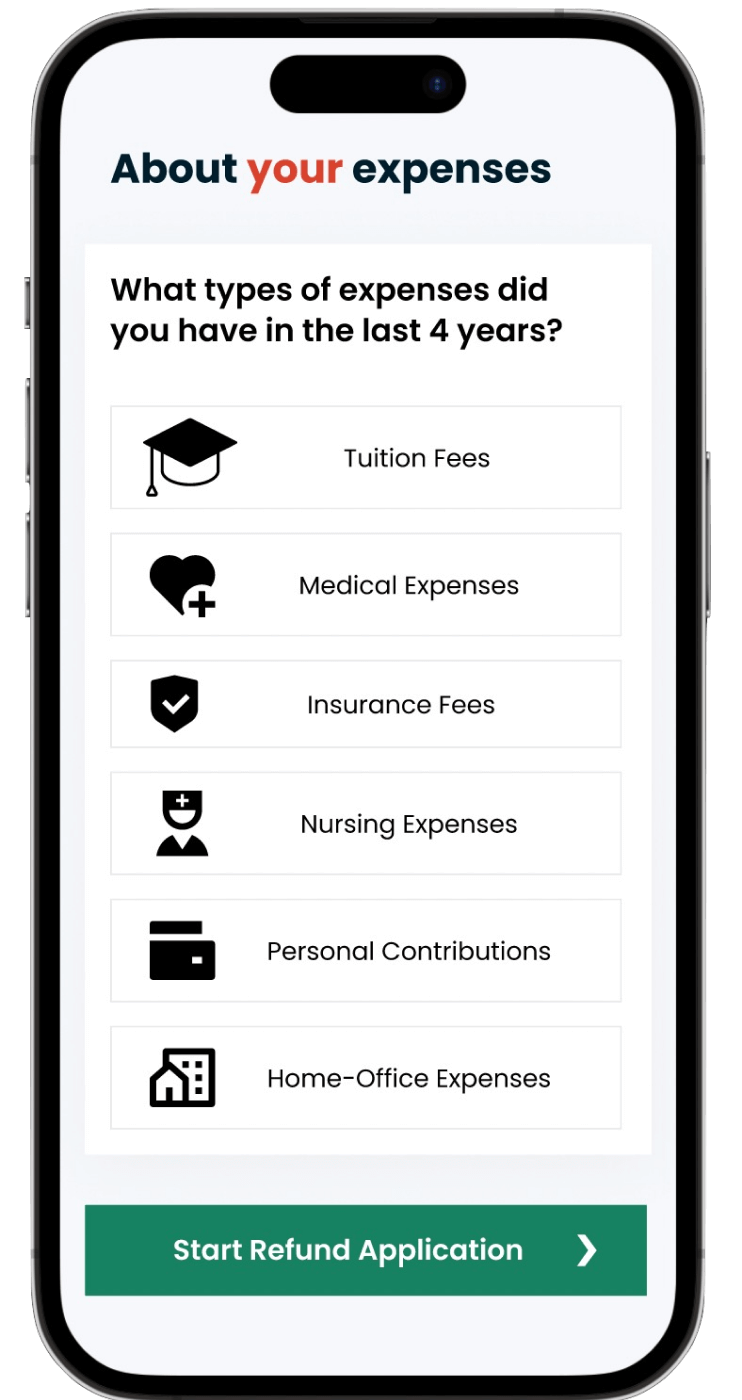

Am I due an Irish tax refund? Find out here!

With an average Irish tax refund of €1,880, it pays to make sure you’re claiming everything you’re owed.

So whether you work remotely, rent your home or have medical expenses, we will carry out a comprehensive four-year review of your tax profile and ensure you receive every entitlement you’re due.

Our Irish PAYE tax refund service costs just €99.

Get started

How it works

Register with Taxback and complete our short, online questionnaire.

Pay our €99 service fee and finalise your details.

We will review your information and ensure you are claiming all available expenses and due credits.

Login to your Revenue MyAccount and authorise Taxback as your tax agent. We will then provide an estimated refund amount, prepare and file your tax return with Revenue, and keep you informed throughout the application process.