Help-to-Buy Scheme: Good News for First-Time-Buyers?

New Help-To-Buy scheme has been announced to help people purchase homes in Ireland

.jpg)

The Minister for Housing Simon Coveney announced a new Help-To-Buy Incentive for first-time-buyers as part of his housing action plan in Budget 2017 and people are flocking to avail of the scheme.

Tough times

With the lack of housing available and stricter borrowing rules, it’s been tough for first-time-buyers looking to get mortgages or find affordable homes in Ireland, especially in Dublin, so the government is now seeking a resolution.

He stated it was important to get the balance right, ‘’ what you don’t want to do is increase the capacity of first time buyers to spend more without actually having a correspondence in an increase in supply’’.

He added that any incentives for first-time-buyers would involve an increase in the supply of affordable homes to avoid a situation where the market overheats.

Housing problem

His housing action plan will also seek to address the lack of starter houses in Dublin, which has led to huge competition and rising prices. Currently, very few houses in the Dublin area can be bought for less than €300,000. The government’s action plan for housing aims to increase the number of homes built to 25,000 per year by 2021.

Confused about taxes?

So...what is the Help-To-Buy Incentive?

The Help-to-Buy Incentive is for first-time-buyers looking to purchase or build a new home to live in. The mechanism works by giving homebuyers a refund of income tax and DIRT paid over the previous 4 tax years.

Who can claim?

You must be a first-time-buyer and purchase or build a new residential property to live in as your new home between July 19, 2016 and 31 December 2019. If there are more than one of you buying a property together, each individual must be a first-time-buyer. This means that you haven’t previously bought or inherited a property.

To avail of the scheme, the home must be occupied by the first-time-buyer for a period of 5 years from the date the building is habitable.

To qualify, you must be borrowing from 70% up to 90% of the value of the property and cash buyers do not qualify.

What type of properties does it cover?

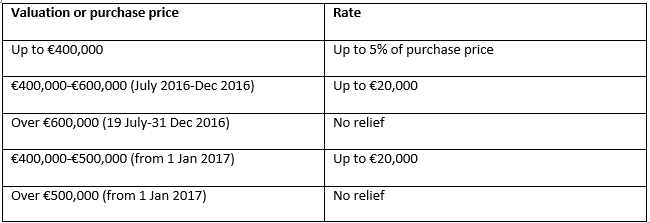

The maximum refund is 5% of the value of the property up to a maximum of €20,000, and from January 2017, is only available on properties valued at €500,000 or less.

For properties purchased between 19 July 2016 and 31 Dec 2016 the max valuation can be €600,000.

The scheme does not cover properties bought or built for investment purposes.

Rates:

How will it be paid?

If you’re purchasing a home this year or anytime up to 2019, then the money will be paid directly to the developer. If you purchased your home last year or you built your own home, the money will be paid directly into your account.

How to apply

PAYE employees can apply through Revenue’s myAccount service and self-assessed can pay through Revenue’s online service. You must be fully tax compliant for at least 4 years prior to claiming. You will need to complete Form 12 (PAYE) or Form 11 (self-assessed) and pay any tax liability that is outstanding.

Other Schemes

There are currently a number of reliefs and schemes available for first-time-buyers and homeowners you can avail of today. We’ve listed them below:

1. DIRT

.jpg)

A first-time buyer of who purchases or self-builds a property between 14 October 2014 and 31 December 2017 may be entitled to claim a refund of DIRT.

DIRT is Deposit Interest Retention Tax which is charged at 41% on all interest payments as of January 2014 and was charged at 33% for ordinary deposit accounts and 36% for long-term deposit accounts for 2013.

Confused about taxes?

This tax is deducted by your bank before the interest is paid and you can request a statement of the amount taken. If you buy or self-build between 14 October 2017 and 31 December 2017 you may be entitled to claim a refund of the DIRT. To claim, you must purchase or build the house to live in as your principle private residence as it doesn’t apply to properties that are purely for investment purposes.

You can claim the relief within the 48 months prior to the purchase date or date of conveyance. The relief is only available on savings up to a maximum of 20% of the purchase price or 20% of the completion value in the case of a self-build.

Unfortunately, it looks like the scheme hasn’t been very successful so far due to the host of other issues hindering first-time-buyers, including new lending rules and the lack of housing supply.

