Understanding Your Irish Payslip Made Easy

Wondering what all the different terms mean on your Irish payslip? We've listed out the most common ones that appear on your payslip and their meanings.

If you're confused by what all those terms on your PAYE payslip mean, don’t worry, you’re not alone!

We want to help with all those confusing terms so we've listed them out for you below.

If you're gearing up for your tax return, understanding these terms will make the process smoother.

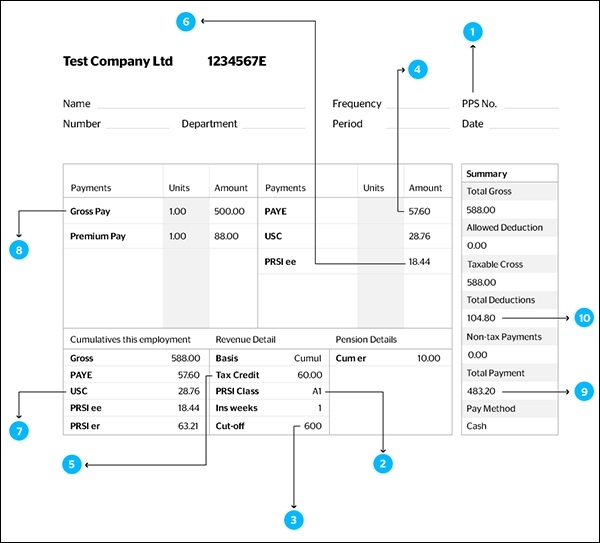

Sample Payslip Ireland:

Free PDF guide to PAYE taxes in Ireland

1. PPS Number

Your Personal Public Service (PPS) number is a unique number used by the Irish Government to identify you for tax purposes.

It is also used when you need to access social welfare benefits and public services.

2. PRSI Class

Your Pay Related Social Insurance, or PRSI Class, is usually determined by your employment and dictates what PRSI contributions you’ll pay.

Currently, there are currently 11 different PRSI classes. They are named classes: A, B, C, D, E, H, J, K, M, S and P.

Understanding the specifics of your PRSI class is crucial for managing your social insurance contributions effectively and ensuring compliance with the PRSI meaning in the context of your employment.

3. Weekly/monthly cut-off

This is the figure you can earn up to every time you’re paid before you pay the higher rate of tax. Each time you’re paid, you pay tax at the standard rate of tax up to your standard rate cut-off point.

Simply put, weekly or monthly cut-off rates are the amount that you can earn while paying tax at the lower rate.

In Ireland, that lower rate is 20%.

4. PAYE

This is the 'Pay As You Earn’ income tax.

It is the system in which you pay tax.

The PAYE income tax system makes paying taxes easier. Instead of paying all at once, a part of your income is automatically set aside for taxes as you earn. If the amount set aside is more than what you owe in taxes by the end of the year, you might get some money back as a tax refund.

5. Tax Credit

A tax credit is the amount of money that can be deducted from the tax you pay.

You’re entitled to tax credits based on your personal circumstances and they are allocated to you each year.

Any unused credits are forwarded to your next pay period(s).

6. PRSI

PRSI is ‘Pay Related Social Insurance’ which contributes to social welfare benefits and pensions. Most people working in Ireland pay this with very few exceptions.

The amount of PRSI you pay is dictated by the type of employment, your earnings, and what PRSI class you’re in. In some cases, you may be entitled to a refund.

7. USC

USC or the ‘Universal Social Charge’ is a tax that was introduced in January 2011 to replace the income levy and health levy.

You’ll pay this if your gross income is over €13,000 per year.

8. Gross Pay

This is the total amount that you’re paid before deductions.

For example, when a job is listed, the gross pay is what you will usually see advertised. That is the difference between Gross Pay and Net Pay.

9. Net Pay

This is the amount you’re paid each time after tax, PRSI, and other deductions.

10. Total Deductions

The total amount of deductions in each pay period.

The average Irish tax refund is €1,880

How is my Irish tax calculated?

Each time you’re paid, your employer applies PAYE tax based on information from Revenue on your employee tax credit certificate.

If Revenue doesn’t have up-to-date information on your personal circumstances (marital status, dependents, etc.), this could result in the incorrect allocation of bands and credits.

So for example, if you get married or enter into a civil partnership, you should inform Revenue as quickly as possible because you could end up paying more tax than you need to! In this case, you could claim some tax back.

Underpayments of tax

An underpayment of tax could happen if you’ve been wrongly allocated tax credits. Revenue will usually seek reimbursement over the following year by making an adjustment to your tax credits.

Your take-home pay will be reduced until the underpayment is settled. If Revenue fails to notice underpayments for several years then you could be faced with a much higher tax bill.

When you get your next payslip, see what it says for your monthly/weekly tax credit and cut off point. Multiply this by 12 or 52 to calculate your annual tax credit and cut-off point.

| Cut-off | Credit | |

|---|---|---|

| Single person | €40,000 | €1,775 |

| Married person one spouse working (no dependents) | €49,000 | €3,550 |

If your tax credits are higher or lower than what they should be, you should request a copy of your tax credit certificate from Revenue. This should make it clear if any adjustments need to be made.

Am I due a tax refund?

That depends!

There are many reasons why you may be due a tax refund, such as if you overpaid tax.

Find out what you’re due with Taxback and get a free refund estimate by clicking here!

For a quick estimate of the refund you could receive, our user-friendly tax refund calculator for Ireland is at your disposal, providing a glimpse into your potential financial benefits.

The average Irish tax refund is €1,880

Still confused? Download your free guide to PAYE taxes in Ireland below!