Declaring Foreign Income in Canada

So, you need to file a Canadian tax return, but you have income from outside Canada. What should you do?

Firstly, there are different rules for residents and non-residents to declare their foreign income in Canada.

Getting to grips with the different rules will help you come tax season.

So, let's look at what you need to know about declaring foreign income in Canada.

Non-residents declaring foreign income in Canada

Non-residents must declare their net income earned outside of Canada on their tax return in order to avail of the non-refundable tax credits in Canada.

As a non-resident your non-Canadian income will not be taxed in Canada, but it will affect how many non-refundable tax credits you can claim. This is your personal tax credit, otherwise known as your tax-free threshold.

In Canada, you can earn up to a certain amount without paying tax. In 2023, this was $15,000.

Basically, you are allowed earn up to $15,000 tax free in the tax year if 90% or more of your total income was sourced in Canada.

If you earned more than 10% outside Canada, you won’t be eligible to earn any tax free income up to a total amount of $15,000. In this case, if the tax-free threshold had been claimed incorrectly at source, then you have underpaid tax, because less taxes were deducted on your behalf.

The average Canadian tax refund is $998

If you don’t know your residency status, you could check it in this article on determine your status.

Please note that this blog is aimed at non-residents, not 'newcomers' as the rules may be slightly different.

Got more questions? Here's eveything a working holidaymaker should know about tax in Canada.

How to correctly complete Canadian TD1 forms

You’ll actually fill out a federal (TD1) and a provincial (TD1BC, TD1AB, TD1ON etc.), but we’ll concentrate on the federal tax form. Here is how it looks like.

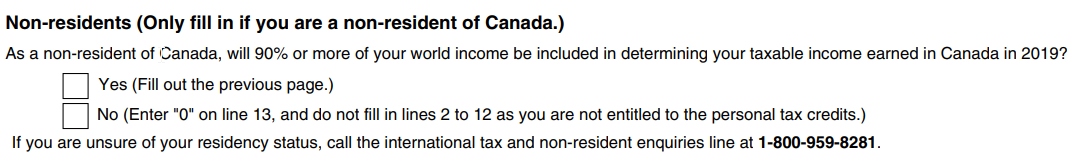

This is on the second page of the TD1 form.

As you can see in the above image, they ask you if you will earn 90% of your income in Canada. If yes, then you can claim the credits on the first page of the form.

If not, you should tick NO and not claim the credits. You’ll be fully taxed but it’s much better than owing money when it comes to filing your tax return.

A lot of non-residents don’t fully understand this and unfortunately end it’s the most common reason they end up owing money to the Canadian tax office.

As a non-resident in Canada you should note that you might be obliged to report your Canadian income in your home country and to use the tax payable in Canada as a credit on your tax return in your country of residence.

Our advice in this case is to file your Canadian income tax return first, in order to determine the net Canadian income and tax payable and then to proceed with your home country tax return.

What residents need to know about declaring foreign income in Canada

If you’re a resident, you must declare any income earned outside of Canada on your Canadian tax return

You will be taxed on this incomein Canada. However, in case you have paid tax outside of Canada on this income, you can claim the tax as a foreign tax credit. The foreign tax credit is not a refundable credit, but will reduce your tax payable in Canada.

In order to report properly your non-Canadian income, be sure to keep records of all your payment documents and copies of your income and tax returns. Our advice is to complete your non-Canadian income tax return before you file in Canada in order to determine the foreign tax credit that you can claim.

File your Canadian Tax Return easily online

Immigrants (Newcomers) and declaring foreign income within Canada

If you are an immigrant during the tax year (i.e. move to Canada with the intention to settle and build a life in Canada), you'll only be taxed on your non Canadian income you earned after you became a resident. Anything earned up to that point should be declared, but you won't be taxed on it.

The non-Canadian income earned before the immigration date is declared for proper determination of the non-refundable tax credits.

For example in case you earned outside of Canada less than 10% of your total income for the year before your immigration date, you can claim the total credit of $12,069 for 2019 tax year. In case your non-Canadian income earned before the immigration date is more than 10% of your total income the non-refundable tax credits should be prorated according the number of days you resided in Canada during the tax year.

Do emigrants from Canada have to declare foreign income on a Canadian tax return?

If you are an emigrant from Canada (i.e. left Canada with the intention to settle in another country and do not keep residential ties with Canada (available home and/or spouse and/or children)) you should report and pay tax in Canada over your foreign income earned before the emigration date.

After the emigration date you are considered a non-resident in Canada and should not pay tax on your non-Canadian income in Canada.

You should note that as a non-resident you still may get some refund from Canada. For example in case you are renting out your home in Canada you or your property manager should withhold 25% tax from your rental income. In case you have expenses related with the rental income you can file an income tax return under Section 216 and to return some of this tax back. Another example is filing under Section 217 in case you receive pension income from Canada after your emigration date.

We at Taxback can help you to sort out your taxes in any tax situation.

Tax refunds in Canada

There are also ways to calculate your applroximate Canadian tax refund.

You can do this by determining:

- How much money you made during the relevant tax year

- If you're eligible for the Canadian tax-free allowance

- Your rate of Canadian income tax

- If you are entitled to any deductions

- By finding out there figures, you can add up what you should have paid in tax and compare it to what you did pay.