Also the fact that you must hand over your deposit before you can claim back the DIRT means it won’t go very far in helping you save the deposit in the first place. You’re also unlikely to earn very much on the interest, given low interest rates at the moment; we’re talking hundreds rather than thousands.

The scheme is also tied to Local Property Tax so you can’t claim it until you are LPT compliant.

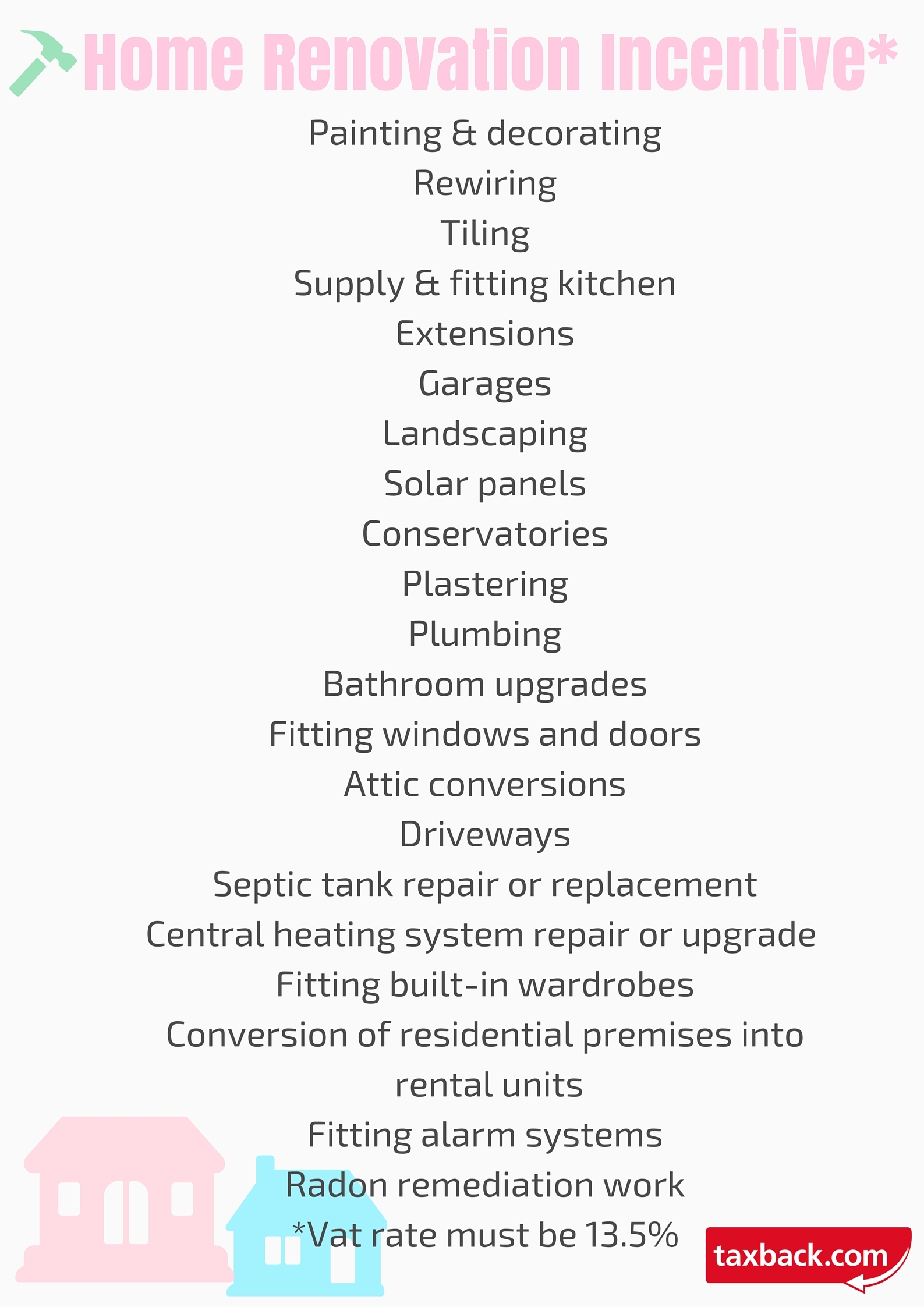

2. Home Renovation Incentive

This Home Renovation Incentive will be useful to you if you buy a home and intend to renovate or already have a home that’s in need of updating. The scheme was introduced in 2013 as a tax relief for homeowners and for landlords in 2014, with a tax credit of 13.5% on certain repairs and improvement works on a main home or rental propert

For the work to qualify, it must be done by qualified contractors and reach a total expenditure of €4,405 (before VAT at 13 %) up to a max of €30,000 per property.