If you want to learn how to check your tax refund in Canada, you can always apply for a Canadian tax refund with us, and once you complete a few short questions, sit back, and wait for us to get your money!

Sound like a lot of work?

That's why Taxback is here to help you!

You can always apply for a Canadian tax refund with us, and once you complete a few short questions, sit back, and wait for us to get your money!

FAQ

Q: I am a non-resident and earned income in my home country and arrived in Canada in that same year, do I put this on my Canadian tax return?

A: Yes.

Q: I paid tax on this income in my home country. Does this make a difference?

A: No. Non-residents in Canada can't claim foreign tax credit in Canada because their non-Canadian income is not taxable in Canada.

Q: Do I need to pay tax on the income I earned at home, in Canada?

A: No. You won't be double taxed on this income.

Q: Why does the tax office in Canada want to know what I earned outside of Canada in case this income is not taxable in Canada?

A: They use it your non-Canadian income to calculate what non-refundable tax credits you can claim in Canada.

Q: If I earn income outside of Canada in the same tax year and include it on my tax return, what difference will it make to my refund?

A: In most cases, it will reduce your refund, but sometimes it could mean you have underpaid tax on your Canadian income after the non-refundable tax credits were recalculated.

Q: Do I declare my Net or Gross income from my home country?

A: Declare your NET income. I.e. how much you received in your bank account.

Q: Why do I owe money in Canada?

A: Your tax obligation in Canada depends on your residency status.

As a non-resident with employment income you may owe money in case less tax has been deducted at source even if you do not have any income outside of Canada in case you have additional income such self-employment or tips not reported on your payslips. Another reason for the less tax deducted may be because you marked on the TD1 form that more than 90% of your total income will be from Canadian source and you earned more than 10% of your total income in another country.

As a resident in Canada you may owe money because you earned income outside of Canada on which you have to pay tax or you claimed non-refundable tax credits at source for which you are not eligible – for example you marked on the TD1 form that you will claim tuition transferred from a dependant but after the end of the tax year you do not claim the tuition on your income tax return. In this case less tax had been deducted at source and you might end owing some money to the tax office.

Q: I've filed an income tax return in Canada before and received a refund, now I am back in Canada and while dealing with my 2022 income tax return I learned that I owe money to the tax office from the previous tax year. What is the reason for this?

A: After your Notice of assessment is issued your file can be reviewed by the Revenue Agency within 6 years. In case your file is being reviewed you should receive a letter from the tax office informing you about the review and asking you about original documents and/or additional information. Such information can be confirmation of amount of income earned outside of Canada, confirmation of your exit date from Canada, documents proving your residency status or expenses claimed on the return.

In case you do not receive the letter or do not reply within the provided timeframe from the tax office may presume that you do not have proving documents and you are not eligible for the credits or expenses claimed on the initial assessment. In this case a notice of reassessment is going to be issued with the amount due to the tax office. In case you have the required information but simply failed to report it on time an amendment can be filed.

Q: I received a Notice of reassessment for a balance due because more income was reported on a T4 slip. What should I do?

A: In case the income reported on the Notice of reassessment is different than the one you received from your employer you should contact the employer in order to issue an amended T4 with the correct income and then you should contact the tax office in case there was a mistake on the Notice of reassessment. In case the reassessment is correct amendment can't be filed and you should pay the balance due to the tax office.

Q: The tax year in my home country is different than the Canadian tax year. How should I prove the foreign income in Canada?

A: The tax year in Canada runs from January 1st to December 31st and is the same as the calendar year. In case it defers than the tax year in your home country you should keep copies of all home country payslips or of each payment document for income paid to you within the tax year in order to calculate properly and prove your foreign income. The same applies to your Canadian payment documents when you have to file the return in your home country.

Q: What is the T1135 form in Canada?

A: Residents in Canada are obligated to report any foreign assets or investments exceeding $100,000 CAD using the Canada T1135 form. This form is crucial for ensuring compliance with Canadian tax laws and may impact your tax liabilities. Make sure to include all relevant details regarding your foreign holdings when filing your tax return to avoid penalties and ensure accurate reporting.

Q: I received unemployment benefit from my home country. Should I report this on my Canadian income tax return?

A: Yes. You should report the most types of foreign income on your Canadian income tax return. Exceptions are some lottery winnings, most gifts and inheritances, child care payments, amounts received from life insurance policy, strike pay received from union, elementary and secondary school scholarship and bursaries.

The average Canadian tax refund is $998

Q: I am citizen of two countries. How should I report my foreign income in Canada?

A: The citizenship is not a criteria for reporting income in Canada. You may have Canadian citizenship, but in case you live in another country and you have stronger residential ties (available home and/or spouse and/or children) in the other country you are considered a non-resident in Canada and a resident in the other country. Therefore you should report your worldwide income in the country you are considered a resident and to apply as a non-resident in Canada.

If you have any questions, please call the Canadian tax office or ask an agent a professional such as Taxback.

If you need to calculate your tax refund first, use our tax refund calculator for Canada.

Note: *The "same year" or "tax year" means January 1st to December 31st of any given year – which is the tax year in Canada.*