The relief is available for works carried out from 15 October 2013 to 31 December 2018 for homeowners and between 15 October 2014 and 31 December 2018 for landlords, and you must be paying income tax under the PAYE or self-assessed system to qualify.

What work qualifies?

All the work must be carried out by a qualifying contractor who is tax compliant and has a VAT number. The contractor will enter the project onto HRI online which you should then double-check to make sure everything is in order.

You can claim the tax credit in the year after the work is carried out and it is payable over the following two years.

Read an in-depth article about the scheme here.

Confused about taxes?

4. Better Energy Homes Scheme

.jpg)

The Better Energy Homes Scheme is a grant available for homeowners to improve the energy efficiency of their homes.

So for example, the grant is available for work such as:

- Roof insulation

- Wall insulation

- Heating controls upgrade

- Installing a high efficiency boiler (over 90%)

- Solar heating

To qualify you must:

- Be the owner of a home built before 2006

- Use a contractor from SEAI’s list

- Use newly fitted materials

- Work must comply with required standards

- Have a BER carried out after work is completed

- Use a BER assessor from SEAI’s national register

You must get the grant approved before you purchase new materials and start any work, otherwise you will not be eligible. Once approved, the grant is valid for 6 months.

Rates

The grants will be paid after work is completed and you have paid the contractor.

If you are claiming a tax credit under the HRI scheme, the expenditure that qualifies for the credit will be reduced.

You can apply for the scheme online here.

5. Rent-A-Room Relief

A great way to earn some income out of your property is to get a housemate!

Once you’ve purchased your property, you may choose to rent a room out to help pay your loan. This could be a temporary measure to help offset the cost of saving for a house and with rents in some parts of Ireland at levels higher than before the recession and you could end up with a nice windfall at the end of the year.

Rent-a-room relief is for people who rent out to tenants in their own home. The threshold was recently increased from €12,000 to €14,000 so you can earn up to this amount from your tenants in 2017 with paying tax on the income.

Read: 5 Facts you need to know about the Rent-a-Room Relief

Under the scheme:

- You don’t need to register with the PRTB

- You can terminate the tenancy at your own discretion

- You don’t have to legally maintain the property to the same set of standards as registered landlords (but it’s in your own interest to maintain it)

Put it in writing!

The downside is that you have no legal agreement with the tenants so if this go wrong it could get messy. This is why it’s advisable to put things in writing! When someone moves in, agree on a rental rate, what date the payment will be due each month and how it should be paid. Write all this down in a contract and sign it along with your tenant. Then make sure you keep a record of deposits. This could save you a lot of hassle.

You should still file a tax return to declare your intentions regarding rental relief. However as long as you don’t exceed the ceiling of income, you’ll qualify for the relief and it will be a handy way of earning income!

6. Airbnb

If you don’t want someone long-term you could do a short-term let with the likes of Airbnb. Although this type of let doesn’t qualify for the rent-a-room relief, you could still find the extra bit of cash handy and it means you could let your property while you’re away, which is often better than leaving it vacant.

If you are going to let a room or your property out on Airbnb, there are a few things you’ll need to know about paying tax and we’ve outline them for you in the below animation.

Filing a Tax Return

You will need to file a tax return to declare your income but if you’re new to this then it can be confusing! Luckily we have a special rate for Airbnb hosts and if you sign up here you can avail of it. We will guide you through the process and take care of any paperwork involved. We’ll also make sure you avail of any expenses you’re due.

The kind of expenses you may be due include:

- Cleaning

- Laundry

- Commission to Airbnb

- Additional insurance purchased

- Electricity, Gas

- Other purchases directly related to the letting the property

Read: 5 Things You Should Know About Hosting Airbnb in Ireland

For help with your Airbnb tax return, you can register here.

Keep an eye on our blog and facebook page here for more updates and news about homebuyers and owners tax reliefs.